Inflation Update: Green light for easing

DOWNLOAD

DOWNLOAD

December Economic Update: One for them, one for us

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Trade trajectories trend along

DOWNLOAD

DOWNLOAD

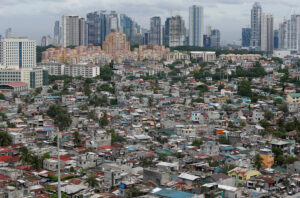

PH faces challenges in securing ‘A’ credit rating

The Philippines is still determined to secure an “A” sovereign credit rating before the end of the Marcos administration, although Finance Secretary Benjamin E. Diokno said it may be more challenging amid uncertainties in the global markets.

“Given the current global environment, getting an ‘A’ rating promises to be challenging,” he told reporters in a press chat on Friday.

Last week, Fitch Ratings downgraded the US debt rating to “AA+” from “AAA” due to a likely fiscal deterioration over the next three years and growing government debt burden.

“At a time of uncertainty in the global market, the Philippines is doing quite well,” Mr. Diokno said. “Our ultimate goal is to get an ‘A’ rating before the end of the President’s term.”

The Philippines currently falls short of the “A” rating across three major debt watchers, with Moody’s Investors Service rating the country at “Baa2,” S&P Global Ratings at “BBB+,” and Fitch Ratings at “BBB.”

All three have assigned a “stable outlook” for the Philippines, indicating that no rating changes may occur in the next 12 to 18 months.

“An upgrade to ‘A’ rating will result in improved perception of the local and international business and financial communities on the country and will help reduce the government’s borrowing cost,” Mr. Diokno said.

“In turn, this will increase investment due to higher investor confidence and will eventually help in achieving the country in its long-term economic plans,” he added.

The Philippines’ outstanding sovereign debt hit a record PHP 14.15 trillion as of end-June.

Finance Undersecretary Zeno Ronald R. Abenoja said interest payments constitute about 10-11% of the government’s budget.

For next year, the government’s debt service program is set at PHP 1.91 trillion, of which PHP 670.47 billion will go to interest payments.

“With the credit rating upgrade, it will lower the borrowing cost of the government that will provide savings for the National Government,” Mr. Abenoja said.

He also said that the savings from lower borrowing costs could be allocated to the government’s priority projects.

Meanwhile, BSP Governor Eli M. Remolona said the credit default swap (CDS) spread of the Philippines on a five-year horizon is around 69-70 bps, which mirrors a CDS spread of a country with an “A” rating.

The CDS spread is a market-based measure of a country’s likelihood of defaulting within a certain period of time.

“The CDS market is anticipating our single ‘A’ rating. Credit rating agencies look at the country’s governance and the fiscal policies to pursue [in deciding their debt ratings]. For the Philippines, they see our policies are good enough, including being able to help the poor,” Mr. Diokno said in mixed English and Filipino.

Still, debt watchers are being careful in giving credit ratings due to the backlash they received during the global financial crisis, Mr. Diokno said.

The three major agencies were criticized for exaggerated ratings of risky mortgage-backed securities back in 2008, which gave investors false confidence that they were safe for investing.

Mr. Remolona said the debt watchers are more “conservative” now.

To achieve the “A” credit rating, the BSP and the Department of Finance organized an InterAgency Committee on the Road to A Credit Rating Agenda in 2019.

The body aims to coordinate the efforts of member agencies in implementing the Road to A Roadmap. It also aims to enhance engagements with analysts, investors, and credit rating agencies.

“It is important to note that we managed to maintain investor grade ratings even during the pandemic, while other countries were downgraded,” Mr. Diokno said. “We’re fully aware that this is not going to be a walk in the park. But we are committed to work unceasingly to achieve our lofty goal.” — Keisha B. Ta-asan

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld