Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Yields on government debt mixed after inflation, Fed

YIELDS on government securities (GS) traded at the secondary market ended mixed last week following slower April inflation data and the US Federal Reserve’s latest rate hike.

YIELDS on government securities (GS) traded at the secondary market ended mixed last week following slower April inflation data and the US Federal Reserve’s latest rate hike.

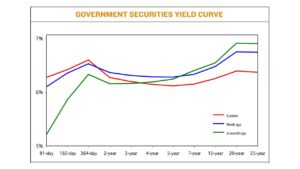

GS yields declined by an average of 9.06 basis points (bps) week on week, based on PHP Bloomberg Valuation Service Reference rates as of May 5, published on the Philippine Dealing System’s website.

The short end of the curve rose, with the 91-, 182-, and 364-day Treasury bills (T-bills) increasing by 13.32 bps (to 5.9526%), 4.93 bps (6.0613%), and 5.24 bps (6.1943%), respectively.

Meanwhile, rates at the belly of the curve dropped. Yields on the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) went down by 6.71 bps (to 5.9524%), 8.48 bps (5.8945%), 10.48 bps (5.8558%), 12.32 bps (5.8339%), and 13.72 bps (5.8591%), respectively.

At the long end of the curve, the 10-, 20-, and 25-year debt papers likewise decreased 16.80 bps, 26.84 bps, and 27.76 bps to 5.9366%, 6.0409%, and 6.0259%, respectively.

Total GS volume traded reached PHP 33.12 billion on Friday, higher than the PHP 18.47 billion on April 28.

Analysts attributed the decline in yields to Philippine inflation data and the Fed’s policy decision last week.

“These developments have been positive for bonds, leading to a decrease in yields on a week-on-week basis,” the bond trader said in a Viber message.

Philippine headline inflation eased to 6.6% in April, the slowest in eight months or since the 6.3% recorded in August 2022, data from the Philippine Statistics Authority showed on Friday.

This was also slower compared with the 7.6% recorded in the previous month.

April inflation was below the 7% median estimate in a BusinessWorld poll and was within the Bangko Sentral ng Pilipinas (BSP) 6.3-7.1% forecast range for the month.

For the first four months of the year, inflation averaged 7.9%, still above the BSP’s 2-4% target and 6% forecast for 2023.

The bond trader said slower April inflation increases the likelihood of a pause in the May 18 meeting of the BSP’s policy-setting Monetary Board.

The BSP hiked borrowing costs by 25 bps in March, bringing its policy rate to a 16-year high of 6.25%.

It has raised key rates by 425 bps since May 2022.

Meanwhile, the US central bank hiked the fed funds rate by 25 bps for a second straight meeting last week to the 5-5.25% range

Since March 2022, the Fed has raised borrowing costs by 500 bps.

Fed Chair Jerome H. Powell said it was now an open question whether further increases will be warranted in an economy still facing high inflation, but also showing signs of a slowdown and with risks of a tough credit crackdown by banks on the horizon, Reuters reported.

“We’re closer, or maybe even there,” Mr. Powell said of the end-point of rate increases that have boosted the Fed’s policy rate by a full 5 percentage points in the 10 meetings since March 2022, a torrid pace for the central bank and one that may now warrant allowing some time for the impact to be felt in full.

At a press conference following the release of the statement, Mr. Powell said inflation remains the chief concern, and that it is therefore too soon to say with certainty that the rate-hike cycle is over.

“We are prepared to do more” he said, with policy decisions from June onward to be made on a “meeting-by-meeting” basis.

He also pushed back on market expectations that the policy-setting Federal Open Market Committee would cut rates this year, saying such a move was unlikely.

“We on the committee have a view that inflation is going to come down not so quickly, it will take some time,” he told reporters, and “in that world, if that forecast is broadly right, it would not be appropriate to cut rates” this year.

For this week, Security Bank Corp. Chief Investment Officer for Trust and Asset Management Group Noel S. Reyes said he expects investors to position ahead of the release of first-quarter Philippine gross domestic product (GDP) data on May 11.

“GDP [this week] likely would affect as long as it’s about 6%. With a strong GDP number, and we have low inflation, most factors are good for market,” he said in a phone call.

Likewise, the bond trader expects secondary market yields to remain at a lower end, driven by the “spillover effect from the positive developments of the previous week.” — By Mariedel Irish U. Catilogo with Reuters

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld