January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

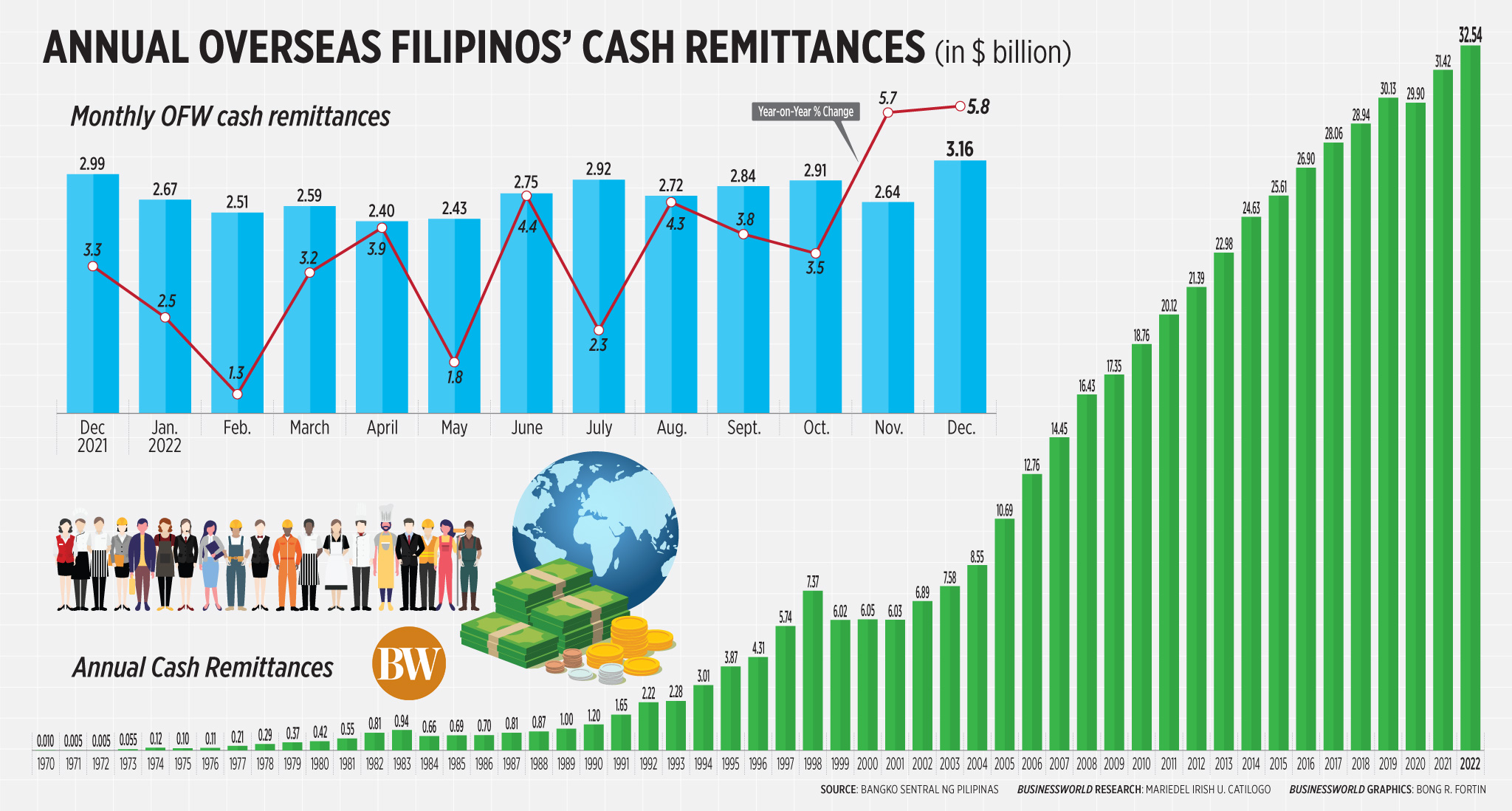

Remittances hit record high in 2022

CASH REMITTANCES hit a record high in 2022, as overseas Filipino workers (OFWs) sent more money to their families who are struggling with soaring prices.

Money sent by OFWs through banks jumped by 3.6% to USD 32.54 billion last year, according to data released by the Bangko Sentral ng Pilipinas (BSP) on Wednesday. It exceeded the previous record of USD 31.42 billion in 2021.

However, the 3.6% annual remittance increase fell short of the BSP’s 4% projection. It was also slower than the 5.1% expansion in 2021.

In December alone, cash remittances jumped by 5.8% to a record USD 3.16 billion, from USD 2.99 billion a year earlier. The growth in remittances for December was also the fastest since the 7% seen in June 2021.

“The expansion in cash remittances in December 2022 was due to the growth in receipts from land- and sea-based workers,” the BSP said.

Land-based OFWs sent USD 2.514 billion in December, up by 5.8% in the same month last year. Remittances from sea-based workers grew by 5.6% to USD 644.91 million from a year ago.

Remittances usually surge in December as OFWs typically send more money to their relatives during the holidays, Union Bank of the Philippines, Inc. (UnionBank) Chief Economist Ruben Carlo O. Asuncion said in a Viber message.

“(This was) Christmas exuberance… Our OFWs were probably just in the mood to spend and spend so much. This December has been the most ‘open’ one in the last three years,” Mr. Asuncion said.

The Philippine economy grew by 7.2% in the fourth quarter, as household consumption rose amid Filipinos’ “revenge spending” during the holidays. This brought full-year economic growth to 7.6% in 2022, the fastest since 1976.

China Banking Corp. Chief Economist Domini S. Velasquez said elevated inflation may have also prompted OFWs to send more money to help their families.

“Pull factors such as high inflation and greater mobility in the home country (Philippines) encouraged more remittances,” Ms. Velasquez said.

Inflation accelerated to a 14-year high of 8.1% in December, bringing full-year inflation to 5.8% in 2022 amid soaring food prices.

Ms. Velasquez said the weaker peso in the last few months of 2022 “could have also helped” boost remittances.

The peso closed at P55.755 on Dec. 29, 2022, down 8.5% or P4.755 from its P51-per-dollar close on Dec. 31, 2021.

“Better economic performance in host economies led to jobs and income for overseas Filipinos — notably the US, Asia, and Middle East continue to post brisk economic activities,” Ms. Velasquez said.

According to the BSP, growth in inflows from economies such as the United States (US), Saudi Arabia, Singapore, Qatar, and United Kingdom (UK) contributed largely to the increase in remittances in 2022.

The US (41.2%) was the biggest source of remittances in 2022, followed by Singapore (7%), Saudi Arabia (6%), Japan (5.1%), the UK (4.7%), the United Arab Emirates (4.2%), Canada (3.6%), Qatar (2.8%), Taiwan (2.7%), and Republic of Korea (2.5%).

These countries altogether account for more than three-fourths (79.8%) of cash remittances during the year.

Meanwhile, personal remittances that include inflows in kind grew 5.7% to USD 3.49 billion in December from USD 3.30 billion in the year prior. This brought the full-year figure 3.6% higher to a record USD 36.14 billion.

“The robust inward remittances reflected the increasing demand for foreign workers amid the reopening of economies. The full-year 2022 level accounted for 8.9% and 8.4% of the country’s gross domestic product (GDP) and gross national income (GNI), respectively,” the BSP said.

UnionBank’s Mr. Asuncion expects remittance growth to slow this year due to the looming global economic slowdown.

“Our forecast for this year is a growth of 2.6%. It will be softer but still respectable,” he said.

Meanwhile, China Bank’s Ms. Velasquez is hopeful remittances will remain robust despite a global recession.

“Next year, we think that despite a global slowdown, remittances will remain robust with soft landing/only a shallow recession is expected from the US — the biggest sending country; better outlook for Asia, with China’s reopening; and continued deployment to the Middle East, Asia, and some European countries,” she said.

The BSP expects remittances to grow by 4% this year. — Keisha B. Ta-asan

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld