January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

Yields on government debt mostly drop on dovish BSP, Q3 borrowing program

Yields on government securities (GS) moved mostly lower last week amid dovish signals from the Bangko Sentral ng Pilipinas (BSP) and following the release of the Treasury bureau’s borrowing plan for this quarter.

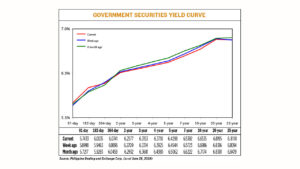

GS yields, which move opposite to prices, went down by an average of 0.71 basis point (bp) week on week, based on PHP Bloomberg Valuation Service Reference Rates published on the Philippine Dealing System’s website as of June 28.

At the short end, the rates of the 91- and 182-day Treasury bills (T-bill) rose by 4.35 bps and 5.72 bps week on week to 5.7433% and 6.0035%, respectively. Meanwhile, the 364-day paper fell by 1.55 bps to yield 6.0741%.

Meanwhile, at the belly of the curve, yields declined across the board. The two-, three-, four-, five- and seven-year Treasury bonds (T-bonds) fell by 1.32 bps (to 6.2577%), 1.61 bps (6.3153%), 2.15 bps (6.371%), 2.46 bps (6.4298%) and 3.31 bps (6.5392%), respectively.

Yields on tenors at the long end mostly fell, as the 10- and 20-year debt papers saw their rates drop by 4.52 bps (to 6.6535%) and 1.21 bps (to 6.8195%), respectively. Meanwhile, the 25-year T-bond went up by 0.24 bp to yield 6.8118%.

Total GS volume traded climbed to P25.17 billion on Friday from the P8.24 billion recorded on June 21.

“The primary driver of yield movements [last] week was the dovish shift in the Bangko Sentral ng Pilipinas’ stance, which significantly lowered its inflation forecasts for 2024 and 2025,” ATRAM Trust Corp. Vice-President and Head of Fixed Income Strategies Lodevico M. Ulpo, Jr. said in an e-mail. “The market’s reaction to a more stable inflation outlook has further lowered yield expectations [as] investors are now anticipating lower interest rates with a predictable inflation trajectory.”

“This dovish outlook, coupled with anticipated rate cuts totaling 50 bps by yearend, exerted downward pressure on yields,” Mr. Ulpo added.

The BSP last week kept benchmark interest rates steady for a sixth straight meeting but signaled that a rate cut at its next meeting in August is “somewhat more likely than before,” with up to 50 bps in easing likely this year.

The Monetary Board on Thursday left its target reverse repurchase rate unchanged at a 17-year high of 6.5%, in line with the expectations of all 15 analysts in a BusinessWorld poll. Interest rates on the overnight deposit and lending facilities were also maintained at 6% and 7%, respectively.

BSP Governor Eli M. Remolona, Jr. said he expects inflation to further ease in the second semester with the implementation of lower tariffs on rice.

“If sustained, an improvement in the inflation outlook would allow more scope to consider a less restrictive monetary policy stance,” he said.

The BSP lowered its average baseline inflation forecasts for 2024 and 2025 to 3.3% and 3.1%, respectively, from 3.5% and 3.3% previously.

It also slashed its risk-adjusted inflation forecasts for this year and next to 3.1% from 3.8% and 3.7%, respectively.

Mr. Remolona said the Monetary Board is “on track” to cut rates when it next meets on Aug. 15, or ahead of the US Federal Reserve, which earlier signaled it may start easing in December.

The BSP could cut rates by 25 bps in the third quarter and by another 25 bps in the fourth quarter, he added.

The Monetary Board’s Aug. 15 review is its only meeting in the third quarter. Meanwhile, its last two reviews for the year will be held in the fourth quarter and are scheduled on Oct. 17 and Dec. 19.

The Philippine central bank hiked rates by a cumulative 450 bps from May 2022 to October 2023 to help bring down elevated inflation.

The BSP’s last cut was implemented in November 2020, when it slashed its key rate by 25 bps to a record low of 2% to help boost economic activity at the height of the coronavirus pandemic.

“Additionally, the Bureau of the Treasury’s (BTr) reduction in long-end bond supply contributed to the flattening of the yield curve. The market is adjusting to the expected lower supply of long-duration securities,” Mr. Ulpo noted.

“This scarcity makes government securities with tenors above 10 years more attractive, especially for investors seeking to lock in long-term rates at current levels. The shift in BTr’s borrowing strategy aligns with the anticipated accommodative monetary policy in the medium term. As a result, the market has seen an increased trading volume and improved market sentiment in GS, particularly for long-duration securities,” he added.

The Treasury bureau is looking to borrow P630 billion from the domestic market this quarter, or P260 billion from T-bills and P370 billion via T-bonds, a notice released on Thursday showed.

The Treasury will auction off more T-bonds with shorter tenors versus those seen in the April-to-June period, based on the notice, with the offer volumes for bonds with tenors above 10 years being smaller than those with shorter maturities. It will also offer bigger volumes of T-bills in its weekly auctions versus the previous quarter.

GS yields may continue to go down in the coming weeks as the market waits for the BSP’s first rate cut and amid the reduced supply of long-term debt, Mr. Ulpo said.

“Investor demand for government securities, especially long-term bonds, will likely remain strong. Positive market sentiment, driven by lower inflation expectations and accommodative monetary policy, will enhance the attractiveness of these investments,” he said.

“The yield curve may experience further flattening, influenced by the faster decline in long-term rates outpacing the decline in short-term rates as investors rush in to lock in interest rates longer ahead of the guided August cut by the BSP,” Mr. Ulpo added. — A.C. Abestano

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld