Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

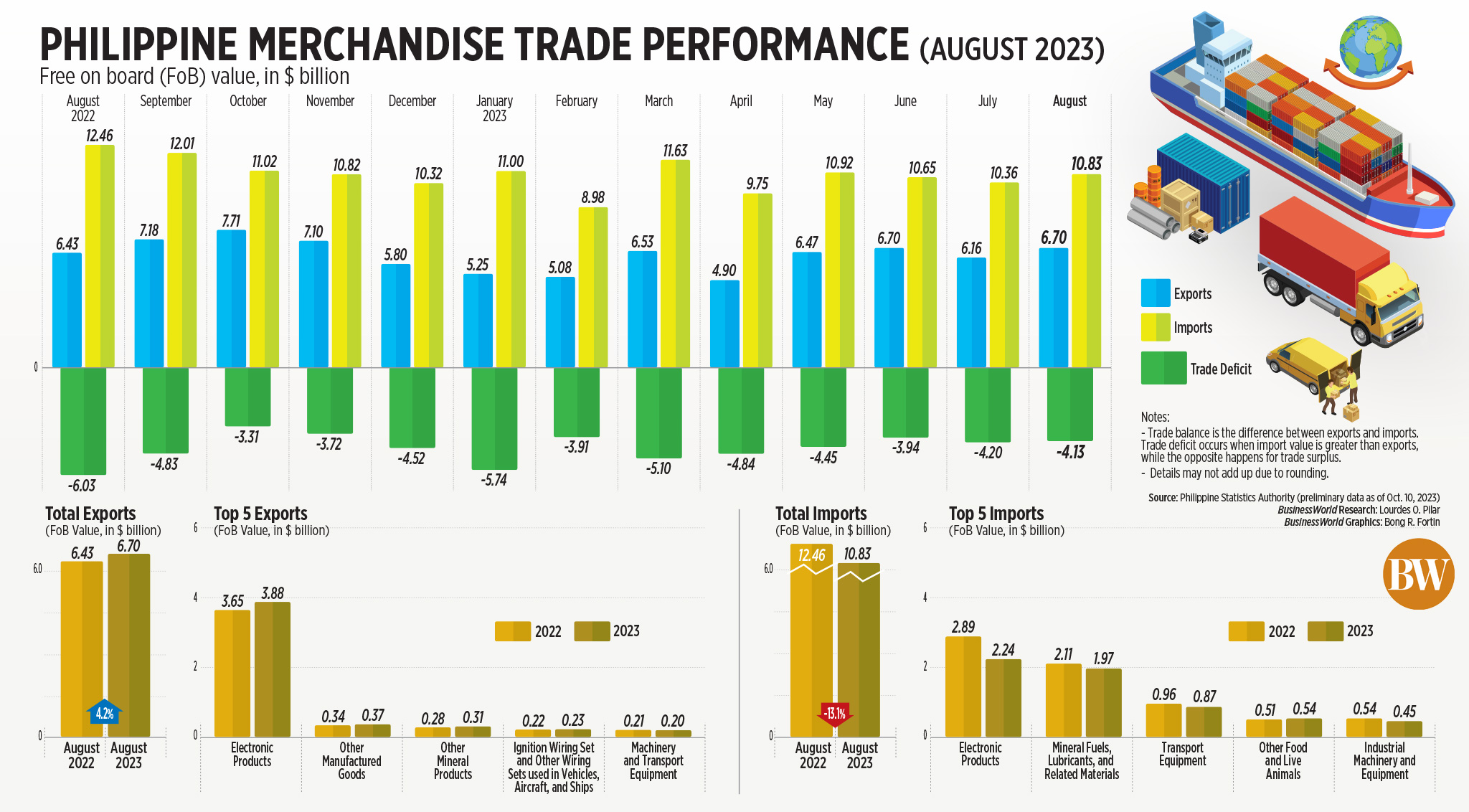

Trade gap narrows to USD4.13B in August

The Philippines’ trade-in-goods deficit for August narrowed to its lowest level in two months, as an increase in exports offset the continued decline in imports.

Preliminary data from the Philippine Statistics Authority (PSA) showed the trade-in-goods balance — the difference between exports and imports — stood at a USD 4.13-billion deficit in August, narrower than the USD 4.2-billion gap in the previous month and the USD 6.03-billion deficit in August last year.

This was the narrowest trade gap in two months or since the USD 3.94-billion deficit in June.

For the first eight months, the trade deficit slimmed down to USD 36.31 billion from the USD 41.86-billion gap during the same period a year ago.

Total sales of outbound goods jumped by 4.2% year on year to USD 6.7 billion in August, a turnaround from the revised 1.7% contraction in the same month in 2022. The 4.2% export growth was the fastest in nine months or since 13.1% in November 2022.

By value, export receipts in August marked the highest level in two months or since USD 6.703 billion in June.

In the eight months to August, exports fell by 6.6% to USD 47.81 billion.

Meanwhile, the country’s merchandise imports contracted by 13.1% year on year to USD 10.83 billion in August, a reversal from the 26.4% growth in August 2022.

The import bill in August was at the highest level in three months or since USD 10.92 billion in May this year.

In the January-to-August period, imports dropped by 9.6% to USD 84.12 billion.

“The main drivers of August exports were manufacturing goods including electronics as well as minerals. We estimate they also improved sequentially, signaling some improvement in external demand for the Philippines’ goods,” Makoto Tsuchiya, assistant economist at Oxford Economics, said in an e-mail.

Mr. Tsuchiya noted the decline in imports is still broad-based, reflecting the softness in domestic demand.

“The seasonally adjusted trend shows imports are declining but less intensely compared to the year-on-year growth, which means the imports might be close to bottoming out soon at least in the sequential term,” he added.

Manufactured goods, which accounted for 81.8% of total August exports, rose by 3.6% to USD 5.48 billion.

Electronic products, which made up more than half of the total exports in August, jumped by 6.1% to USD 3.88 billion.

Almost half of total exports came from semiconductors, which jumped by 14% to USD 3.12 billion.

The United States remained as the main destination of local goods in August, with export value reaching USD 1.1 billion or a 16.4% share of the total export receipts. Exports to Japan were valued at USD 918 million, followed by Hong Kong with USD 871 million and China with USD 838 million.

Meanwhile, imports of raw materials and intermediate goods, which made up 35.6% of the total imports in August, declined by 18.9% to USD 3.86 billion.

Imports of capital goods, likewise, contracted by 19.3% to USD 2.73 billion in August.

On the other hand, mineral fuels, lubricants and related materials, increased by 18.2% to USD 1.97 billion, while consumer goods grew by 20.6% to USD 2.24 billion.

China was the main source of imported goods in August with a 22.4% share or USD 2.43 billion of the total bill. Imports from Indonesia reached USD 977 million, followed by Japan with USD 787 million, South Korea with USD 777 million and United States with $752 million.

ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa expects the conflict between Israel and Palestinian Islamist group Hamas to send global energy prices soaring, which would drive up the country’s import bill.

“Global growth could also slow, which would slow demand for Philippine exports, either directly or indirectly,” he said in an e-mail.

Despite the exports growth, Mr. Mapa said he does not expect a sustained pickup in exports in the coming months.

“Exports will be hard pressed to hit the -4% target for this year given that year-to-date (YTD) exports are down by more than 6%,” he said.

“Meanwhile, imports will also not likely hit the forecast of -3% this year given the YTD drop of 9.6% for inbound shipments and our expectations that imports will remain soft on contracting demand for capital goods and raw materials given fast fading capital formation due to elevated borrowing costs.”

Mr. Mapa was referring to the Bangko Sentral ng Pilipinas’ forecasts for exports and imports.

Philippine Exporters Confederation, Inc. President Sergio R. Ortiz-Luis, Jr. said improvements in the supply chain helped drive export growth in August.

“[Export] orders increased slightly because of the improved supply chain… [the growth of orders] is continuous, not on a big level but it will improve,” he said in a phone interview.

The Development Budget Coordination Committee is projecting a 1% growth for exports and 2% for imports this year. — Mariedel Irish U. Catilogo

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld