January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

Yields end mixed amid US, PHL economic data

Yields on government securities (GS) ended mixed last week as the market mainly consolidated ahead of key US economic data and following slower-than-expected Philippine headline inflation in August.

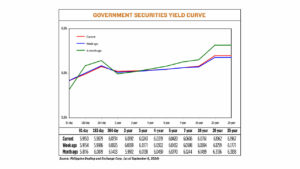

GS yields, which move opposite to prices, inched up by 0.41 basis point (bp) on average week on week on Friday, according to PHP Bloomberg Valuation Service Reference Rates data published on the Philippine Dealing System’s website.

Yields on the short end of the curve dropped. Rates of the 91-, 182-, and 364-day Treasury bills (T-bills) slipped by 0.04 bp (to 5.9150%), 1.07 bps (to 5.9879%), and 0.91 bp (6.0734%) week on week, respectively.

At the belly, most tenors rallied except for the five-year bond, which saw its yield decline by 0.12 bp to 6.0420%. Rates of the two- three-, four-, and seven-year Treasury bonds (T-bonds) went up by 1.01 bps (to 6.0192%), 0.72 bp (6.0243%), 0.17 bp (6.0319%), and 0.08 bp (6.0606%) respectively.

Lastly, rates of all tenors at the long end rose. The 10-, 20-, and 25-year debt papers saw their yields increase by 0.67 bp (to 6.0761%), 2.03 bps (6.1962%), and 1.96 bps (6.1967%) respectively.

GS volume traded was at P30.76 billion on Friday, higher than the P16.01 billion recorded a week earlier.

“Despite well-subscribed T-bills and 20-year bond auctions and a better-than-expected inflation print, yields were consolidating last week as the market was focused on US numbers and anticipation of a Federal Reserve action by the middle of this month,” Security Bank Corp. Chief Investment Officer for Trust and Asset Management Group Noel S. Reyes said in an e-mail.

Mr. Reyes said US economic data released last week, including reports on manufacturing and employment, pointed to an “increased dovish bias for the Fed, fueling further division about how much the Fed will cut (25 bps or 50 bps).”

“A 50-bp cut may lead market to believe the Fed is behind the curve, hence the caution last week. The market did see pockets of buying when yields went up midweek, but still not enough to stir a rally given the focus on the US economy and the Fed’s possible action. Overall, week on week, yields were up 1-3 bps,” he added.

US employment increased less than expected in August, but a drop in the jobless rate to 4.2% suggested the labor market was not falling off the cliff to warrant a half-point interest rate cut from the Federal Reserve this month, Reuters reported.

The closely watched employment report from the Labor department on Friday also showed solid wage growth last month, which should help to support consumer spending and keep the economy out of recession for now. Nonetheless, labor market momentum has slowed, with 86,000 fewer jobs added in June and July than previously reported.

The report led to a chorus of Fed officials declaring that the US central bank was ready to start cutting rates at its policy meeting in about two weeks. Higher borrowing costs are curbing overall demand in the economy.

Nonfarm payrolls increased by 142,000 jobs last month after a downwardly revised 89,000 rise in July, which was the smallest gain since an outright decline in December 2020, the Labor department’s Bureau of Labor Statistics said. Economists polled by Reuters had forecast payrolls increasing by 160,000 jobs after a previously reported 114,000 gain in July.

June payrolls were revised down by 61,000 jobs to 118,000. The slowdown in employment growth is coming from a step-down in hiring. Layoffs remain at historic low levels.

In addition to waning demand evident in declining job openings, the below-expectations rise in employment last month likely reflected a seasonal quirk, characterized by a tendency for August payrolls to initially print lower relative to the consensus estimate before being revised higher later.

Financial markets initially raised the chances of a half-point rate cut at the Fed’s Sept. 17-18 policy meeting to above 50% before slashing them to 25%, CME Group’s FedWatch Tool showed. The odds of a 25-bp rate reduction increased to 75% from 57% earlier.

Fed Governor Christopher Waller said on Friday “the time has come” for the central bank to begin a series of interest rate cuts this month, adding “if the data suggests the need for larger cuts, then I will support that as well.”

The Fed has maintained its policy rate in the current 5.25%-5.5% range for more than a year, having raised it by 525 bps in 2022 and 2023.

Meanwhile, Philippine headline inflation eased to a seven-month low of 3.3% in August from 4.4% in July and 5.3% in the same month a year ago, the government reported on Thursday.

This was within the Bangko Sentral ng Pilipinas’ (BSP) 3.2-4% forecast for the month and was well below the 3.7% median estimate in a BusinessWorld poll of 15 analysts.

“With August inflation lower than expected at 3.3%, prospects of another 25-bp cut before the end of the year is likely,” Jonathan L. Ravelas, senior adviser at professional service firm Reyes Tacandong & Co., said in a Viber message.

The BSP on Aug. 15 reduced its policy rate by 25 bps to 6.25%, marking its first easing move in nearly four years.

BSP Governor Eli M. Remolona, Jr. has said they could cut rates by another 25 bps within the year. The Monetary Board’s last two policy-setting meetings this year are on Oct. 17 and Dec. 19.

For this week, both Mr. Reyes and Mr. Ravelas said GS yields could move sideways amid a lack of leads.

“All eyes will focus on the US CPI (consumer price index) midweek since there are not much economic data coming out in the Philippines. Expectations are for a low print, which should intensify talks of how much the Fed cuts…,” Mr. Reyes said.

US consumer inflation data will be released on Sept. 11 (Wednesday).

Local GS yields may remain range-bound before the Fed’s policy review next week, he added. — P.O.A. Montalvo with Reuters

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld