January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

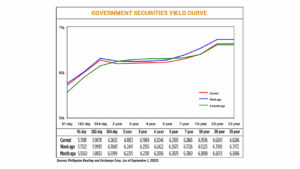

Yields on government debt decline ahead of key economic data

Rates of government securities (GS) fell last week following US Treasury yields as the market awaits the release of key data.

GS yields, which move opposite to prices, dropped by an average of 6.11 basis points (bps) week on week, according to the PHP Bloomberg Valuation Service Reference Rates as of Aug. 31 published on the Philippine Dealing System’s website.

Yields fell across the board, with rates of the 91-, 182-, and 364-day Treasury bills (T-bills) going down by 4.41 bps (to 5.7081%), 1.15 bps (5.9878%), and 4.11 bps (6.2632%), respectively.

At the belly, rates of the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) decreased by 5.48 bps (to 6.1863%), 3.86 bps (6.1969%), 3.76 bps (6.2046%), 4.77 bps (6.2193%), and 8.61 bps (6.2865%).

Yields at the long end also dropped. The rate of the 10-year papers went down by 12.89 bps to 6.3936%, followed by the 20- and 25-year T-bonds, which declined by 9.26 bps and 8.86 bps to 6.6243% and 6.6286%, respectively.

Total GS volume reached PHP 31.13 billion on Thursday, up from PHP 10.26 billion on August 25.

Yields declined for a third consecutive week as the market took cues from US Treasuries’ movements after data showed slower economic growth for the second quarter and lower ADP employment in August, analysts said.

Benchmark Treasury yields rebounded after a US jobs report showed an uptick in unemployment, cementing expectations that the US Federal Reserve will let interest rates stand at its September meeting, Reuters reported.

US 10-year Treasury yields reversed earlier declines following the employment report, as investors pared positions ahead of the Labor Day weekend.

Benchmark 10-year notes last fell 23/32 in price to yield 4.1788% from 4.091% late on Thursday.

The 30-year bond last fell 48/32 in price to yield 4.2945% from 4.204% late on Thursday.

“On auction, the [five-year] reissuance was well absorbed by the market as it cleared at 6.22%, within the indicative range and bid to cover reached 1.8 [times]. Post auction, the market continued to buy GS from the belly to the long end pushing yields lower by another 3.5 bps,” ATRAM Trust Corp. Chief Investment Officer Alessandra P. Araullo added in a Viber message.

The release of the Bureau of the Treasury’s September borrowing plan last week also caused the market to be cautious as some anticipate supply risks, with two bond maturities due this quarter, prompting speculations of a “jumbo” retail Treasury bond offer in the few next months, Ms. Araullo said.

For this week, the T-bond offer scheduled on Tuesday could affect yield movements, she said.

“There will be an original issue for a [three-year] bond with early indications of 6.125-6.25%. Investors might look to reposition as they shorten their duration ahead of the jumbo supply being speculated,” Ms. Araullo added.

Yields are also expected to tread higher amid the release of August Philippine inflation data on Tuesday, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in an e-mail.

Mr. Ricafort added that expectations of rate cuts from the Bangko Sentral ng Pilipinas in the first quarter of 2024 could also affect yield movements, as well as the upcoming Fed Beige Book Report on Wednesday. — BTMG with Reuters

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld