Inflation Update: Weak demand softens shocks

DOWNLOAD

DOWNLOAD

Monthly Economic Update: Fed cuts incoming

DOWNLOAD

DOWNLOAD

Consensus Pricing – June 2025

DOWNLOAD

DOWNLOAD

TOP SEARCHES

PHL factory activity hits 6-month high in December

FACTORY ACTIVITY in the Philippines continued to expand in December, hitting a six-month high thanks to a rise in production and new orders, a survey by S&P Global showed on Tuesday.

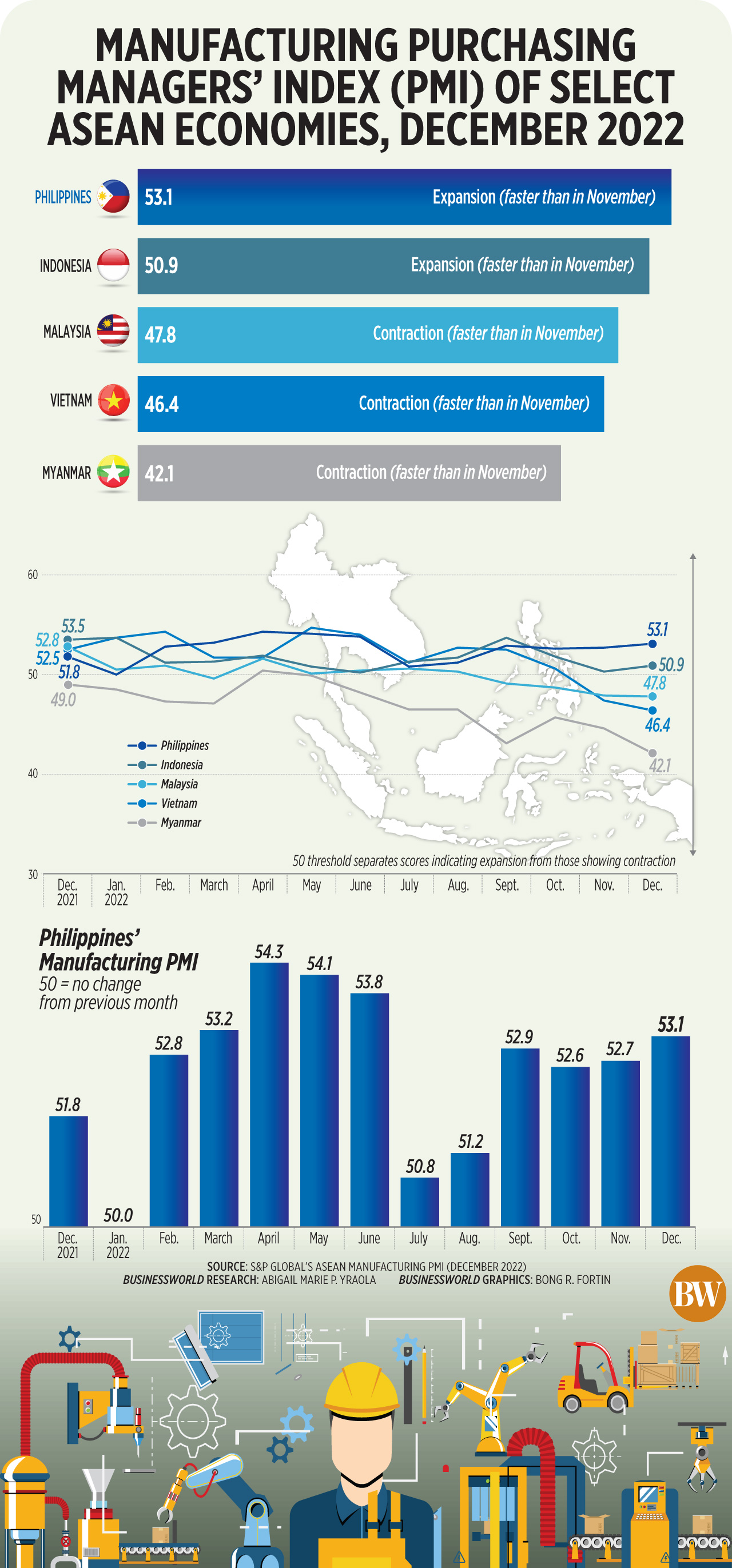

The S&P Global Philippines Manufacturing Purchasing Managers’ Index (PMI) jumped to a six-month high of 53.1 in December, from 52.7 in November, indicating a “solid improvement in the health of the Filipino manufacturing sector.”

December also marked the 11th straight month of expansion for manufacturing activity.

“The latest PMI data signaled sustained growth across the Filipino manufacturing sector. The release of pent-up demand because of the COVID pandemic continued to help the recovery of the manufacturing sector this year. The latest upturns in output and new orders were stronger than the survey averages,” Maryam Baluch, economist at S&P Global Market Intelligence, said in a report.

“The latest PMI data signaled sustained growth across the Filipino manufacturing sector. The release of pent-up demand because of the COVID pandemic continued to help the recovery of the manufacturing sector this year. The latest upturns in output and new orders were stronger than the survey averages,” Maryam Baluch, economist at S&P Global Market Intelligence, said in a report.

A PMI reading above 50 denotes improvement in operating conditions compared with the preceding month, while a reading below 50 signals deterioration.

The headline PMI measures manufacturing conditions through the weighted average of five indices: new orders (30%), output (25%), employment (20%), suppliers’ delivery times (15%) and stocks of purchases (10%).

Based on the available PMI reports, the Philippines had the highest reading among some of its Association of Southeast Asian Nations (ASEAN) neighbors for the month.

Indonesia had the second-highest PMI reading with 50.9. On the other hand, Malaysia (47.8), Vietnam (46.4), and Myanmar (42.1) all recorded contractions in December. PMI data for Thailand has not been released.

In the Philippines, S&P Global reported that both production and new orders expanded for a fourth consecutive month.

“A solid expansion in production levels was reported during December. The rate of growth quickened in the month, indicating the fastest rise in output levels since June,” it said.

New orders also entered its fourth straight month of expansion as demand conditions remained robust for Philippine-manufactured goods.

However, S&P Global noted that domestic demand drove new orders, while foreign orders shrank for a 10th month in a row.

Philippine firms started hiring new workers again in December.

“Increasing business requirements resulted in firms resuming hiring activity in December, following the first fall in headcounts in eight months during November. While the return to growth was clearly a positive indication of improvement across the Filipino manufacturing sector, the rate of job creation was only fractional overall,” S&P Global said.

However, firms were more cautious in input buying in December.

“Adjusted for seasonality, the respective index ticked down from November’s six-month high, indicating only a slight increase in the quantity of inputs purchased,” it added.

S&P Global said that inflation rates of both input price and output charges eased, with selling prices rising at the slowest pace in a year.

“Recent months have signaled some easing of price pressures but rates of inflation remain sharp and an ongoing threat to demand. The pace of increase in cost burdens was the slowest for three months, whilst firms raised their selling prices at the softest rate for a year in December amid efforts to drive sales. Firms remained optimistic in the outlook for output for the year ahead,” it added.

INFLATION A CONCERN

Ms. Baluch said supply chain disruptions and inflationary pressures remain an ongoing concern for manufacturers, and may threaten growth prospects in 2023.

“While the central bank of the Philippines has taken measures to curb inflation, global supply chain delays and material shortages remain a much more complex issue to solve. Nonetheless, goods producers remain strongly upbeat for the year ahead, banking largely on domestic demand to help maintain growth,” she added.

ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said that improved business conditions and solid pickup in economic activity led to better production and higher orders.

“Furthermore, the increase in activity led to a rise in employment which bodes well for the recovery. Momentum likely to persist although we’ll be monitoring the fallout from the sustained rise in inflation and borrowing costs on the overall economy as 2023 wears on,” Mr. Mapa said in a Viber message.

China Banking Corp. Chief Economist Domini S. Velasquez said in a Viber message that factory activity was strong in December despite elevated inflation.

“On a positive note, inflation momentum is likely already slowing which would be beneficial for the manufacturing sector, especially if input prices decelerate. A return to normal, in terms of economic activities and employment, continues to provide the necessary boost to keep domestic demand high,” she said.

The Bangko Sentral ng Pilipinas (BSP) gave a 7.8-8.6% inflation forecast for December. A BusinessWorld poll of 11 analysts yielded a median estimate of 8.3% for December inflation.

Ms. Velasquez said that factory output this year will likely continue to expand as China reopens its economy.

“A faster and stronger recovery from China bodes well for manufactured export products,” she added. — Luisa Maria Jacinta C. Jocson

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld