Inflation Update: Nowhere but up

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

Yields on government debt climb before PH inflation, US jobs data

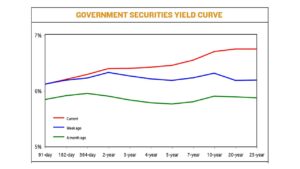

Yields on government securities (GS) climbed last week as expectations of strong US jobs data and slower Philippine inflation pushed yields higher.

GS yields, which move opposite to prices, jumped by an average of 23.31 basis points (bps) week on week, according to the PHP Bloomberg Valuation Service Reference Rates as of July 7 published on the Philippine Dealing System’s website.

Yields on the 182- and 364-day Treasury bills (T-bills) went up by 1.24 bps and 6.59 bps fetching 6.1939% and 6.2834%, respectively. Meanwhile, the 91-day T-bill saw its rate drop by 0.25 bp to 6.1088%.

At the belly, rates of the two-, three-, four-, five, and seven-year Treasury bonds (T-bonds) increased by 7 bps (to 6.3871%), 13.67 bps (6.3918%), 20.80 bps (6.4106%), 26.62 bps (6.4436%), and 31.37 bps (6.5360%).

Likewise, at the long-end, yields on the 10-, 20-, and 25-year papers climbed 38.42 bps, 55.82 bps, and 55.09 bps to 6.6878%, 6.7353%, and 6.7348%, respectively.

Total GS volume reached PHP 7.02 billion on Friday, lower than the PHP 7.89 billion on June 30.

Analysts attributed the higher yields seen last week to expectations of a strong US labor market and the release of June Philippine inflation data.

A bond trader said in an e-mail that the slightly lower inflation rate helped limit the upside on short-term rates last week.

“The surprise upside in private payrolls as measured by Automatic Data Processing, Inc. (ADP) has bolstered views of a potentially robust US employment report for June 2023. The said data release continued to support higher bond yields from the previous week,” the bond trader added.

An estimated 497,000 jobs were added in the US in June from the revised 267,000 jobs in May, and jobless claims fell to a four-month low of 1.72 million.

“The strong US economic data continues to drive overall sentiment that the Fed will continue to tighten and put further pressure on other central banks such as the BSP (Bangko Sentral ng Pilipinas),” a second bond trader said in a Viber message.

“While the BSP has reiterated its stance to resume tightening if needed, this will likely be tested if the tightening differential begins to show in the FX (fixed-income) market where the peso weakens significantly against the [US dollar],” the second bond trader added.

The BSP has held borrowing costs steady at its last two meetings, keeping its policy rate at 6.25%, while the US central bank paused its tightening cycle in June, keeping the fed funds rate at a range between 5% and 5.25%.

Following hawkish hints from Fed officials in the coming months, analysts said they are closely monitoring both central banks’ moves, specifically whether the Fed would resume hiking rates in its July 25-26 meeting and if the BSP would follow suit to keep a healthy rate differential.

“Should the BSP decide to move in step with the US, this will likewise spur some tailwinds for the local bond yields to move higher,” the first bond trader said.

For this week, the first bond trader said local yields are likely to trend downwards as the market awaits US consumer and producer inflation data.

“Traders might fixate on core inflation which has proven sticky in the past few months despite notable declines on the headline inflation level,” the trader added.

The second bond trader expects the market to remain defensive this week as the Bureau of the Treasury (BTr) continues to offer bonds.

“Just last week, the BTr issued the same bond for [two] consecutive weeks, drawing adverse reactions from market participants as the first batch of issuances was immediately put under pressure with added supply the following week,” the second bond trader said. — Bernadette Therese M. Gadon, with Reuters

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld