Inflation Update: Nowhere but up

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

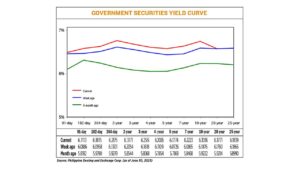

Yields on government debt climb

Yields on government securities (GS) rose nearly across the board last week after the hawkish stance signaled by central banks in the US and Europe.

Yields on government securities (GS) rose nearly across the board last week after the hawkish stance signaled by central banks in the US and Europe.

GS yields, which move opposite to prices, went up by an average of 7.71 basis points (bps) week on week, according to the PHP Bloomberg Valuation Service Reference Rates as of June 30 published on the Philippine Dealing System’s website.

Total GS volume traded reached PHP 7.89 billion on Friday, higher than the PHP 5.87 billion seen on June 23.

Yields increased across all tenors last week except for the 25-year bonds, which saw its rate inch down by 0.26 bp to 6.1839%.

Meanwhile, the 91-, 182-, and 364-day Treasury bills rose by 2.27 bps, 8.57 bps, and 8.74 bps to 6.1113%, 6.1815%, and 6.2175%, respectively.

The belly of the curve climbed as yields on the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) went up by 11.17 bps (6.3171%), 9.33 bps (6.2551%), 9.17 bps (6.2026%), 10.48 bps (6.1774%), and 13.58 bps (6.2223%), respectively.

At the long end, the rates of the 10-, and 20-year debt went up by 11.6 bps (6.3036%) and 0.11 bps (6.1771%), respectively.

Hawkish signals from the US Federal Reserve and other central banks in advanced economies pushed yields higher last week, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in a Viber message.

Leaders of the world’s top central banks reaffirmed on Wednesday they see further policy tightening as needed to tame stubbornly high inflation but still believe they can achieve that without triggering outright recessions, Reuters reported.

US Federal Reserve Chairman Jerome H. Powell did not rule out further hikes at consecutive Fed meetings, while European Central Bank (ECB) President Christine Lagarde confirmed expectations the bank will raise rates in July, saying such a move was “likely.”

“Policy hasn’t been restrictive enough for long enough,” Mr. Powell told an annual gathering of central bankers hosted by the ECB in the Portuguese mountain resort of Sintra.

“I wouldn’t take moving in consecutive meetings off the table at all,” he said. The next rate-setting Federal Open Market Committee meeting is scheduled for July 25-26.

For this week, eManagement for Business and Marketing Services Managing Director Jonathan L. Ravelas sees yields moving sideways to down amid expectations of slower Philippine inflation.

The Bangko Sentral ng Pilipinas (BSP) last week said headline inflation may have settled within 5.3% to 6.1% in June, as higher electricity rates and increases in costs of oil and some food items could have been offset by lower prices of meat, fruits and liquefied petroleum gas.

Inflation stood at 6.1% in May, bringing the five-month average to 7.5%, still above the BSP’s 2-4% target.

The Philippine Statistics Authority will release June consumer price index data on July 5.

Meanwhile, Mr. Ricafort expects yields to continue moving upwards this week.

“So far, there is no reversal yet of the underlying upward trend, also largely a function of, and being correlated with, the US government bond/treasury yields at new highs.” — with Reuters

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld