Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Remittances jump by 2.6% in Sept.

CASH REMITTANCES from overseas Filipino workers (OFWs) jumped by 2.6% in September amid steady demand for healthcare and maritime workers abroad.

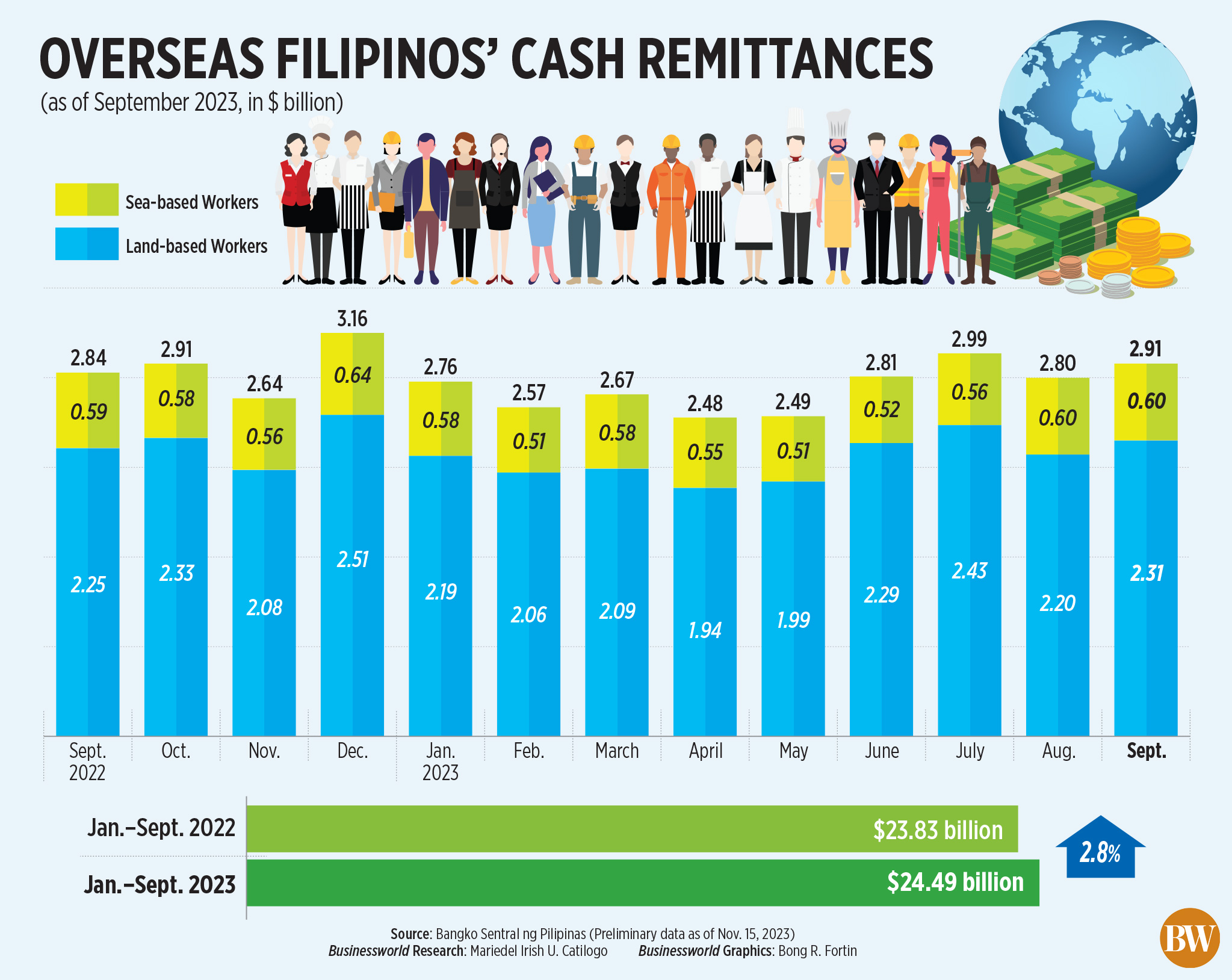

Data released by the Bangko Sentral ng Pilipinas (BSP) on Wednesday showed cash remittances coursed through banks rose by 2.6% to USD 2.91 billion in September from USD 2.84 billion in the same month last year.

The amount of cash sent home by OFWs was the highest in two months or since USD 2.99 billion in July.

However, the pace of cash remittance growth was a tad slower than 2.7% in August and 3.8% in September last year.

“The growth in cash remittances in September 2023 was due to increased receipts from both land- and sea-based workers,” the BSP said in a statement.

Land-based OFWs sent home USD 2.31 billion in September, up by 3% from USD 2.25 billion in the same month last year. Remittances from sea-based workers went up by 0.9% to USD 600 million from a year ago.

Security Bank Corp. Chief Economist Robert Dan J. Roces said in a Viber message that the sustained demand for OFWs has resulted in a consistent flow of remittances.

“First, there has been a continuous demand for OFWs in various sectors, particularly in industries such as healthcare, information technology, and maritime,” he said.

Mr. Roces also noted the government and the private sector’s efforts to boost the efficiency and accessibility of remittance services through digital channels have helped make it easier for OFWs to send money home.

“These factors, combined, have resulted in the overall increase in cash remittances, albeit at a slightly slower pace compared to previous years,” Mr. Roces said.

For the first nine months of the year, cash remittances jumped 2.8% year on year to USD 24.49 billion from USD 23.83 billion in the same period in 2022.

Inflows from the United States, Saudi Arabia, and Singapore largely contributed to the growth in cash remittances during the January-to-September period.

Nearly half or 41.5% of the overall remittances came from OFWs in the United States. Other major sources of cash remittances include Singapore (6.9%), Saudi Arabia (6%), Japan (5%), the United Kingdom (4.8%), and the United Arab Emirates (4.1%).

Remittances from the top 10 countries accounted for 79.9% of the nine-month total.

Meanwhile, personal remittances, which contain inflows in kind, rose by 2.6% year on year to USD 3.23 billion in September. This was slightly slower than the 2.8% growth in August, and the 4% increase in September last year.

This brought personal remittances 2.8% higher to USD 27.24 billion in the January-to-September period from USD 26.49 billion a year ago.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said elevated inflation in the Philippines may have prompted migrant workers to send more money home to help their families cope with rising prices.

In September, headline inflation went up to 6.1% from 5.3% a month prior. September marked the 18th straight month inflation breached the BSP’s 2-4% target this year.

Mr. Roces said sustained inflows from remittances may continue to prop up the peso in the coming months.

However, Mr. Ricafort said the Israel-Hamas war may reduce the demand for OFWs in Israel and nearby countries.

“Israel’s economy could slow down amid reduced tourism business amid flight/tour cancellations to Tel-Aviv, Israel/Holy Land amid risk of missile attacks from Hamas recently,” he said.

“There are many Filipino caregivers, domestic helpers/workers, and other service/tourism workers in Israel and in nearby/neighboring Middle Eastern countries. There would be minimal adverse effects on the economy, provided there are no evacuations or repatriation of OFWs back to the country, as seen in recent years,” he said.

The BSP expects remittances to grow by 3% this year. – Keisha B. Ta-asan, Reporter

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld