January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

Yields on government debt rise as Jan. inflation hits fresh 14-year high

YIELDS on government securities (GS) increased last week as headline inflation accelerated to a fresh 14-year high in January, which could prompt the Bangko Sentral ng Pilipinas (BSP) to increase benchmark rates again at its upcoming meeting.

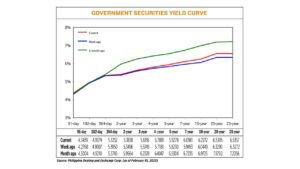

Bond yields, which move opposite to prices, went up by 10.2 basis points (bps) on average week on week, based on PHP Bloomberg Valuation Service Reference Rates as of Feb. 10, published on the Philippine Dealing System’s website.

Rates at the short end of the curve went up, with the 91-, 182- and 364-day T-bills rising by 6.71 bps, 3.72 bps, and 2.02 bps to fetch 4.3439%, 4.9379%, and 5.3252%, respectively.

Similarly, the belly of the curve, also increased, with the rates of the two-, three-, four-, five-, and seven-year T-bonds gaining 3.42 bps (to 5.3838%), 3.87 bps (5.6136%), 7 bps (5.7881%), 10.49 bps (5.9279%) and 14.88 bps (6.0981%), respectively.

The long end of the curve rose, with yields on the 10-, 20-, and 25-year debt papers increasing by 18.23 bps (to 6.2272%), 21.05 bps (6.5395%), and 20.85 bps (6.5357%).

Total GS volume traded reached P14.118 billion on Friday from P9.068 billion seen on Feb. 3.

Noel S. Reyes, Security Bank Corp. chief investment officer for Trust and Asset Management Group, said US jobs numbers and high Philippine inflation in January were the main drivers for bond yields last week.

“Longer bias for hawkishness needs to be undertaken by both the Fed and BSP (Bangko Sentral ng Pilipinas) as a result,” he said in an e-mail.

Similarly, the bond trader said inflation data drove yield movements last week.

The trader said the latest retail Treasury bond (RTB) sale and the Fed’s comments of a higher peak rate this year also affected rates.

“[It] indicated strong demand, therefore, influenced the secondary market. Yields are somewhat anchored to the RTB demand despite the bad news (inflation),” the bond trader said in an e-mail.

The Bureau of the Treasury last week raised an initial P162.180 billion from the rate-setting auction for the 5.5-year RTBs.

The RTBs fetched a coupon rate of 6.125%. The papers were awarded at rates ranging from 5.375% to 6.24%, bringing the average to 6.022%.

Meanwhile, Philippine headline inflation soared to a 14-year high of 8.7% in January, above the 7.5% to 8.3% forecast of the central bank for the month. It also marked the 10th straight month inflation was above the BSP’s 2-4% target.

Inflation last month was higher than 8.1% in December and 3% a year earlier.

Abroad, Fed Chair Jerome H. Powell last week said borrowing costs may reach a higher peak than traders and policy makers anticipate, Bloomberg reported.

“We think we are going to need to do further rate increases… The labor market is extraordinarily strong,” he said.

Data released earlier showed employers added 517,000 new workers in January while unemployment fell to 3.4%, the lowest rate since 1969.

For this week, Mr. Reyes sees remittances and the central bank’s policy action influencing this week’s trading as well as US inflation and retail sales data.

“So far, from the looks of it, the sell-off [last] week seemed to be welcomed by the market which I think should be the same case as well for any sell-off [this] week,” he said.

He added that with the latest inflation data, the market is expecting a 50-bp increase from the BSP at their policy meeting this week, as anything lower could push back further the timeline of achieving a lower inflation trend.

The Monetary Board is set to review its policy settings on Feb. 16, Thursday. It hiked key policy rates by a total of 350 bps last year to control surging inflation. — Abigail Marie P. Yraola

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld