January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

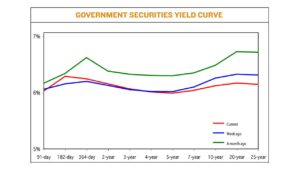

Yields on gov’t debt mixed

Yields on government securities (GS) ended mixed last week on expectations of slower May Philippine inflation and steady borrowing costs here and abroad.

Yields on government securities (GS) ended mixed last week on expectations of slower May Philippine inflation and steady borrowing costs here and abroad.

GS yields, which move opposite to prices fell by an average of 2.46 basis points (bps) week on week, according to the PHP Bloomberg Valuation Service Reference Rates as of June 2 published on the Philippine Dealing System’s website.

Yields on the 182- and 364-day Treasury bills (T-bills) went up by 9.98 bps and 3.53 bps to 5.963% and 9.9314%, respectively. Meanwhile, the 91-day T-bills dropped by 2.43 bps to 5.7657%.

At the belly, the two- and three-year Treasury bonds (T-bonds) increased by 2.13 bps (5.8646%) and 1.01 bps (5.7971%), respectively.

Meanwhile, the four-, five-, and seven-year T-bonds decreased by 0.43 bp, 2.09 bps, and 4.38 bps to fetch 5.7563%, 5.7394%, and 5.777%, respectively.

Similarly, at the long end, the 10-, 20-, and 25-year papers dropped by 10.22 bps (5.8375%), 11.78 bps (5.8745%), and 12.36 bps (5.8578%).

Total GS volume reached P4.38 billion on Friday, lower than the P4.66 billion on May 26.

“Market participants were closely analyzing the potential direction of monetary policy rates, leading to mixed yields across the curve,” Kevin S. Palma, Robinsons Bank Corp. assistant vice-president and peso fixed-income trader, said in an e-mail.

“There is prevailing uncertainty regarding the upcoming FOMC (Federal Open Market Committee) meeting in June, with differing opinions on whether the US Federal Reserve will continue to hike rates, pause, or just ‘skip’ hiking,” Mr. Palma added.

Philadelphia Fed President Patrick Harker said on Thursday “it’s time to at least hit the stop button for one meeting and see how it goes,” referring to the June 13-14 Fed meeting, Reuters reported.

A day earlier, Fed Governor Philip Jefferson said “skipping a rate hike at a coming meeting would allow the committee to see more data before making decisions about the extent of additional policy firming.”

The US central bank has raised rates by 500 bps since March 2022, bringing the Fed funds rate to a range between 5% and 5.25%. Its latest move was a 25-bp hike at its May 2-3 review.

Its next meeting is on June 13-14.

The nine-year bond auction’s result last week also reflected positive market sentiment as the Bangko Sentral ng Pilipinas’ (BSP) lower inflation forecast may show that its policy tightening is beginning to take effect, a bond trader said in a Viber message.

The BSP on May 18 paused its tightening cycle for the first time after nine meetings. Since it began its aggressive monetary tightening cycle in May 2022, the central bank had raised borrowing costs by 425 bps.

Its next policy meeting is on June 22.

For this week, investors may take cues from the May inflation data to be released on June 6 and the five-year bond auction.

“Investors are likely to approach the coming week with a degree of caution and to carefully assess the Philippine inflation report this coming Tuesday. Should the release point to the downside, sentiment may continue to improve for local bonds,” Mr. Palma said.

The US jobs report released on Friday could also affect local yields amid “strong two-way interest” from the market, he added. — By Bernadette Therese M. Gadon with Reuters

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld