Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Yields on gov’t debt end mixed after policy meetings

YIELDS on government securities (GS) traded in the secondary market ended mixed last week after the US Federal Reserve and the Bangko Sentral ng Pilipinas (BSP) opted for smaller rate hikes at their meetings last week.

YIELDS on government securities (GS) traded in the secondary market ended mixed last week after the US Federal Reserve and the Bangko Sentral ng Pilipinas (BSP) opted for smaller rate hikes at their meetings last week.

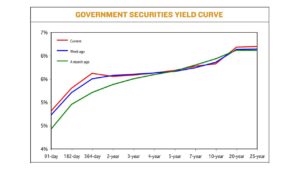

Bond yields, which move opposite to prices, went up by 4.23 basis points (bps) on average week on week, based on PHP Bloomberg Valuation Service Reference Rates as of March 24, published on the Philippine Dealing System’s website.

Rates at the short end of the curve went up, with the 91-, 182- and 364-day Treasury bills (T-bills) rising by 10.45 bps, 11.31 bps, and 13.89 bps to fetch 4.9666%, 5.5587%, and 5.9397%, respectively.

Meanwhile, the belly of the curve ended mixed. Yields on the two-, and three-year Treasury bonds (T-bonds) declined by 2.27 bps (to fetch 5.8625%) and 2.12 bps (5.8945%), respectively. The rates of the four-, five-, and seven-year T-bonds rose by 0.08 bp (5.9505%), 2.83 bps (6.0174%) and 3.92 bps (6.1251%), respectively.

The long end of the curve also closed mixed, with yields on the 20-, and 25-year debt papers increasing by 5.96 bps (to 6.6161%), 6.45 bps (6.6318%), respectively, while the 10-year debt paper fell by 3.96 bps to fetch 6.1878%.

Total GS volume traded reached PHP 14.340 billion on Friday, more than doubled the PHP 5.128 billion seen on March 17.

Analysts said the Fed and BSP’s policy decisions drove local yield movements last week.

“Domestic yields increased amid market views of policy rate hikes from the BSP and the US Federal Reserve,” a bond trader said in an e-mail.

“In line with the expectations, the local and the US central bank delivered 25-bp rate hikes, but expressed reservations on further policy rate hikes, noting dependency on incoming economic data,” the bond trader said.

The trader added that the declines in the yields on the two- and three-year bonds was due to the lack of market appetite for tenors at the belly of the curve.

Jose Miguel B. Liboro, head of fixed income at ATRAM Trust Corp., said in an e-mail that the 20-year bond auction and the policy reviews of the Fed and the BSP served as catalysts for the market last week.

“We saw healthy demand at the BTr’s (Bureau of the Treasury) 20-year auction early in the week given that market levels and expectations on central bank action had aligned by last week,” Mr. Liboro said.

He added that the 25-bp hikes delivered by the Fed and the BSP were already largely priced in at the current yield levels, with decent two-way trading activity seen last week.

The Fed on Wednesday raised interest rates by 25 bps to a range between 4.75% and 5%, but hinted at a pause due to the collapse of two US banks.

The US central bank has now raised rates by 475 bps since March 2022.

Fed Chair Jerome H. Powell sought to reassure investors about the soundness of the banking system, saying that the management of Silicon Valley Bank “failed badly,” but that the bank’s collapse did not indicate wider weaknesses in the banking system.

California regulators on March 10 closed Silicon Valley Bank. This was the largest US bank failure since the 2008 financial crisis.

Meanwhile, the BSP, in its own meeting on Thursday, also decided to hike benchmark interest rates by 25 bps to anchor inflation expectations.

The latest move brought its policy rate to 6.25%, with cumulative increases since May 2022 reaching 425 bps.

On the other hand, the BTr raised PHP 25 billion as planned from the reissued 20-year bonds it offered on Tuesday as total bids reached PHP 34.412 billion.

The bonds, which have a remaining life of 19 years and eight months, were awarded at an average rate of 6.631%, with accepted yields ranging from 6.5% to 6.745%.

The average rate of the 20-year bond was 10.60 bps higher than the 6.525% quoted for the same series when it was last offered on January 17 but 149.40 bps below the 8.125% coupon for the issue.

Mr. Liboro expects the curve to remain flat this week, with longer tenors offering little additional yield over one- to three-year papers.

“We believe the upcoming seven-year auction could be a catalyst to cause the curve to steepen a little bit and cause an adjustment higher in the seven- to 20-year space,” he said.

“We remain constructive on Philippine fixed income and maintain the view that inflation is likely to decelerate over the coming months — making current levels attractive from a longer-term standpoint,” Mr. Liboro added.

The bond trader said local yields will likely move with a downward bias as market worries over the health of the global economy might resurface amid potentially downbeat US consumer confidence and Chinese manufacturing reports.

“Moreover, this downside might be supported due to likely weaker inflation reports from the US and Eurozone,” the bond trader added. — Abigail Marie P. Yraola

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld