Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Yields on gov’t debt up on hawkish BSP, holidays

YIELDS on government securities (GS) traded in the secondary market soared across the board on Friday as investors remained on the sidelines amid hawkish remarks from the Bangko Sentral ng Pilipinas (BSP) and the holidays ahead.

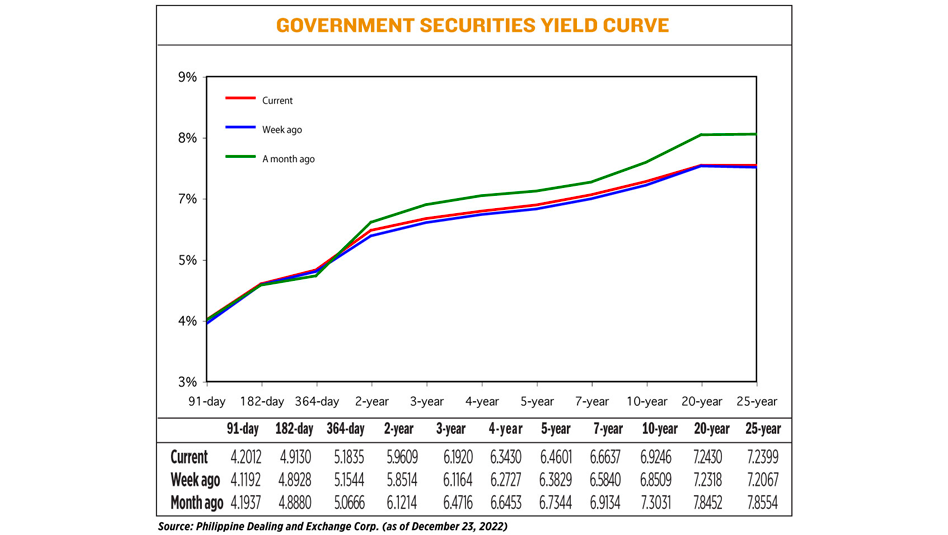

On average, GS yields — which move opposite to prices — went up by 6.02 basis points (bps) week on week, based on the PHP Bloomberg Valuation (BVAL) Service Reference Rates as of Dec. 23 published on the Philippine Dealing System’s website.

Total volumes of GS traded thinned given the holiday season, reaching PHP 5.316 billion on Friday, lower than the PHP 7.744 billion recorded on Dec. 16.

At the secondary market on Dec. 23, yields on Treasury bills (T-bills) increased from their week-ago levels. The 91-, 182-, and 364-day T-bills picked up 8.20 bps, 2.02 bps, and 2.91 bps to yield 4.2012%, 4.9130%, and 5.1835%, respectively.

At the belly, the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) saw their yields rise by 10.95 bps (5.9609%), 7.56 bps (6.1920%), 7.03 bps (6.3430%), 7.72 bps (6.4601%) and 7.97 bps (6.6637%), respectively.

At the long end of the curve, rates of the 10-, 20-, and 25-year T-bonds went up by 7.37 bps, 1.12 bps, and 3.32 bps, respectively, to fetch 6.9246%, 7.2430%, and 7.2399%.

A bond trader said GS yields’ average increase over the week came after “hawkish policy remarks from BSP Governor Felipe M. Medalla over two more potential rate hikes in 2023, as well as the surprise policy tweak by the Bank of Japan.”

The bond trader said that investors remained on the sidelines and that market activity was relatively subdued.

“These market developments have firmed expectations of continuing hawkish policy guidance for at least until early 2023,” added the bond trader.

Last week, Mr. Medalla said that the Monetary Board’s first two meetings next year might announce rate hikes to help bring inflation near 3% by the third quarter of 2023.

The country’s Inflation rate accelerated to 8% in November, well above its 2-4% target for the current year.

Meanwhile, the Bank of Japan stunned markets after its recent meeting by tweaking its yield curve policy, allowing long-term interest rates to increase more in a move aimed at ironing out market strains given its huge bond buying, said a Reuters report.

The decision to allow the 10-year bond yield to move 50 bps on either side of the 0% target is wider than the previous 25 bps band.

The central bank kept its yield target unmoved and said it would increase bond buying, a sign of fine-tuning the ultra-loose monetary policy rather than a withdrawal of stimulus.

“Pretty much rangebound for the GS market with yields higher as market players lighten their positions ahead of the holidays,” a second bond trader said in a Viber message.

For this week, the bond trader expects the same movement to continue.

For the first bond trader, bond yields might move sideways with a downward bias because of “thin” market activity as investors might remain on the sidelines from the holidays and potentially downbeat economic data releases.

“This downside might be supported by unexpected geopolitical worries, driving some safe-haven demand,” added the first bond trader. — Lourdes O. Pilar

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld