Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

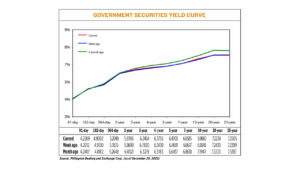

Yields end mixed amid lack of leads

YIELDS on government securities (GS) were mixed last week amid a lack of catalysts and as investors took positions ahead of the new year.

YIELDS on government securities (GS) were mixed last week amid a lack of catalysts and as investors took positions ahead of the new year.

GS yields at the secondary market went up by an average of 1.48 basis points (bps) week on week, based on the PHP Bloomberg Valuation (BVAL) Service Reference Rates as of Dec. 29 published on the Philippine Dealing System’s website.

Financial markets were closed on Dec. 30 in observance of Rizal Day.

The 91- and 364-day Treasury bills (T-bills) saw their yields go up by 2.57 bps and 2.64 bps to 4.2269% and 5.2099%, respectively.

Meanwhile, the rate of the 182-day T-bill dropped by 1.28 bps week-on-week to 4.9002%.

Almost all rates at the belly of the curve increased. Yields on the two- and five-year Treasury bonds (T-bonds) inched up by 0.97 bp and 0.99 bp to 5.9706% and 6.47%, respectively. The rates of the three- and four-year papers also climbed by 5.44 bps and 3.25 bps to 6.2464% and 6.3755%, respectively.

Meanwhile, the yield on the seven-year paper inched down by 0.52 bp to 6.6585%.

At the long end of the curve, the 10-year T-bond rose by 6.14 bps to 6.986%, while the 20- and 25-year papers fell by 1.96 bps (7.2234%) and 1.94 bps (7.2205%).

Total GS volume traded reached PHP 7.227 billion on Friday, lower than the PHP 5.204 billion recorded on Dec. 23.

“The main driver for the movement (or lack thereof) [last] week was the shortened three-day work week. Given this, market activity was fairly limited, with most investors already having repositioned previously and winding down towards the holidays. Given the focus on the long-end of the yield curve, we saw bids get more defensive,” ATRAM Trust Corp. Head of Fixed Income Jose Miguel B. Liboro said in an e-mail.

“Not a lot of actual selling activity given the reduced market liquidity, but we expect market bids to remain defensive in January, especially with expectations for December CPI (consumer price index) to remain above the 8% handle over the short term,” Mr. Liboro said.

Headline inflation likely settled within the 7.8% to 8.6% range in December due to higher electricity rates and rising food prices, the Bangko Sentral ng Pilipinas (BSP) said last week.

The BSP’s month-ahead forecast range indicates that inflation may have been faster than the 14-year high of 8% in November.

The upper end of the forecast or the 8.6% would also be the fastest pace since the 9.1% print during the Global Financial Crisis in November 2008.

If the 8.6% forecast is realized, this would bring the full-year average inflation to 5.9%, slightly above the BSP’s 5.8% average forecast for 2022.

December would also be the ninth straight month that inflation surpassed the BSP’s 2-4% target range.

Mr. Liboro said yields climbed in 2022 amid a volatile trading environment.

“Rates moved up across the yield curve by 250-300 basis points from a year-on-year standpoint. Similar to other markets both locally and globally, Philippine fixed income had a challenging 2022. However, this has put it in a decent position for much brighter prospects for 2023, given where yield levels currently are,” he said.

“We are likely to see a defensive bias initially in January as the combination of likely still-above 8% CPI, long-end auction focus, a resumption of the trend upwards in global yields and a large potential supply injection in the form of a jumbo RTB (retail Treasury bond) to weigh on the market. Despite these short-term headwinds, we expect Philippine fixed income to deliver a stronger performance in 2023 given the current starting levels.

The government plans to borrow PHP 200 billion from the domestic market in January, higher than the PHP 135-billion program in December. It will raise PHP 60 billion via T-bills and PHP 140 billion from T-bonds. — A.O.A. Tirona

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld