January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

Philippine short selling in short demand 3 months after its launch

John Russell DC. Manarang, 22, is excited about finally being able to short sell on the Philippine Stock Exchange (PSE), thinking this would let him take a profit when the market is down.

“I am considering short selling because I don’t like buying long,” Mr. Manarang, who runs a food cart business, said in a Facebook Messenger chat. “Even when you short sell, you could still be a profitable trader.”

After a nearly three-decade wait, traders have been allowed since November to short-sell stocks in the Philippines after regulators approved a proposal first made by the Philippine Stock Exchange, Inc. in 1996 — five years before Mr. Manarang was born.

A total of 52 stocks including all shares on the Philippine Stock Exchange index (PSEi), and one exchange-traded fund, may be sold short, meaning investors can borrow a security, sell it on the open market and expect to buy it back later at a lower price.

The Philippines embraced short selling, which is limited to brokers and their clients, when its peers like China and South Korea are tightening control over it amid higher US interest rates. Aside from the Philippines, short selling is being done in Singapore, Hong Kong, Malaysia, Thailand and Indonesia.

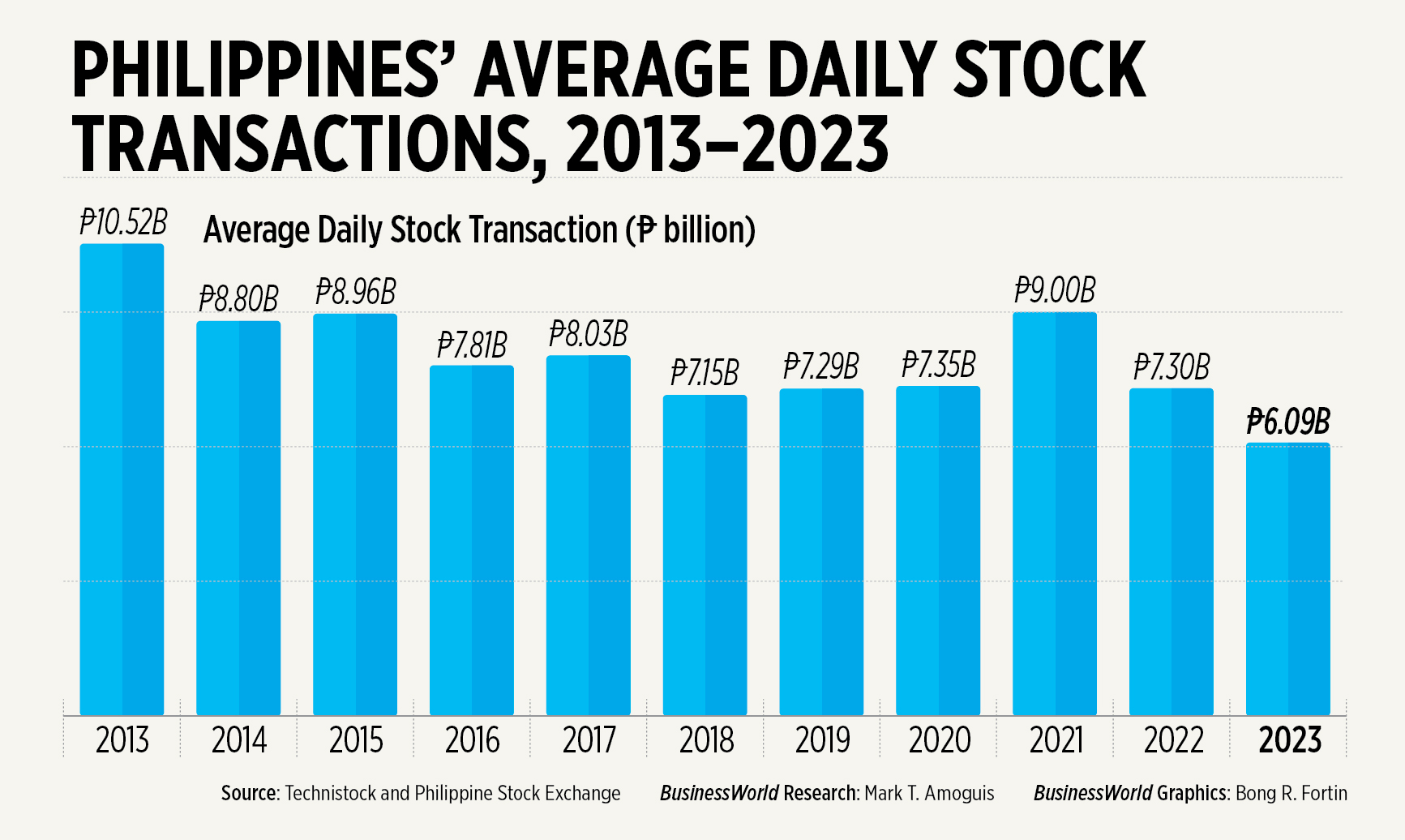

The PSE is seeking to revive interest in a market where average daily stock transactions have slumped by about 40% in the past decade, and foreign equity investments have sunk for the past six years, according to Bloomberg data.

But not so many traders share Mr. Manarang’s excitement, based on the slow adoption of the trading strategy in the country, Juan Paolo E. Colet, managing director at China Bank Capital Corp., is not surprised.

“First, the backend and client systems and processes of local brokers are configured for a long-only market, so it takes time to adopt the necessary changes,” he said in a Viber message. “Second, many investors are still not knowledgeable on how short selling works and even some seasoned market participants find the setup quite complex.”

Short selling is also being introduced when there is more upside rather than downside risks in the Philippine stock market, “so that premise makes short selling a challenging trading strategy to deploy,” Mr. Colet said.

Short selling is also being introduced when there is more upside rather than downside risks in the Philippine stock market, “so that premise makes short selling a challenging trading strategy to deploy,” Mr. Colet said.

Still, local brokerages are planning to introduce short selling to their clients by June, he said.

Alfred Benjamin R. Garcia, senior research analyst at AP Securities, Inc., said short selling could increase market liquidity.

“Think of it as a one-way street that suddenly became two-way,” he said in a Viber message. “It will also help price discovery.”

“Currently, the prevailing strategy is you find an undervalued stock, buy it and hold until it reaches fair value, or close to it,” Mr. Garcia said.

“But stocks that are overvalued remain overvalued because there is no financial incentive for the market to bring it down to its fair value. With short selling, ideally, the market will be incentivized to seek out overvalued stocks and correct this overvaluation,” he added.

‘RISKIER’

Short selling would let investors trade and make money in either bullish or bearish market conditions, said Michael L. Ricafort, chief economist at Rizal Commercial Banking Corp. “The penultimate objective is to create a healthy balance in the market for both long and short trade positions to co-exist in the local stock market,” he said in a Viber message.

“Local adoption should be based on established global best practices, especially for risk management for our local stock market,” he added.

Mr. Colet said short selling could become “very risky” for retail investors. “If they are not careful, they can lose more money compared with a long-only investment in stocks.”

“On that note, it is important for the PSE and brokerages to properly educate investors about the uses, risks and requirements of shorting,” he added.

Mr. Garcia said short selling could be riskier than buying stocks.

“We need more market education campaigns,” he said. “It’s significantly riskier than buying because when you buy, hypothetically your investment will never reach zero unless the stock delists, and you weren’t able to tender.”

“But when you short sell, you can potentially zero out your investment if the stock keeps going up. But there are safeguards in place for that,” he added.

PSE President and Chief Executive Officer Ramon S. Monzon earlier said the bourse does not expect any spikes in liquidity in the short term following the November short-selling launch.

“We are not expecting any spike in liquidity in the short term since market participants, including brokers and investors, will need time to understand the requirements and risks of securities borrowing and lending and short selling,” he said.

“This is typical in any market introducing a new product or service, most especially in more complex ones like shorting. Short selling is also not a cure-all for market liquidity but a necessary step and building block towards developing other products such as derivatives,” he added.

Over time, the PSE expects more shares to become available for short selling.

Mr. Manarang, mentioned at the outset, said he’s aware of the risks of short selling. “I’m willing to face the risks, even if I don’t fully know where the prices will go.” – Revin Mikhael D. Ochave, Reporter

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld