Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

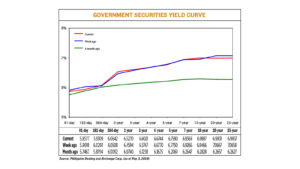

Yields on gov’t debt mixed after less hawkish Fed

Yields on government securities were mixed last week after less hawkish comments from the US Federal Reserve.

The yields, which move opposite to prices, fell by 1.43 basis points (bps) on average week on week, according to data from the PHP Bloomberg Valuation Service Reference Rates as of May 3 posted on the Philippine Dealing System website.

Rates at the short end were mixed, with yields on the 91- and 182-day Treasury bills (T-bills) going down by 4.41 bps and 8.92 bps 5.8577% and 5.9309%. The 364-day debt rose by 1.34 bps to 6.0642%.

At the belly of the curve, the rates of the two-, three- and seven-year Treasury bonds went up by 6.76 bps, 2.74 bps and 1.03 bps to 6.527%, 6.6021% and 6.9369%. The rates of the four- and five- year T-bonds shed 0.26 bp and 1.6 bps to 6.6744% and 6.7590%.

The 10- year bonds rose by 4.21 bps to 6.9887%, while the rates of the 20- and 25-year bonds fell by 8.36 bps and 8.21 bps to 6.9831% and 6.9837%.

Volume jumped to P17.38 billion from P11 billion on April 26. Financial markets were closed on May 1 for Labor Day.

“The holiday-shortened week saw yields still impacted by global bond market movements,” Nicholas Antonio T. Mapa, senior economist at ING Bank N.V. Manila Branch, said in an e-mail. “Investors were focused on two developments: the [Federal Open Market Committee] meeting and the US job report on Friday.”

The Fed kept its policy rates steady at 5.25%-5.5% on May 1, holding off rate cuts until “greater confidence” that inflation will continue to fall, Reuters reported.

Mr. Mapa said the Fed’s stance was less hawkish than investors anticipated, leading to a dip in bond yields.

“Weak demand at recent auctions further pressured local yields upwards,” the market seems to be pricing in a scenario where concerns about growth and inflation will prevent the Fed from cutting rates this year,” Robert Dan J. Roces, chief economist at Security Bank Corp., said in an e-mail.

The government partially awarded reissued 20-year T-bonds on Tuesday, raising P27.476 billion.

Global developments would continue to influence sentiment this week, Mr. Mapa said. “We do get some important data reports locally as well, with gross domestic product and inflation out in the coming days, which could add additional color to this week’s trading,” he added.

Inflation probably quickened to 4.1% in April, according to a median estimate of 16 analysts in a BusinessWorld poll last week. The economy likely grew by 5.9% last quarter, according to a median estimate of 20 economists in a separate BusinessWorld poll.

The local statistics agency will report April inflation and first-quarter GDP data on May 7 and 9. — Karis Kasarinlan Paolo D. Mendoza

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld