Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Yields on government debt inch down after Fed review

Yields on government securities (GS) traded in the secondary inched lower on average last week after the US Federal Reserve affirmed that it remains on track to cut rates within the year.

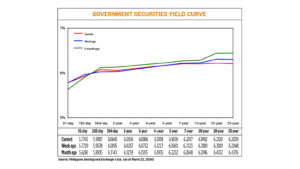

Bond yields, which move opposite to prices, fell by 1.38 basis points (bps) on average week on week, based on PHP Bloomberg Valuation Service Reference Rates data as of March 22 published on the Philippine Dealing System’s website.

Rates were mostly mixed last week. Yields on the 91- and 364-day Treasury bills (T-bills) rose by 0.16 bp and 4.50 bps to 5.7745% and 6.0645%, respectively. Meanwhile, the 182-day T-bills fell by 3.91 bps to yield 5.9187%.

At the belly of the curve, yields on the two-, three-, and four-year Treasury bonds (T-bonds) rose by 2.59 bps (to 6.0516%), 1.74 bps (6.0906%), 0.81 bp (6.1308%), respectively. On the other hand, the rates of the five- and seven-year T-bonds went down by 0.01 bp to fetch 6.1659% and 1.06 bps to 6.2017%, respectively.

Meanwhile, at the long end, the 10-, 20- and 25-year debt papers saw their rates fall by 1.97 bps (to 6.1992%), 8.81 bps (6.2120%), 9.19 bps (6.2029%), respectively.

GS volume traded declined to PHP 10.12 billion on Friday from PHP 19.01 billion a week earlier.

A bond trader said GS yields mostly moved lower as investors were cautious ahead of the Fed’s March 19-20 policy meeting.

The downward pressure persisted after Fed Chair Jerome H. Powell said they continue to see three rate cuts within this year, the trader said in an e-mail.

The market was trading range-bound for most of last week as investors awaited the Fed meeting and the Bureau of the Treasury’s (BTr) auctions, Noel S. Reyes, chief investment officer for Trust and Asset Management Group at Security Bank Corp., said in an e-mail.

More money was deployed towards the T-bond auction last week, he noted.

“Some buying came out from the dovish statements of the US Fed last week, easing yields a bit,” Mr. Reyes added.

Mr. Powell said on Wednesday recent high inflation readings had not changed the underlying “story” of slowly easing price pressures in the US as the central bank stayed on track for three interest rate cuts this year and affirmed that solid economic growth will continue, Reuters reported.

Speaking after a policy meeting at which officials left the benchmark overnight interest rate in the 5.25%-5.50% range and held onto their outlook for three cuts in borrowing costs this year, Mr. Powell said the timing of those reductions still depends on officials becoming more secure that inflation will continue to decline towards the Fed’s 2% target even as the economy continues to outperform expectations.

Inflation reports at the beginning of the year showed price pressures remained “elevated,” in the Fed’s view, but “haven’t really changed the overall story, which is that of inflation moving down gradually on a sometimes bumpy road to 2%,” Mr. Powell said in a press conference.

But “I also don’t think that those readings added to anyone’s confidence” of a continued decline in inflation, Mr. Powell said, comments that put weight on upcoming inflation reports to confirm that price pressures continue to ease.

If they don’t, Mr. Powell said the Fed would maintain high interest rates as long as needed. Asked explicitly about recent comments to Congress that the Fed was “not far” from gaining the confidence it needs to cut rates, he sidestepped repeating those words and instead said his “main message” was that the US central bank still needed more data to change policy.

“It’s appropriate for us to be careful,” the Fed chief said, reiterating a go-slow approach to rate cuts that has been buttressed by the economy’s ongoing strength, with officials saying they are in no rush to ease monetary policy while the economy and the job market continue to grow.

Meanwhile, the BTr made a full award of the reissued 20-year T-bonds it auctioned off last week.

The BTr raised PHP 30 billion as planned as total bids amounted to PHP 60.946 billion, more than twice the amount on the auction block. The bonds, which have a remaining life of 19 years and 11 months, were quoted at an average rate of 6.189%, with accepted yields ranging from 6.17% to 6.25%.

For this week, yields may move higher due to strong US employment data and before the release of the February US personal consumption expenditures price index report on March 29, the bond trader said.

Meanwhile, Mr. Reyes expects the market to continue monitoring external developments amid a shortened trading week at home in observance of Holy Week. — Abigail Marie P. Yraola with Reuters

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld