Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Yields on government debt down on inflation, GDP data

YIELDS on government securities (GS) traded in the secondary market went down last week, still driven by easing inflation in April as well as the Philippine economy’s slower expansion in the first quarter.

YIELDS on government securities (GS) traded in the secondary market went down last week, still driven by easing inflation in April as well as the Philippine economy’s slower expansion in the first quarter.

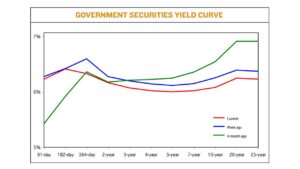

GS yields, which move opposite to prices, fell by 9.43 basis points (bps) on average week on week, based on PHP Bloomberg Valuation Service Reference Rates as of May 12, published on the Philippine Dealing System’s website.

Rates went down across all tenors. Last week’s yield curve was fully inverted, with short-term papers having higher rates than longer tenors.

On Friday, the 91-, 182- and 364-day Treasury bills (T-bills) declined by 3.59 bps, 0.43 bps, and 20 bps to fetch 5.9167%, 6.0570%, and 5.9943%, respectively.

The belly of the curve went down, as yields on the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) fell by 8.16 bps (5.8708%), 9.46 bps (5.7999%), 9.30 bps (5.7628%), 8.62 bps (5.7477%), and 9.74 bps (5.7617%), respectively.

At the long end of the curve, the rates of the 10-, 20-, and 25-year debt papers also dropped by 13 bps (5.8066%), 10.85 bps (5.9324%) and 10.58 bps (5.9201%), respectively.

Total GS volume traded reached PHP 15.74 billion on Friday, lower than the PHP 33.12 billion seen on May 5.

Jose Miguel B. Liboro, head of local markets at ATRAM Trust Corp., said buying momentum for local bonds was largely driven by the country’s easing inflation rate in April.

“The recent numbers have validated the view that inflation is poised to decelerate further by yearend,” Mr. Liboro said in an e-mail.

“Buying sentiment has remained strong, with the curve having fully inverted,” he added.

With the inverted yield curve, “investors are incentivized to invest on shorter-dated securities since that will offer them better rates while not locking their investments for a long time,” a bond trader said in a separate e-mail interview.

The bond trader said recent economic data releases drove yields lower last week.

“Moreover, this downside has been supported after Monetary Board member [V. Bruce J.] Tolentino hinted that the BSP (Bangko Sentral ng Pilipinas) could consider pausing its domestic rate hikes at its policy meeting [this] week,” the bond trader added.

“The market activity [last week] was rather tepid as participants remained uncertain on the future prospects of the global economy,” the bond trader said.

Inflation eased to an eight-month low of 6.6% in April from the 7.6% logged in March, preliminary data from the Philippine Statistics Authority showed.

Still, this was faster than the 4.9% in April 2022. Last month’s headline print also marked the 13th straight month that inflation breached the BSP’s 2-4% target.

The April print brought the four-month inflation average to 7.9%, still above the BSP’s 6% forecast for the year.

Slower inflation in April strengthens the case for a tightening pause at the Monetary Board’s May 18 meeting, analysts have said.

The BSP has raised borrowing costs by a cumulative 425 bps since May 2022 to help temper elevated inflation, bringing the policy rate to a 16-year high of 6.25%.

Meanwhile, Philippine gross domestic product (GDP) expanded by 6.4% in the January-to-March period, the slowest in eight quarters or since the 3.8% contraction in the first quarter of 2021.

This was slower than the revised 7.1% growth in the fourth quarter last year and the 8% in the same period in 2022.

The trader said besides the BSP’s policy meeting on Thursday, the market will also monitor this week’s 13-year bond auction for leads.

The Treasury will offer PHP 25 billion in reissued 13-year bonds with a remaining life of 12 years and 11 months on Tuesday.

“While we expect yields to continue to trend lower towards yearend, given the shape of the yield curve at the moment and the recent rally, it could be vulnerable to a short-term retracement,” Mr. Liboro added.

He said any move higher in global yields could prompt some profit-taking activity and a slight adjustment from current levels.

“With that said, we remain constructive on fixed income and expect it to continue to do well for the balance of 2023,” he said.

For the bond trader, local yields are expected to rise amid the possibility of a 25-bp policy rate hike from the BSP this week, which could be its last increase in the meantime.

“However, this might be capped as the potentially weaker US retail sales might bolster market concerns of a near-term recession this year,” the bond trader added. — Abigail Marie P. Yraola

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld