Inflation Update: Nowhere but up

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

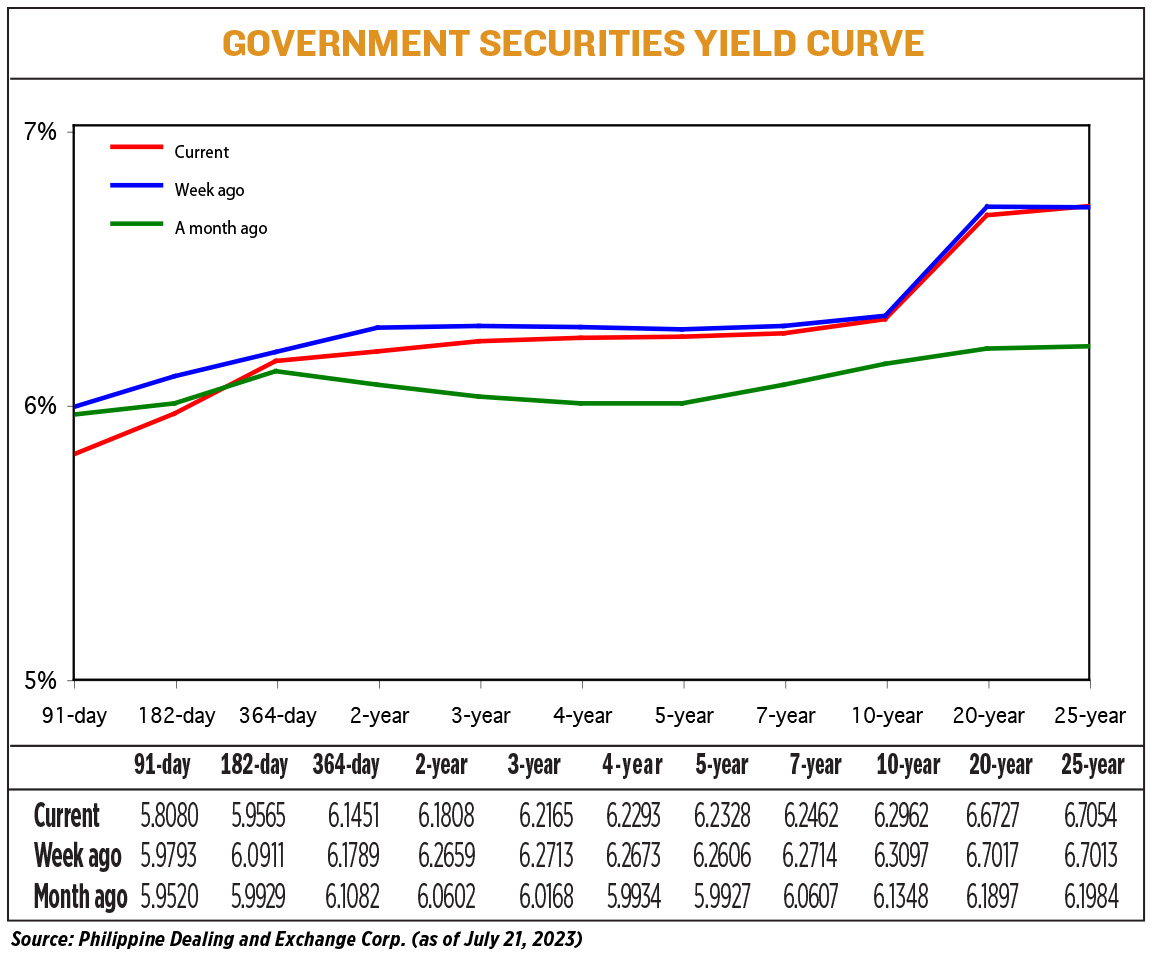

Yields on government debt end lower

YIELDS on government securities (GS) mostly fell last week amid a lack of catalysts, with the result of a bond auction affecting rate movements, analysts said.

Bond yields, which move opposite to prices, declined by an average of 5.54 basis points (bps) week on week, based on PHP Bloomberg Valuation Service Reference Rates as of July 21 posted on the Philippine Dealing System’s website.

At the short end of the curve, the 91-, 182- and 364-day Treasury bills fell by 17.13 bps, 13.46 bps and 3.38 bps to 5.808%, 5.9565%, and 6.1451%, respectively.

The belly of the curve likewise declined as yields on the two-, three-, four-, five- and seven-year Treasury bonds (T-bonds) went down by 8.51 bps (to 6.1808%), 5.48 bps (6.2165%), 3.8 bps (6.2293%), 2.78 bps (6.2328%) and 2.52 bps (6.2462%), respectively.

Meanwhile, the long end of the curve ended mixed, with rates of the 10- and 20-year debt papers decreasing by 1.35 bps (to 6.2962%) and 2.9 bps (6.6727%), while the 25-year debt paper saw its yield inch up by 0.41 bp to 6.7054%.

Traded volume fell to PHP 7.43 billion last week from PHP 44.96 billion a week prior.

GS rates ended mostly lower amid a lack of fresh leads, a bond trader said in a Viber message.

“Yields were lower because the market is now focusing more on the domestic fundamentals,” the trader added. “The bounce of yields in the latter part of the week resulted in lower trading volume as fewer players are inclined to sell.”

Meanwhile, last week’s auction of reissued seven-year T-bonds also affected GS yields, Jose Miguel B. Liboro, head of local markets at ATRAM Trust Corp., said in an e-mail.

“The key driver for short-term market movements recently has been the action in global bond yields. A drop in yields after the six-year auction provided a lift in buying sentiment and drove a shallow rally in the local bond market. Global bond yields have since retraced the move but buying sentiment remained broadly positive for local bonds towards the end of the week,” Mr. Liboro added.

Last week, the government fully awarded the reissued seven-year T-bonds it auctioned off amid strong demand for the offer.

The Bureau of the Treasury (BTr) raised PHP 30 billion as planned from the reissued seven-year bonds, with total bids reaching PHP 57.788 billion.

The bonds, which have a remaining life of six years and two months, were awarded at an average rate of 6.299%, with accepted yields ranging from 6.2% to 6.348%.

For this week, the result of the BTr’s auction of fresh seven-year T-bonds on Tuesday could drive GS yield movements, Mr. Liboro said.

“As a new issuance, we could see a slight concession on the awarded coupon which could tilt towards the higher end of the indicative 6.25%-6.5% range that it potentially prices within. We see value particularly if it prices at least at 6.375% (or higher),” he said.

The US Federal Reserve’s policy meeting on July 25-26 could also affect rates, Mr. Liboro added.

“Consensus expectation is for the Fed to hike by 25 bps at their policy meeting — but this is unlikely to move the market unless their guidance is hawkish,” he said.

“We expect global bond yield action to drive short-term onshore movements but remain broadly positive on the prospects for Philippine bonds,” he added. — A.M.P. Yraola

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld