January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

Philippine inflation slowest in a year

Philippine inflation cooled for a fourth straight month in May to the lowest in a year as food and transport prices eased, the local statistics agency said on Tuesday, giving the central bank room to keep key rates steady.

The consumer price index slowed to 6.1% from 6.6% in April, though it was faster than 5.4% a year earlier, matching the median estimate in a BusinessWorld poll last week. Still, it was the 14th straight month that inflation breached the central bank’s 2-4% goal.

In a statement, the Bangko Sentral ng Pilipinas (BSP) said the Monetary Board would consider its inflation and macroeconomic outlook at its monetary policy meeting on June 22.

“The BSP stands ready to adjust the monetary policy stance as necessary to prevent the further broadening of price pressures, as well as the emergence of additional second-order effects,” it said. It also backs timely and effective nonmonetary state measures to ease the impact of persistent supply-side pressures on inflation, it added.

There is still a chance for another rate increase given uncertainties surrounding the US Federal Reserve, said Emilio S. Neri, Jr., lead economist at Bank of the Philippine Islands.

“Keeping an appropriate interest rate differential between the US and the Philippines is still important because this could affect the exchange rate,” he said in a note. “With the country becoming more reliant on imports, the depreciation of the peso may prevent inflation from declining faster.”

The Fed, which has raised borrowing costs by 500 basis points (bps) since March last year, will meet on June 13-14 to discuss policy.

Mr. Neri also cited the need to monitor rice prices in the coming months given the expected global shortage mainly due to lower production in China and Pakistan. “As the country becomes more reliant on imported rice, the local supply may be at risk and this could lead to higher prices,” he said.

Rice is almost 9% of the inflation basket, he pointed out.

The BSP said the balance of risks to the inflation outlook for 2023 and 2024 remains tilted to the upside due to persistent constraints in the supply of key food items, a looming El Niño and potentially higher fares and wages.

Inflation has averaged 7.5% this year, higher than the revised 5.5% forecast by the central bank.

Core inflation, which excludes volatile food and fuel prices, slowed to 7.7% last month from 7.9% a month earlier. It has averaged 7.8% this year.

The slowdown in May was driven by a decline in transport, food and nonalcoholic beverages, National Statistician Claire Dennis S. Mapa told a news briefing. Philippine Statistics Authority data showed the inflation transport index was -0.5%.

“Significant and favorable base effects were the biggest factor since global oil prices were peaking from May to July of last year,” Aris Dacanay, HSBC economist for the Association of Southeast Asian Nations, said in a note.

Domestic fuel prices fell by double digits last month and should continue doing so in the next two months barring any external and domestic surprises, he added.

The statistics agency said prices of heavily weighted food and nonalcoholic beverages rose by 7.4% in May, easing from 7.9% in April. Food inflation alone fell to 7.5% from 8%.

Mr. Mapa attributed the downtrend to the slower rise in prices of fish and other seafoods, meat and other parts of slaughtered land animals, as well as milk, eggs and other dairy products.

Price increases for corn; flour, bread and other bakery products; oils and fats; fruits and nuts; sugar, confectionery and desserts; and ready-made food also slowed. Restaurants and accommodation services posted slower inflation at 8.3%.

On the other hand, rice prices rose by 3.4%, while vegetables, tubers, plantains, cooking bananas and pulses increased by 12.6%.

‘Bottlenecks’

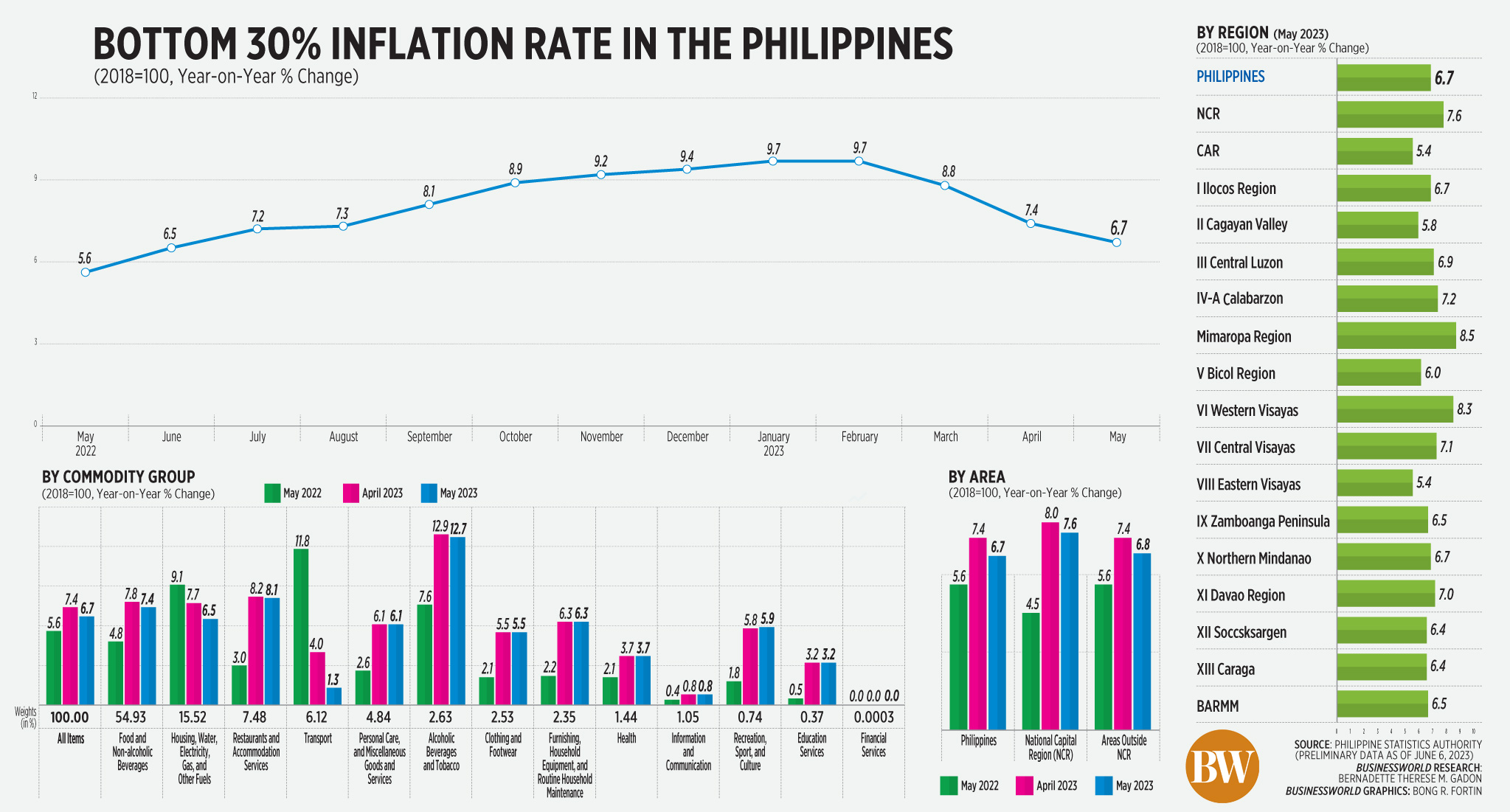

Meanwhile, inflation experienced by poor households eased to 6.7% from 7.4% in April. Year to date, inflation for the bottom 30% income households was 8.4%.

“The new inflation number and the declining trend give confidence that inflation would be within the target range of 2-4% by September this year,” Finance Secretary Benjamin E. Diokno said in a separate statement.

“It is also encouraging to see that inflation has gone down in all regions,” he said. “The government is committed to identifying bottlenecks in the country’s supply chain and improving the distribution of commodities down to the localities.”

Trade Secretary Alfredo E. Pascual told a separate news briefing removing bottlenecks in the supply chain would help ease prices.

“For example, the harvest from a certain area does not reach places with high demand,” he said in mixed English and Filipino. “The solution there is to make sure that logistics can deliver the harvest to where the demand is.”

Meanwhile, National Economic and Development Authority (NEDA) Secretary Arsenio M. Balisacan said the government is working to keep prices low and stable.

“With accurate data at hand, we can anticipate possible food and energy shortages and provide timely recommendations to prevent increases in commodity prices,” he said in an e-mailed statement. “This will ensure food and energy security and safeguard the purchasing power of Filipino families, especially the poor and vulnerable.”

The Philippine central bank paused its aggressive monetary policy tightening campaign last month. The Monetary Board has raised key rates by 425 basis points (bps) to 6.25% since May 2022.

BSP Governor Felipe M. Medalla earlier said the central bank is prepared to keep the benchmark interest rate unchanged for two to three meetings if inflation continues to ease.

HSBC’s Mr. Dacanay said the May inflation could spur the BSP to keep policy rates steady not only on June 22 but also at the next meetings. “Our baseline view is for the BSP to be on hold until the second half of 2024.” — By Keisha B. Ta-asan, Reporter

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld