February Economic Update: Cut to the chase

DOWNLOAD

DOWNLOAD

Inflation Update: Nowhere but up

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

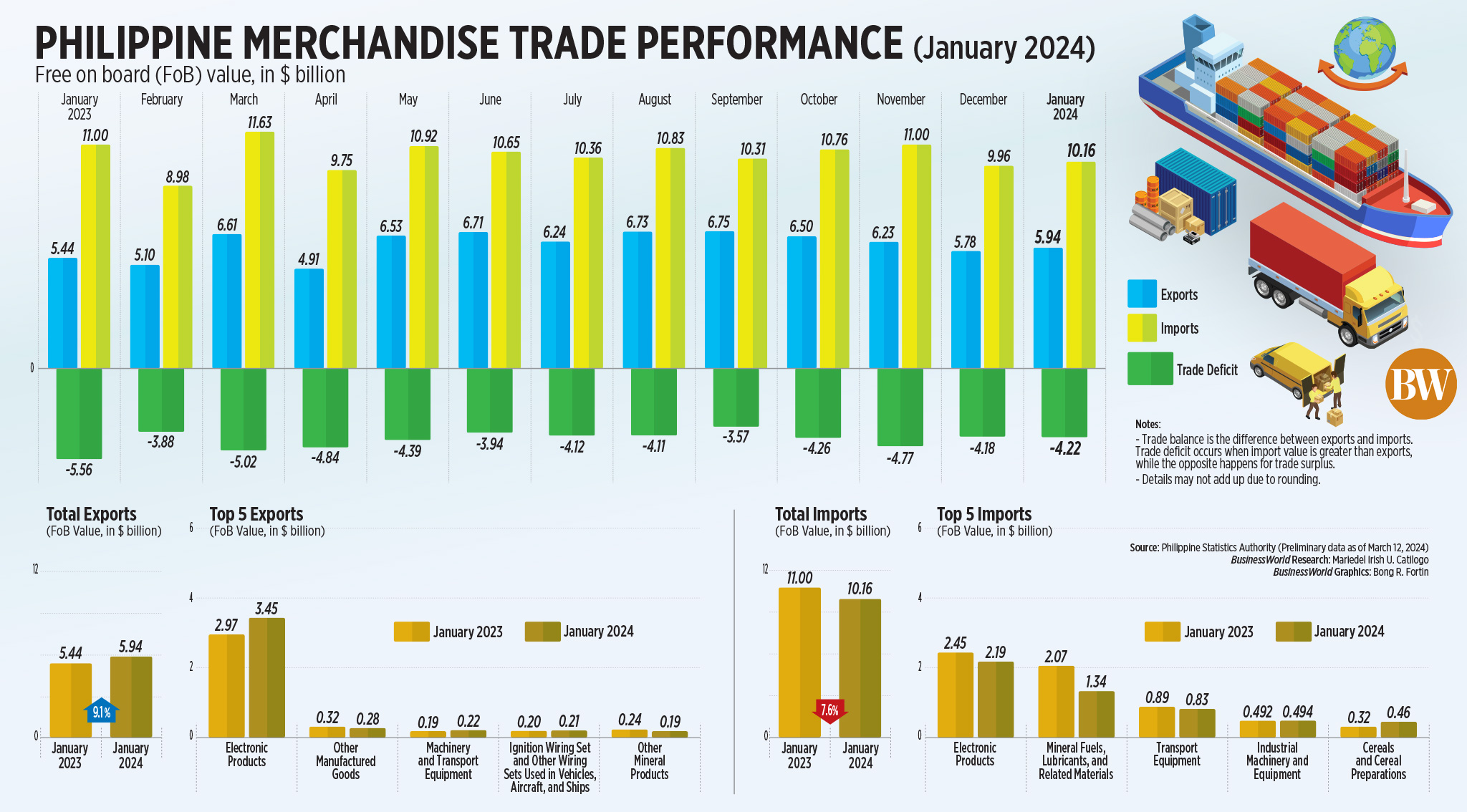

Trade gap shrinks to USD4.2B in January

The Philippines’ trade deficit in goods narrowed sharply in January, as exports returned to positive territory while imports growth contracted, the Philippine Statistics Authority (PSA) reported on Tuesday.

Preliminary data from the PSA showed the country’s trade-in-goods balance — the difference between exports and imports — reached a deficit of USD 4.22 billion in January, 24% smaller than the USD 5.56-billion deficit in January last year.

Month on month, the trade gap ballooned from the revised USD 4.18 billion in December.

January saw the widest trade deficit since the USD 4.77-billion gap in November 2023.

Total outbound sales of the country’s goods rose by 9.1% year on year to USD 5.94 billion in January, a turnaround from the 10.6% decline in the same month last year and the 0.5% dip in the previous month.

January ended four straight months of exports decline and marked the fastest growth in 14 months or since the 14.1% in November 2022.

Meanwhile, merchandise imports fell by 7.6% year on year to $10.16 billion in January, a reversal of the 4.2% growth a year earlier and a sharper drop than the -3.5% in December.

The imports decline was the biggest in four months or since the 14.1% decline in September 2023.

The Development Budget Coordination Committee (DBCC) projects a 5% and 7% growth in exports and imports, respectively, this year.

“Goods exports were boosted by higher semiconductor exports, which grew both sequentially and annually given the turn in the chip cycle and support from the AI (artificial intelligence) demand,” Makoto Tsuchiya, economist from Oxford Economics Japan, said in an e-mail.

Outbound shipments of manufactured goods in January, which accounted for 81.4% of total exports, grew by 10.5% year on year to USD 4.83 billion.

Electronic products, which accounted for 58.2% of the manufactured goods or more than half of total exports, rose by 16.3% to USD 3.45 billion.

Semiconductors, which made up 45.5% of the total, jumped nearly 20% to USD 2.7 billion in January.

“Electronics, the country’s largest export segment, showed a stronger recovery. This outturn was in line with positive trends in the global semiconductor industry, where technology bellwethers Taiwan and South Korea have also experienced improved export performance due to strong chip demand,” China Banking Corp. (China Bank) said in a research note.

However, ANZ Research economists Debalika Sarkar and Sanjay Mathur said the rebound in exports was mainly driven by favorable base effects.

“The base effect lift to exports was particularly evident in the electronics segment, which accounts for close to half of overall exports,” they said in a research note.

They added that even if the growth is impressive, export levels remained almost unchanged wherein the lack of improvement in level data makes them less confident about the real strength of the export recovery.

This also showed that the relationship between the Philippines’ semiconductor exports and the global technology cycle is weakening.

The United States was the main destination of Philippine-made goods in January as exports amounted to USD 902.33 million or 15.2% of the total exports that month.

Other top export trading partners include Japan, which accounted for a 14.6% share or USD 869.25 million, and Hong Kong with 12.8% or USD 761.08 million.

IMPORTS CONTINUE TO DROP

Robert Dan J. Roces, chief economist at Security Bank Corp., said in an e-mail that the imports decline in January can be attributed to “lower global commodity prices or a slowdown in domestic spending.”

The Philippines’ importation of raw materials and intermediate goods slipped by 5% to USD 3.73 billion in January. This segment accounted for 36.8% of the January import bill.

Imports of capital and consumer goods were valued at USD 2.95 billion (down 6.5%) and USD 2.09 billion (up 15.8%), respectively.

“The persistent decline in imports of capital goods and of raw materials and intermediate goods remains an area of concern for the economy, as it reflects businesses’ hesitance to invest in items that would contribute to economic productivity,” China Bank said.

Mineral fuels, lubricants and related materials plunged 35.4% to USD 1.34 billion in January from USD 2.07 billion a year earlier.

China remained the country’s biggest source of imports with a 26.1% share worth USD 2.65 billion. Japan trailed with a 7.8% share (USD 789.36 million) and Indonesia with a 7.7% share (USD 779.13 million).

Looking ahead, Mr. Tsuchiya expects exports growth to remain weak due to the expectations of a slowing global economy, which will put pressure on overall external demand.

“On the other hand, elevated interest rates and lower investment demand will weigh on capital goods,” he said.

Mr. Roces said it’s still too early to predict if the exports growth and imports decline seen in January will continue “given the possibility of market volatility due to various central banks globally preparing to unwind rates.”

China Bank said it expects a further recovery in exports, particularly semiconductors, in the second semester.

“Going forward, firm private consumption, government’s infrastructure spending and existing food supply issues in the domestic economy will provide a floor to imports. In combination with a tentative recovery in exports, we do not expect a material reduction in the trade deficit this year,” ANZ Research said. — By Abigail Marie P. Yraola, Deputy Research Head

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld