January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

Vehicle sales surpass target in 2023

By Justine Irish D. Tabile, Reporter

VEHICLE SALES rose by an annual 22% in 2023, surpassing the industry’s target, a report showed, as consumer demand remained robust despite elevated inflation and rising interest rates.

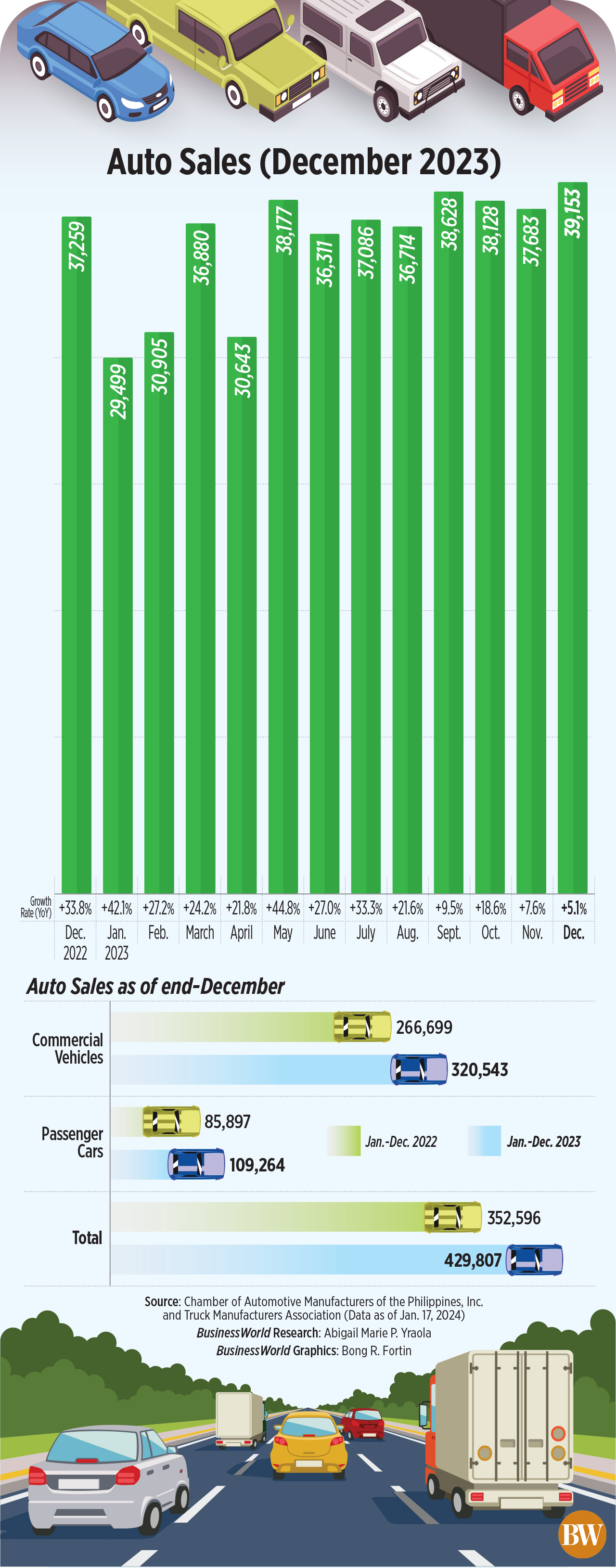

A joint report of the Chamber of Automotive Manufacturers of the Philippines, Inc. (CAMPI) and the Truck Manufacturers Association (TMA) showed total vehicle sales last year reached 429,807, a 21.9% increase from the 352,596 units sold in 2022.

It also surpassed the industry’s 423,000 revised sales target by 1.6%. CAMPI-TMA’s original sales target was 395,000 units.

In a statement, CAMPI noted the strong year-on-year sales growth was mainly due to “sustained consumer demand, easier access to credit, and improved supply conditions across all brands.”

In a statement, CAMPI noted the strong year-on-year sales growth was mainly due to “sustained consumer demand, easier access to credit, and improved supply conditions across all brands.”

“2023 was a very strong year for the industry and we are very excited about 2024,” CAMPI President Rommel Gutierrez said in a statement on Wednesday.

For the January-to-December period, commercial vehicle sales jumped by 20.2% to 320,543 units, while passenger car sales rose by 27.2% to 109,264 units.

The higher sales of commercial vehicles were driven by the 30.5% growth in Asian utility vehicles (AUVs) and 18.3% rise in light commercial vehicles.

Mr. Gutierrez said that the industry is hoping to reach record-breaking sales in 2024, banking on the country’s growth and new car models.

“Positive economic outlook, new model introductions and the electrification trend are expected to contribute to a record-breaking sales this year,” he said.

Economic managers are targeting 6.5-7.5% gross domestic product (GDP) growth for 2024.

Sought for comment, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said that the double-digit sales growth could also be attributed to the country’s favorable demographics and employment data, which he said was at the strongest in at least 18 years.

“Furthermore, lower downpayment and other promos and perks offered by some automakers also helped spur greater demand for vehicles,” he said.

Mr. Ricafort noted that the limited mass and public transport system also pushed consumers to purchase vehicles, especially with the release of new models including hybrid and electric vehicles.

For the coming months, he said that the easing trend in headline inflation towards the target of the central bank at 2%-4% would support local policy rate cuts.

“This would reduce borrowing costs for automotive loans which would also lead to some increase in vehicle sales that are financed by loans,” Mr. Ricafort added.

China Banking Corp. Chief Economist Domini S. Velasquez said that the downtrend in inflation may have provided consumers with more flexibility in their budgets, allowing them to make big-ticket purchases.

“Recovery from the pandemic may also have encouraged consumers to purchase vehicles for increased mobility, as more companies adopted return to office, and as demand for leisure travel increased,” she said.

“Looking ahead, vehicle sales will likely continue to post decent growth on the back of improved consumer confidence due to cooler inflation and lower borrowing costs with the possible interest rate cuts this year,” she added.

SINGLE-DIGIT INCREASE

In December last year, new automotive sales went up by an annual 5.1% to 39,153 units from 37,259 in December 2022. This was the slowest growth in 22 months or since the 7.3% contraction recorded in February 2022.

Month on month, vehicle sales jumped by 3.9% from 37,683 units sold in November.

Mr. Gutierrez said that the end-of-year deals spurred sales in the month of December.

Sales of commercial vehicles, which made up nearly three-fourths of the monthly sales, went up by 3.2% to 29,554 units in December. Month on month, commercial vehicle sales jumped by 5.1% from 28,114 units sold in November.

Broken down, light commercial vehicle sales declined by 2.3% to 22,102 units, while sales of AUVs surged by 29.5% to 6,558 units in December.

Sales of medium and heavy trucks dropped by 22.5% and 6.9% to 286 and 54 units, respectively.

On the other hand, light truck sales went up by 5.3% to 554 units in December.

CAMPI-TMA data showed sales of light, medium and heavy trucks all had a double-digit decline versus November’s tally.

Meanwhile, passenger car sales jumped by 11.4% to 9,599 units in December from 8,614 units a year prior.

Month on month, sales of passenger cars inched up by 0.31% from 9,569 in November.

Toyota Motor Philippines Corp. remained the market leader with a 46.54% share as full-year sales rose by 14.9% to 200,031 units.

Mitsubishi Motors Philippines Corp. came in second with a 47.3% increase in sales to 78,371 units from January to December.

In third spot is Ford Motor Co. Phils., Inc. as sales jumped by 26.8% to 31,320 units.

Rounding out the top five were Nissan Philippines, Inc., which saw a 27.9% increase in sales to 27,136 units, and Suzuki Phils., Inc. whose sales fell by 7.5% to 18,454 units.

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld