Inflation Update: Nowhere but up

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

Yields on gov’t debt decline amid Fed bets

Yields on government securities (GS) went down last week following the release of minutes of the US Federal Reserve’s policy meeting held earlier this month.

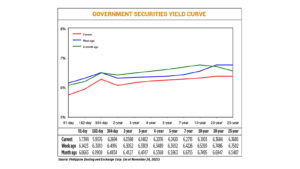

GS yields dropped by an average of 25.7 basis points (bps) week on week, based on PHP Bloomberg Valuation Service Reference Rates as of Nov. 24 published on the Philippine Dealing System’s website.

Yields on fell across all tenors, with rates of the 91-, 182-, and 364-day Treasury bills (T-bills) going down by 40.24 bps (to 5.7399%), 36.34 bps (5.9376%), and 22.22 bps (6.2694%), respectively.

At the belly, rates of the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) declined by 24.54 bps (to 6.0598%), 18.27 bps (6.1482%), 14.13 bps (6.2076%), 12.72 bps (6.242%), and 15.11 bps (6.2715%), respectively.

Likewise, yields on the 10-, 20-, and 25-year papers decreased by 22.87 bps (to 6.3103%), 38.02 bps (6.3684%), and 38.22 bps (6.368%), respectively.

Total GS volume reached PHP 23.25 billion on Friday, lower compared with the PHP 32.24 billion on Nov. 17.

Last week’s release of minutes of the Fed’s policy meeting from Oct. 31 to Nov. 1 affected local yield movement, analysts said.

“The slew of softer US economic data on durable goods sales and consumer sentiment bolstered market views of an impending weakness in the US economy. These developments supported the latest policy guidance from the Fed minutes wherein policy makers expressed caution on tightening monetary settings further,” a bond trader said in an e-mail.

Fed officials agreed at their last policy meeting that they would proceed “carefully” and only raise interest rates if progress in controlling inflation faltered, the minutes of the Oct. 31-Nov. 1 gathering showed on Tuesday, Reuters reported.

The US central bank kept its benchmark interest rate steady at the 5.25%-5.5% range for a second straight time during this month’s meeting. It has hiked rates by 525 bps since it began its tightening cycle in March 2022.

The Federal Open Market Committee will next meet on Dec. 12-13 to review policy.

Reports on jobless claims, durable goods, and consumer sentiment seemed to suggest the economy is easing but may stay strong enough to avoid a recession.

Meanwhile, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said US rates also affected GS yields last week.

US 10-year Treasury yields, which set the tone for borrowing costs worldwide, rose to 4.485%. They were still comfortably below the 5% milestone reached last month, Reuters reported.

For this week, local yields are expected to continue their downward path as the peso has gained strength against the dollar, Mr. Ricafort said in an e-mail.

“Given the recent divergence in the inflation path of the US and the Philippines, the Bangko Sentral ng Pilipinas (BSP) might remain relatively more hawkish than the US Federal Reserve. GS yields are likely to be influenced more by the BSP policy guidance and the near-term outlook on domestic inflation,” the bond trader said.

The BSP kept its policy rate unchanged at a 16-year high of 6.5% at its Nov. 16 meeting amid an improving inflation outlook after hiking by bps in an off-cycle move last month.

Since May 2022, the BSP has raised rates by a cumulative 450 bps to tame inflation.

The Monetary Board will hold its last policy meeting this year on Dec. 14.

Philippine headline inflation fell to a three-month low of 4.9% in October from 6.1% in September. For the 10-month period, inflation averaged 6.4%, still well above the BSP’s 2-4% target for the year. — M.I.U. Catilogo with Reuters

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld