January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

Vehicle sales jump by 21.8% in April

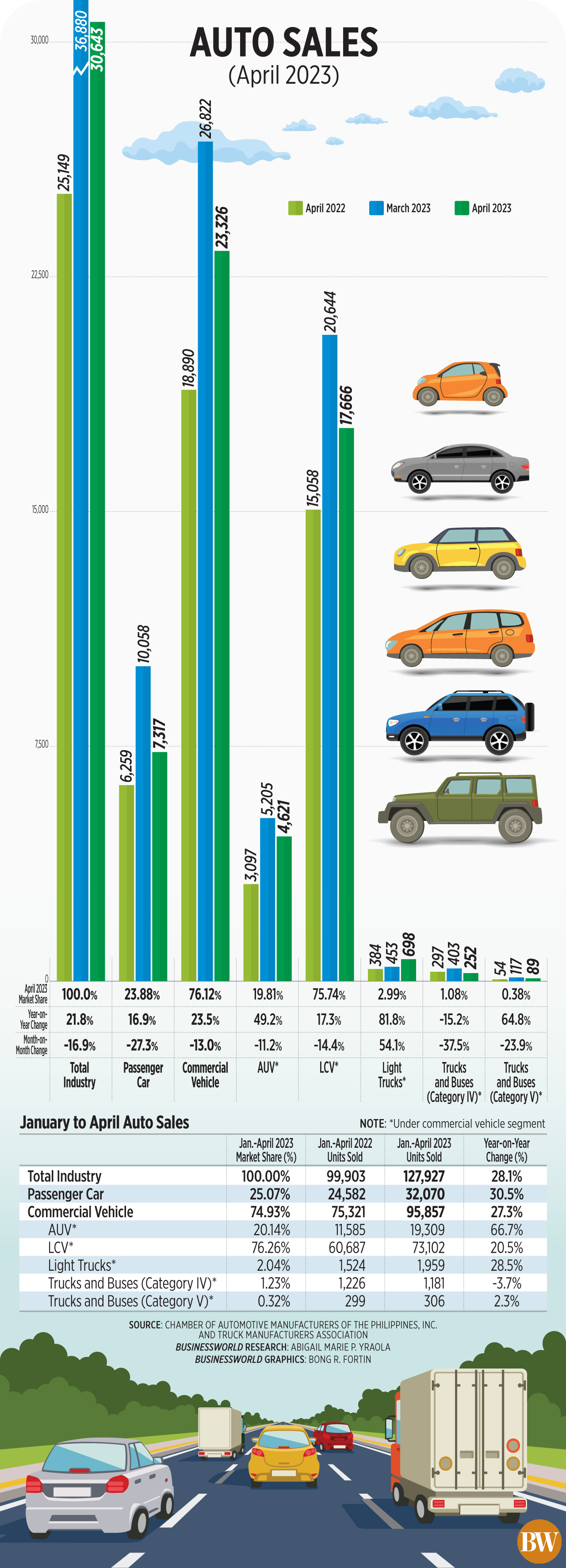

NEW VEHICLE SALES rose by an annual 21.8% in April, but a month-on-month decline in sales may reflect slowing consumer demand.

A joint report by the Chamber of Automotive Manufacturers of the Philippines, Inc. (CAMPI) and Truck Manufacturers Association (TMA) showed that total sales jumped to 30,643 in April from 25,149 in the same month a year ago.

However, April sales were 16.9% lower than the 36,880 units sold in March. This was the first month-on-month decline in car sales since the 20.8% drop seen in January.

Commercial vehicles jumped by 23.5% year on year to 23,326 in April but dropped 13% from March. This was driven by a 17.3% rise in sales of light commercial vehicles to 17,666 and a 49.2% increase in sales of Asian utility vehicles to 4,621.

Commercial vehicles jumped by 23.5% year on year to 23,326 in April but dropped 13% from March. This was driven by a 17.3% rise in sales of light commercial vehicles to 17,666 and a 49.2% increase in sales of Asian utility vehicles to 4,621.

Passenger cars, on the other hand, went up by an annual 16.9% to 7,317 in April. However, this was 27.25% lower month on month.

For the first four months of the year, total vehicle sales rose by 28.1% year on year to 127,927 units from 99,903 units a year ago.

Commercial vehicle sales increased by 27.3% to 95,857 during the January-to-April period, while passenger car sales jumped by 30.5% to 32,070.

“The improving economic indicators, which in fact remain favorable until the end of the year, according to a government report, is an essential metric for the continued growth of the auto industry,” CAMPI President Rommel R. Gutierrez said in a separate statement.

Mr. Gutierrez said the economy’s recovery is “perfectly timed” with the market availability of a wider range of motor vehicle models by CAMPI-TMA members.

Philippine economic growth eased to 6.4% in the first quarter, from the 8% expansion a year ago, amid slowing consumer spending, high interest rates and elevated inflation. Despite this, government officials are confident that this year’s 6-7% growth target can be achieved.

However, consumer demand for new vehicles may have been tempered by high interest rates. Latest data from the Bangko Sentral ng Pilipinas (BSP) showed bank lending for motor vehicles inched up 0.5% in March, from the 1.3% contraction in February.

Toyota Motor Philippines Corp. sold 59,328 units in the first four months, equivalent to a 46.38% market share.

Mitsubishi Motors Philippines Corp. sold 23,378 units (18.27% market share) in the January-to-April period, followed by Nissan Philippines, Inc. with 8,510 units (6.65% market share) and Ford Motor Co. Phils., Inc. with 8,069 units (6.31% market share).

Honda Cars Philippines, Inc. reported sales of 5,901 units (4.61% market share), while Suzuki Phils, Inc. sold 5,438 units sold (4.25% market share).

“As the economic outlook remains favorable, the auto industry is optimistic to attain full recovery from the pandemic-induced challenges — well-positioned to grow to significant levels, even higher than the pre-pandemic figures. It is worth noting that the industry has already recorded this growth trajectory in the past four months compared with the 2019 levels,” Mr. Gutierrez said.

For 2023, CAMPI-TMA members are targeting to sell 395,000 units, which is 12% higher than the 352,596 units sold last year.

The overall local vehicle industry, which includes Association of Vehicle Importers and Distributors exclusive members and MG Motors Phils., is aiming to sell 408,300 units this year. If achieved, this would be 10.4% higher than the 369,981 units sold last year. — By Revin Mikhael D. Ochave

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld