January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

Yields on government debt fall after central banks’ policy decisions

Yields on government securities (GS) traded in the secondary market ended lower last week, driven by policy decisions of both the Bangko Sentral ng Pilipinas (BSP) and central banks around the world.

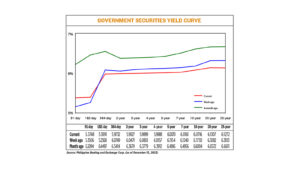

Bond yields, which move opposite to prices, fell by 6.37 basis points (bps) on average week on week, based on PHP Bloomberg Valuation Service Reference Rates as of Dec. 15 published on the Philippine Dealing System’s website.

Last week, rates were mixed across all tenors with yields on the 91-, and 182- day Treasury bills (T-bills) rising by 22.42 bps and 13.23 bps to 5.3748% and 5.3891%, respectively. Meanwhile, the 364-day T-bills went down by 10.17 bps to 5.9732%.

Similarly, the belly of the curve went down as yields on the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) fell by 6.44 bps (5.9827%), 9.62 bps (5.9899%), 10.69 bps (5.9988%), 10.84 bps (6.0070%), and 11.79 bps (6.0161%), respectively.

At the long end, the rates of the 10-, 20-, and 25-year debt papers also decreased by 10.14 bps (6.0716%), 17.75 bps (6.1307%), and 18.31 bps (6.1272%), respectively.

On Friday, total GS volume traded fell to PHP 7.46 billion from PHP 8.67 billion, a week earlier.

This weakness in volume traded is due to muted local market activity from the holiday season, a bond trader said.

The local bond market was significantly influenced by key monetary policy decisions, Lodevico M. Ulpo, Jr., vice-president, and head of Fixed Income Strategies at ATRAM Trust Corp., said in an e-mail.

“The US Federal Reserve maintained the federal funds rate at 5.25%-5.5%, signaling a potential end to its aggressive rate hikes and hinting at possible rate cuts in 2024, introducing a dovish tone,” he said.

In the local scene, the central bank maintained its key rate at 6.5% aligning with the Fed’s cautious approach, he added.

However, he said that the reluctance of other central banks, such as the Bank of England and the European Central Bank to follow this dovish path suggests ongoing global monetary policy divergences.

“Such differences hint at a potential limit to how much global yields might decrease, indicating a likelihood of continued dislocations in the bond market,” he further explained.

For the bond trader, the bond market was notably volatile this week amid the flurry of policy decisions from various major central banks both abroad and in the country.

“The continued easing of US consumer and producer inflation in November has likewise firmed views that the US Federal Reserve might have already concluded its rate-hiking cycle,” the bond trader said.

In November, headline inflation slowed to 4.1% from 4.9% in October and 8% a year ago, the weakest pace it and in 20 months or since the 4% in March 2022.

Still, the headline figure was above the central bank’s 2-4% target. Year to date, inflation averaged 6.2%, faster than 5.6% logged in January to November 2022.

On the other hand, US consumer prices unexpectedly rose in November as a decline in the cost of gasoline was more than offset by increases in rents, further evidence that the Federal Reserve is unlikely to pivot to interest rate cuts early next year, Reuters reported.

In the 12 months through November, the consumer price index increased 3.1% after rising 3.2% in October. The annual increase in consumer prices has slowed from a peak of 9.1% in June 2022, Reuters said.

Back home, the week saw the central bank maintaining its policy rates for the second straight meeting but hinting at a “tighter-for-longer” policy to anchor inflation expectations.

With these developments, the bond trader said that in totality, “these [news] were taken by market participants as potential leading cues for the expected monetary policy landscape in 2024.”

For Mr. Ulpo, given the US Fed’s dovish guidance, the Philippine bond market saw a significant shift, with yields falling across the curve, closely following the trend in US Treasuries.

“The absence of primary market auctions further amplified this movement, leading to a noticeable decline in yields, moving in parallel by about 15 to 25 bps,” he added.

For this week’s trading session, Mr. Ulpo sees yield movements likely to be more constrained within a trading range as the market heads into the holiday season.

“Despite the recent bullish sentiment and the overall firm fundamental backdrop for rates, the upcoming week might experience a quieter and more range-bound market behavior,” he said.

For the bond trader, likewise, yields will continue to move lower as the projected easing in the Fed’s preferred inflation gauge, the US personal consumption expenditure inflation could bolster the policy pause signaled by the US Fed in its latest December meeting. — Abigail Marie P. Yraola

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld