January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

Philippine jobless rate climbs despite holiday hiring

The Philippines’ unemployment rate unexpectedly rose year on year in November 2025 despite the start of the holiday hiring season, as bad weather and job losses in key industries outweighed the usual fourth-quarter lift, data from the Philippine Statistics Authority (PSA) showed.

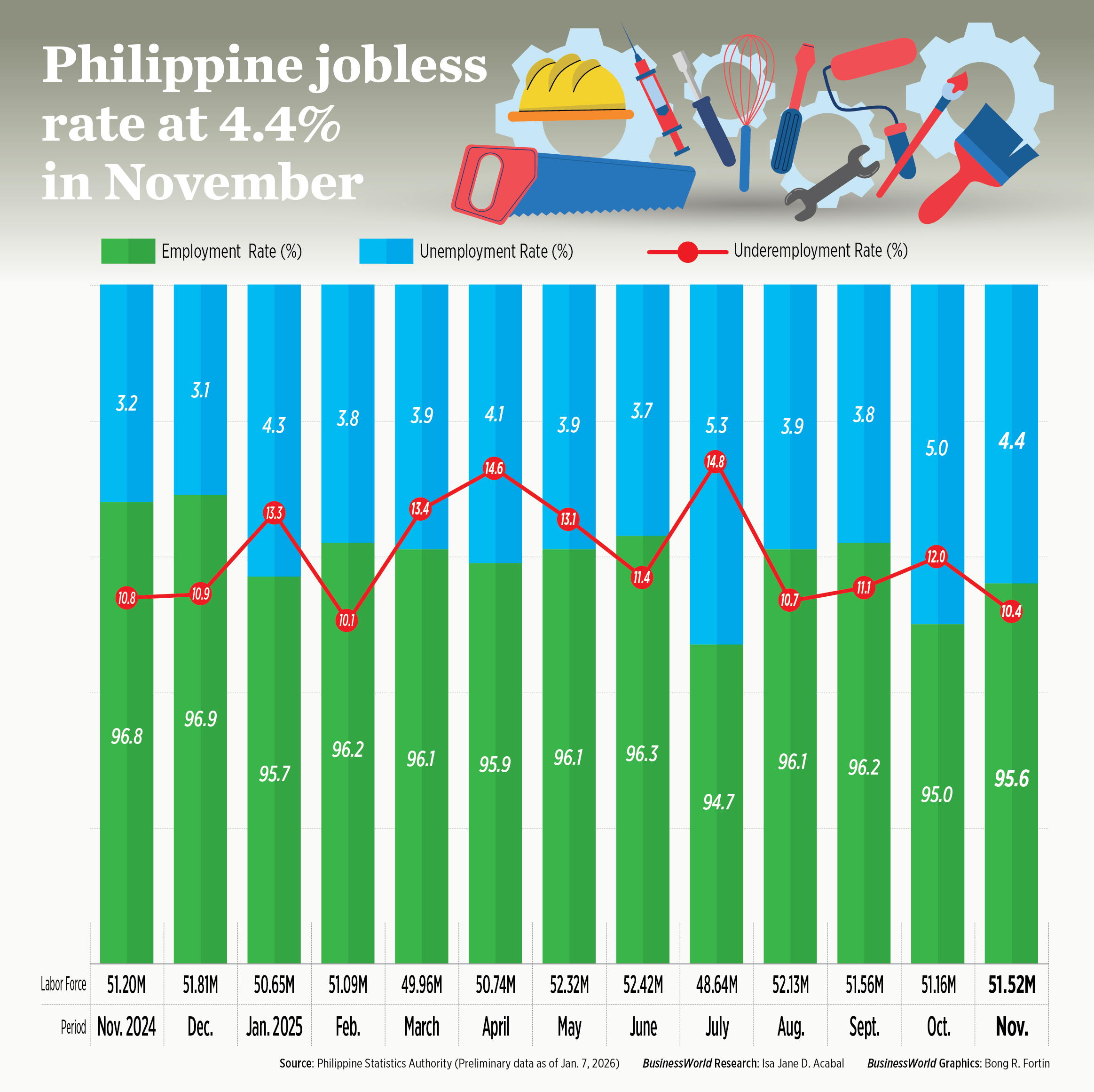

Preliminary results of the Labor Force Survey (LFS) put the jobless rate at 4.4% in November, up from 3.2% a year earlier, though lower than 5% in October. This translated to about 2.25 million jobless Filipinos, compared with 1.66 million in November 2024 and 2.54 million in the previous month.

Labor Secretary Bienvenido E. Laguesma said the November figures were unexpected given the seasonal pattern of stronger hiring toward the yearend.

“Yes, I am surprised because, as you pointed out, ‘ber’ months are associated with increased hiring. Note, however, that the November 2025 stats are better than the October 2025 figures indicating recovery,” he told BusinessWorld.

National Statistician and PSA Undersecretary Claire Dennis S. Mapa said the year-on-year weakening in the jobs market reflected weather-related disruptions and employment declines across several major sectors.

“[There were] two major typhoons in November last year, including Tinio, and their impact was widespread,” he told a news briefing on Wednesday. He noted that the storms disrupted economic activity, transport and supply chains, affecting hiring and job retention across regions.

In the first 11 months of 2025, the unemployment rate averaged 4.19%, higher than the 3.9% average recorded in the same period in 2024.

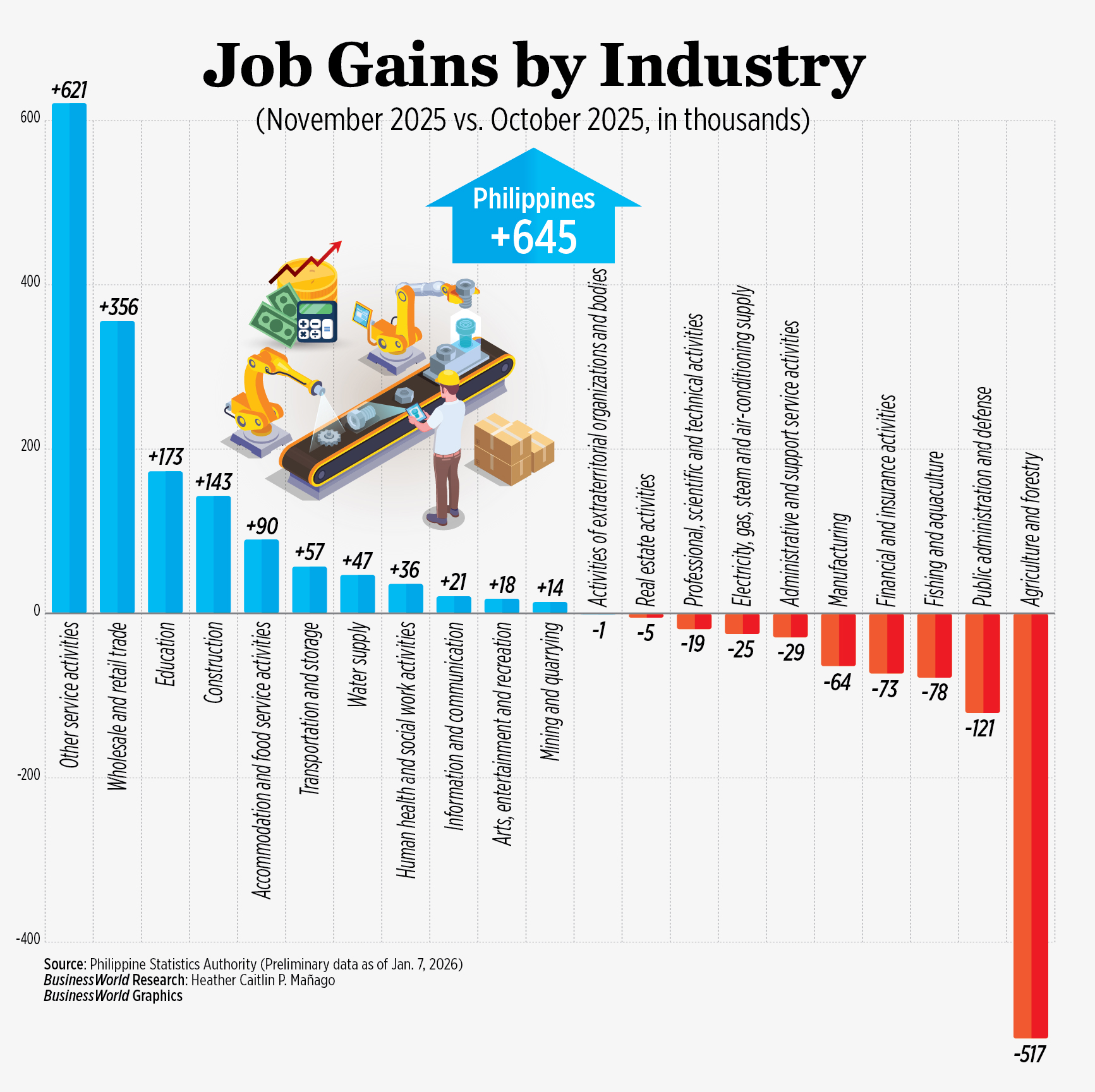

The November employment data also showed mixed signals. The number of employed Filipinos rose to 49.26 million in November from 48.62 million in October, pointing to some seasonal recovery.

However, employment remained below the 49.54 million recorded in November 2024, underscoring the lingering effects of disruptions earlier in the year.

As a result, the employment rate slipped to 95.6% in November from 96.8% a year earlier, though slightly better than 95% in October.

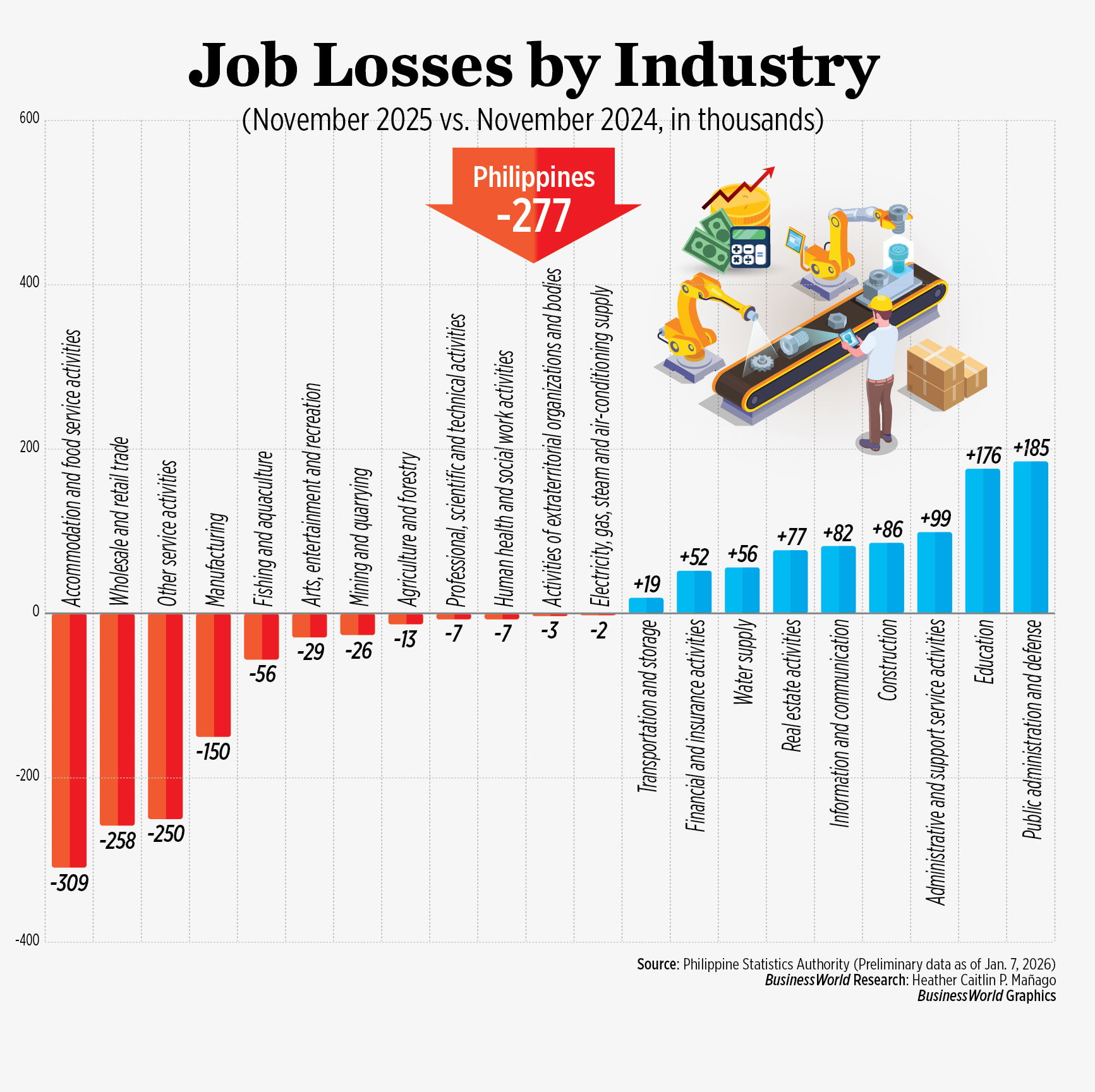

Mr. Mapa said the typical hiring boost during the “ber months” was weaker than expected. He noted that there were 49.26 million employed people in November 2025, 277,000 fewer than a year earlier.

The impact was most visible in sectors sensitive to mobility, such as tourism and logistics.

The average employment rate for the first 11 months of 2025 stood at 95.8%, lower than the level recorded in the comparable period in 2024.

Uunderemployment

Data from the PSA showed underemployment rate fell to 10.4% in November from 10.8% in November 2024 and 12% in October. This was the lowest underemployment rate in nine months or since 10.1% in February.

The ranks of underemployed Filipinos — those who want longer work hours or an additional job — dropped to 5.11 million in November from 5.35 million a year earlier and 5.81 million in October.

Year to date, the average underemployment rate stood at 12.26%, inching up from 12% a year earlier.

Labor force participation rate rose to 64% in November from 63.6% in October but slipped from 64.6% a year earlier. This translated to a labor force of 51.52 million in November, higher than the 51.16 million in October and 51.2 million in No-vember 2024.

PSA data showed job losses were concentrated in industries directly affected by adverse weather conditions and weaker consumer activity in November.

Accommodation and food service activities had the largest year-on-year decline, shedding 309,000 jobs. Losses were concentrated on restaurants and mobile food service activities, which cut 191,000 positions, followed by short-term accommodation activities with a reduction of 76,000 jobs, and event catering services, which declined by 23,000.

Wholesale and retail trade, including the repair of motor vehicles and motorcycles, also saw jobs drop by 258,000 year on year.

Employment declines were also recorded in retail sales in stalls and markets dealing in food, beverages, and tobacco, as well as buyer stalls and motor vehicle sales. Other service activities shed 250,000 jobs, driven largely by cuts in personal wellness services and domestic services.

Jobs in manufacturing fell by 150,000, reflecting continued weakness in the sector. Mr. Mapa said the semiconductor and electronics sector, in particular, lost 106,000 jobs year on year in November.

He said that manufacturing of other food products and the processing and preserving of fruits and vegetables also posted notable job losses, partly due to supply-chain disruptions and reduced operating days following the typhoons.

“These sectors — accommodation and food service activities, wholesale and retail trade, other service activities, and manufacturing — contributed to the decline in the number of employed persons, which in turn pushed unemployment higher year on year,” Mr. Mapa said.

Some sectors, however, recorded employment gains. Public administration and defense, including compulsory social security, added 185,000 jobs year on year, while education employment increased by 176,000, partly reflecting continued hiring in government and public institutions.

Better in December?

Michael L. Ricafort, chief economist at Rizal Commercial Banking Corp., told BusinessWorld that the relatively higher unemployment rate in November was “partly due to the series of typhoons, storms, flooding that led to weather-related disruptions that reduced business days, sales, incomes for some businesses, consumers, and other institutions.”

For Chinabank Research, the decline in manufacturing jobs, particularly those in the production of semiconductors and other electronic components, reflected the impact of recent typhoons on business operations.

“Looking ahead, the sector continues to face risks from the challenging external environment, though a pickup in domestic demand could help support factory activity and improve job prospects,” it said.

Chinabank Research said it expects holiday demand in December to have provided support to employment and consumption at the end of 2025.

“December might show better data with stronger holiday-driven demand, though this seasonal boost will likely wane this month. This year, we expect the labor market to remain generally robust and support a recovery in consumption growth,” it added.

Mr. Ricafort said the labor market may have improved in December 2025 amid peak seasonal demand, better weather conditions, and increased economic activity.

“Nevertheless, unemployment rate at 3%-4% levels is still considered among the best in about 20 years or since revised records started in 2005,” he said.

Mr. Ricafort also pointed to the government’s planned catch-up spending in 2026, anchored on governance reforms and anti-corruption measures, as a potential boost to investor confidence, economic growth, and employment going forward.

In a statement, the Department of Economy, Planning, and Development (DEPDev) said the latest LFS results underscore the need to strengthen workforce competitiveness and business resilience amid persistent disruptions.

“The government is prioritizing investments in skills development, lifelong learning, and social protection systems to enable workers to transition across sectors and withstand economic shocks. Strengthening workforce competitiveness is one of the key elements to attract investments that generate quality jobs,” DEPDev Secretary Arsenio M. Balisacan said in a statement.

For his part, Mr. Laguesma said the Department of Labor and Employment, in collaboration with the private sector, will ramp up efforts to come up with “better employment results” in the coming months. — Erika Mae P. Sinaking

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld