Inflation Update: Nowhere but up

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

Slight inflation uptick seen in September

Inflation likely quickened in September due to pump price hikes, higher electricity rates, and the peso depreciation against the dollar, analysts said.

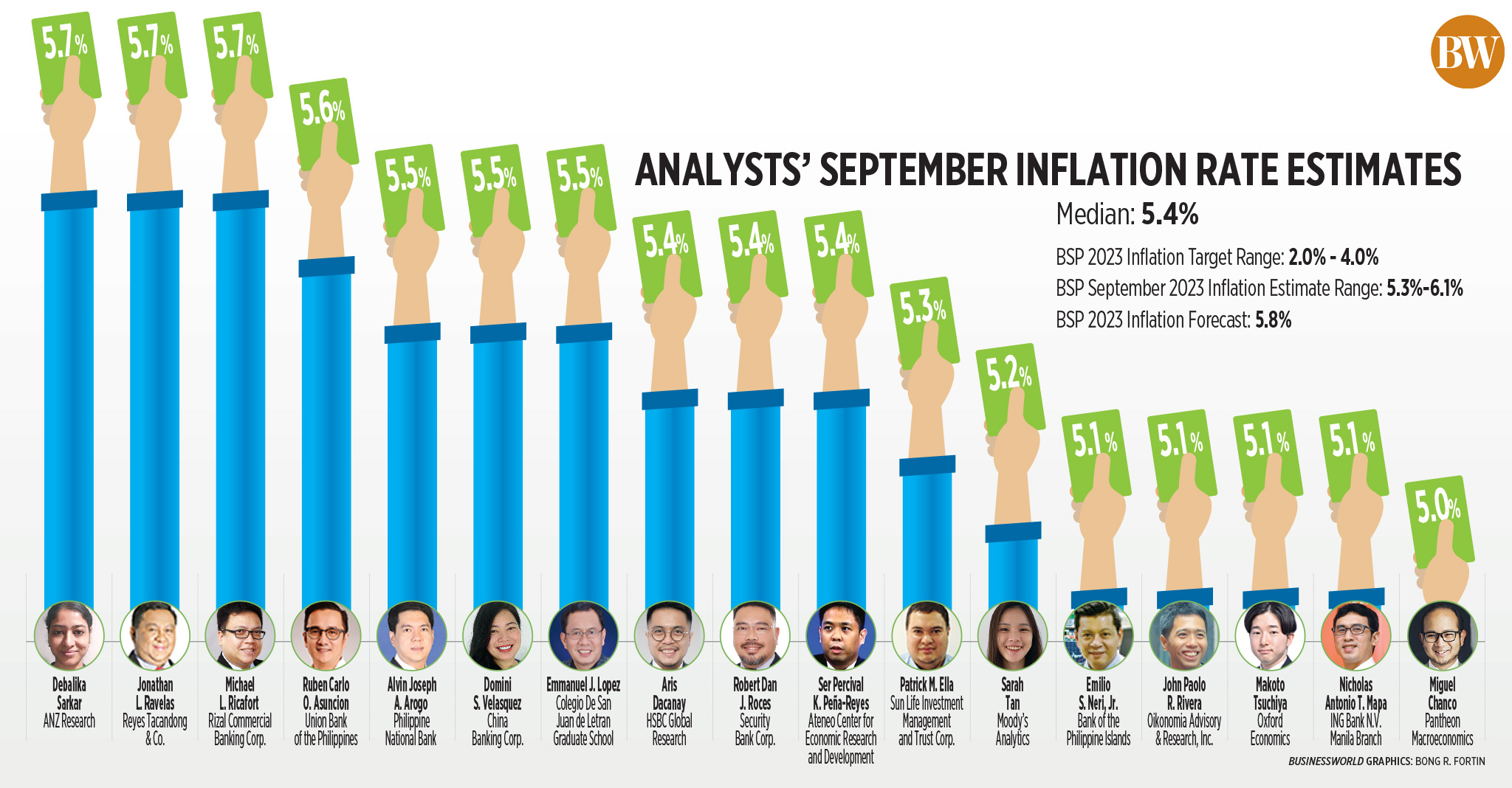

A BusinessWorld poll of 17 analysts yielded a median estimate of 5.4% for September inflation, at the low end of the 5.3-6.1% forecast of the Bangko Sentral ng Pilipinas (BSP).

If realized, September inflation would be slightly faster than the 5.3% print in August, but lower than 6.9% in the same month in 2022. It would also be the highest print in four months or since 6.1% in June.

Inflation in September will likely breach the central bank’s 2-4% target range for the 18th straight month.

The Philippine Statistics Authority (PSA) is scheduled to release the latest consumer price index (CPI) data on Oct. 5 (Thursday).

“Higher prices of fuel, electricity, and key agricultural commodities, as well as the peso depreciation are the primary sources of upward price pressures in September,” the BSP said in a statement on Friday.

“Meanwhile, lower rice and meat prices could contribute to downward price pressures for the month,” it added.

In September alone, oil companies raised pump prices for gasoline by PHP 2.50 per liter, diesel by PHP 3.90 per liter, and kerosene by PHP 0.80 per liter.

Customers of Manila Electric Co. (Meralco) saw higher electricity bills in September after the overall rate went up by PHP 0.5006 per kilowatt-hour (kWh) to PHP 11.3997 per kWh.

HSBC economist for ASEAN (Association of Southeast Asian Nations) Aris Dacanay said electricity rates rose more than 4% in September, reflecting the higher energy import bill due to the depreciation of the peso against the dollar.

The peso finished trading at PHP 56.575 per dollar on Friday, gaining 40.5 centavos from its previous close of PHP 56.98. In September alone, the peso has slightly strengthened by two centavos or 0.03% from its Aug. 31 finish of PHP 56.595.

However, China Banking Corp. Chief Economist Domini S. Velasquez said higher electricity rates from Meralco may have been offset by lower rates in other provinces like Batangas, Pampanga, and Bohol.

She noted that prices of fish and fruits remained elevated last month and increases in cooking gas prices may have also added to upward inflationary pressures in September.

Cooking gas prices rose by PHP 6.65 per kilogram in September, marking the second straight month of price hikes.

“On a positive note, rice and vegetable prices, which were the primary drivers of food inflation in August, eased due to the mandated rice price cap and relatively favorable weather (i.e., no strong typhoons this month),” Ms. Velasquez said.

Sarah Tan, an economist from Moody’s Analytics, noted that rice prices have cooled due to the imposition of a price ceiling in early September. The spike in rice prices was one of the main drivers of inflation in August.

“Notably, the average price of locally produced regular milled rice in Metro Manila has fallen about 20% from its end-August peak,” Ms. Tan said.

Starting Sept. 5, the Marcos administration imposed a price ceiling of PHP 41 per kilo for regular milled rice and PHP 45 per kilo for well-milled rice.

Meanwhile, core inflation may have settled at 5.9% in September, Ms. Velasquez said.

If realized, this would be lower than the 6.1% print in August. It would also be the first-time core inflation fell below the 6% level since the 5.9% print in October 2022.

“We won’t be surprised if higher oil prices have spilled over to core (inflation) already,” Bank of the Philippine Islands Lead Economist Emilio S. Neri, Jr. said.

For the rest of the year, ANZ Research economist Debalika Sarkar said global oil prices may remain elevated amid tight supply.

“While some effort has been made to stabilize domestic food prices, domestic retail pump prices continue to adjust to global oil price movements,” she said. “The low oil inventory also implies a faster pass-through in the absence of adequate fiscal controls.”

Ms. Sarkar said another round of transport fare hikes, which may be implemented in November, could further add upward pressure on inflation.

“Overall, we do not see the monthly inflation print falling back below 4% year on year this year,” she said.

The BSP earlier said it still sees inflation falling within the 2-4% target in November, but raised its average inflation forecast for 2023 to 5.8% (from 5.6% previously).

Philippine National Bank economist Alvin Joseph A. Arogo said it is still possible for the headline print to fall within the target by fourth quarter if inflation will not accelerate past 5.5% in September.

“However, the risk to this view is elevated due to El Niño, typhoons, oil production cuts, and prolonged Russia-Ukraine war,” Mr. Arogo said.

On the other hand, Patrick M. Ella, economist at Sun Life Investment Management and Trust Corp., said inflation may return to the 2-4% target range by the first quarter next year instead, and not in the fourth quarter as previously expected.

A surge in consumer spending ahead of the holiday season in the fourth quarter may put the 2-4% target range out of reach, Colegio de San Juan de Letran Graduate School Associate Professor Emmanuel J. Lopez said.

Barring any new shocks, Ms. Velasquez said inflation is still on track to return to the 2-4% target band in the fourth quarter.

“Hence, we think that the BSP can still keep its policy rate on hold at 6.25% this year, especially if third-quarter GDP (gross domestic product) comes out weaker than anticipated,” she said.

The PSA will release the third-quarter GDP data on Nov. 9.

The Monetary Board has kept its key interest rate at 6.25% for a fourth straight meeting last month. This was after it hiked policy rates by 425 basis points from May 2022 to March 2023.

Ms. Velasquez noted that recent supply shocks to inflation could be addressed by non-monetary measures.

“However, we are cognizant that another rate hike in November is a live possibility if the peso weakens further given another Fed rate hike,” she added.

The US Federal Reserve earlier signaled it would keep rates higher for longer, even as it opted to keep the target Fed funds rate unchanged at 5.25-5.5% at its meeting last month.

The Fed’s next meeting is from Oct. 31 to Nov. 1, while the BSP is scheduled to discuss policy on Nov. 16. — Keisha B. Ta-asan, Reporter

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld