January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

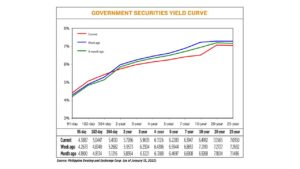

Yields on government debt mixed

YIELDS on government securities (GS) were mixed last week as central banks signaled slower policy tightening amid expectations of easing inflation.

Bond yields, which move opposite to prices, fell by 21.62 basis points (bps) on average week on week, based on PHP Bloomberg Valuation Service Reference Rates as of Jan. 13, published on the Philippine Dealing System’s website.

Last week’s trading session saw yields on Treasury bills (T-bills) increase, but those on Treasury bonds (T-bonds) decreased across the board, offsetting the rise in rates of shorter tenors.

Rates at the short end of the curve went up, with the 91-, 182- and 364-day T-bills rising by 12.14 bps, 17.07 bps, and 14.48 bps to fetch 4.3887%, 5.0447%, and 5.413%, respectively.

Meanwhile, at the belly of the curve, rates of the two-, three-, four-, five-, and seven-year T-bonds declined by 23.07 bps (to 5.7266%), 26.69 bps (5.9635%), 31.8 bps (6.1126%), 36.61 bps (6.2283%) and 47.06 bps (6.3947%), respectively.

Likewise, the long end of the curve fell as yields on the 10-, 20-, and 25-year debt papers went down by 71.27 bps (to 6.4992%), 21.62 bps (7.0565%), and 23.42 bps (7.0350%), respectively.

Total GS volume traded reached P30.902 billion on Friday from P7.897 billion seen on Jan. 6.

“[Last] week was characterized by risk-on positioning based on a view that central banks will pause from their hawkishness as a result of tempering of inflation,” Noel S. Reyes, Security Bank Corp. Chief Investment Officer for Trust and Asset Management Group said in an e-mail.

Mr. Reyes added that slower December US consumer inflation contributed to this sentiment.

A bond trader said GS yields declined amid growing views of a smaller US Federal Reserve policy rate hike in their Jan. 31 to Feb. 1 meeting.

“Yields likewise declined after BSP Governor [Felipe M.] Medalla hinted at a similarly softer local rate hike in their upcoming February policy meeting, taking cue from Fed expectations,” the bond trader said in an e-mail.

“Participants rather reacted quite earlier than the official release of the US inflation report amid prevailing views of declining inflation this year,” the bond trader added.

US consumer prices fell for the first time in more than two years in December, bolstering hopes that sustained easing inflation could give the Fed room to consider smaller interest rate hikes.

The consumer price index (CPI) dipped 0.1% last month, the first decline since May 2020. The CPI rose 0.1% in November.

In the 12 months through December, the CPI increased 6.5%, the smallest rise since October 2021 but well above the Fed’s 2% target. This followed the 7.1% posted in November.

The US central bank hiked borrowing costs by 425 bps in 2022, bringing its fed funds rate to 4.25-4.5%.

Meanwhile, Mr. Medalla last week said they will likely continue to hike benchmark rates amid persistent inflation risks, but these increases could be smaller than previous moves.

The Monetary Board last year raised borrowing costs by a total of 350 bps, bringing the policy rate to a 14-year high of 5.5%.

For this week, the bond trader said yields might move lower on expectations of weaker US producer inflation and retail sales reports for December 2022.

“Likewise, concerns of a possible global recession might be bolstered owing from potentially slower Chinese economic growth for the fourth quarter of 2022,” the bond trader added.

For Mr. Reyes, there could be some profit taking in the market after the sudden drop in yields and amid expectations of a retail Treasury bond issuance.

“However, sell-offs should be met by buyers and they will be buying for the same reasons attainment of peak inflation on central banks’ imminent pause. [The] scheduled 20-year auction should see decent buying interest,” Mr. Reyes added.

On Tuesday, the government will offer P35 billion in reissued 20-year T-bonds with a remaining life of 19 years and 10 months. — A.M.P. Yraola

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld