Inflation Update: Nowhere but up

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

Yields on gov’t debt end mostly flat amid policy hints

Yields on government securities (GS) traded in the secondary market ended mostly flat last week amid bets on the next policy moves of central banks at home and abroad and following the results of the Treasury bureau’s bond auction.

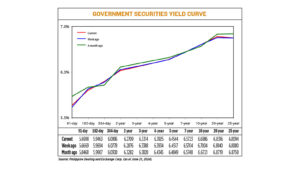

GS yields, which move opposite to prices, inched up by 0.17 basis point (bps) on average week on week, based on PHP Bloomberg Valuation Service Reference Rates data as of June 21 published on the Philippine Dealing System’s website.

Rates were mostly mixed last week. Yields on the 91- and 364-day Treasury bills (T-bills) increased by 3.29 bps and 1.18 bps week on week to 5.6998% and 6.0896%, respectively. Meanwhile, the 182-day T-bill fell by 2.31 bps to yield 5.9463%.

At the belly of the curve, yields on the two-, three-, and four-year Treasury bonds (T-bonds) declined by 1.67 bps (to 6.2709%), 0.74 bp (6.3314%), and 0.09 bp (6.3925%), respectively. On the other hand, the five- and seven-year T-bonds went up by 0.27 bp and 0.19 bp to fetch 6.4544% and 6.5723%, respectively.

At the long end, the 20-, and 25-year debt papers saw their rates increase by 1.76 bps (to 6.8316%) and 0.14 bp (6.8094%), respectively, while the 10-year bond inched down by 0.18 bp to yield 6.6986%.

GS volume traded reached PHP 8.24 billion on Friday, lower from the PHP 28.55 billion recorded a week earlier.

Debt yields moved sideways this week as market participants assessed the latest policy signals from both the Bangko Sentral ng Pilipinas (BSP) and the US Federal Reserve, a bond trader said.

“[This assessment comes] amid mixed signals from weak US economic data and hawkish policy signals by the BSP,” the bond trader said in an e-mail. “The recent economic data from the US bolstered hopes that an eventual US policy rate remains on the table.”

The first trader added that this optimism has been dampened by the cautious policy remarks from various Fed officials, who have urged patience over the timeline of these expected rate cuts.

The BSP’s policy-setting Monetary Board has kept its benchmark rate steady at a 17-year high of 6.5% since October 2023 following increases worth 450 bps to bring down inflation.

Its next meeting is on Thursday, June 27.

Headline inflation picked up to 3.9% year on year in May from 3.8% in April, but marked the sixth straight month that inflation settled within the BSP’s 2-4% target band.

From January to May, the consumer price index averaged 3.5%, matching the central bank’s full-year forecast.

The BSP expects inflation to continue quickening and possibly breach their 2-4% annual target until July due to base effects.

BSP Governor Eli M. Remolona, Jr. has said the central bank can begin easing their policy stance as early as August, with a total of 25-50 bps in cuts likely within the second half as they have become “less hawkish.”

Mr. Remolona said the BSP does not need to wait for the Fed to begin cutting rates. The Fed held interest rates steady for a seventh straight meeting this month, with expectations of the start of rate cuts being pushed to as late as December.

Meanwhile, Finance Secretary and Monetary Board member Ralph G. Recto said it is “highly probable” that the BSP will only begin easing its policy stance once the Fed does so.

Mr. Recto previously said the Monetary Board could cut rates by as much as 150 bps in the next two years.

A second bond trader said that the Bureau of the Treasury (BTr) has been capping bond yields at certain levels during its past few auctions, which means they have been willing to cut the volume of borrowing to keep rates low.

This will likely benefit markets, as yields have increased significantly amid uncertainty over the Fed’s next move, the trader added.

“It provides some relief to market participants because the [BTr] has been relatively keeping rates at bay over the past few auctions,” the second bond trader said in a phone interview.

The BTr has made partial awards at its last two T-bond auctions despite strong demand for its offerings as it sought to keep rates low.

Last week, the Treasury raised only PHP 24.003 billion via the reissued 20-year bonds it auctioned off, below the PHP 30-billion program, despite total bids reaching PHP 46.331 billion.

The bonds, which have a remaining life of 14 years and seven months, were awarded at an average rate of 6.781%. Accepted yields ranged from 6.72% to 6.82%.

The average rate of the reissued bonds went down by 16.9 bps from the 6.95% fetched for the series’ last award on May 14.

However, this was 3.1 bps above the 6.75% coupon for the issue. This was likewise 1.2 bps higher than 6.769% quoted for the 15-year bond, the tenor closest to the remaining life of the papers offered, and 1.5 bps above the 6.766% seen for the same bond series at the secondary market before the auction.

For this week, GS yields may increase due to potentially hawkish policy signals from the BSP following its policy meeting on Thursday, the first bond trader said.

“Traders might also take cues from the direction of revisions to the medium-term BSP inflation outlook, which might provide clues over the future actions of the domestic central bank,” the first bond trader added.

Yields will likely continue to consolidate as the BSP’s first rate cut remains far off, the second bond trader said.

“The market will be watching for further leads when it comes to their tone — if it’s on the dovish or the hawkish side. So, if they continue on the dovish side, we might see a further drop in rates in the next few weeks,” the second trader said. — By Abigail Marie P. Yraola, Deputy Research Head

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld