January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

NG debt inches up to PHP13.9T as of April

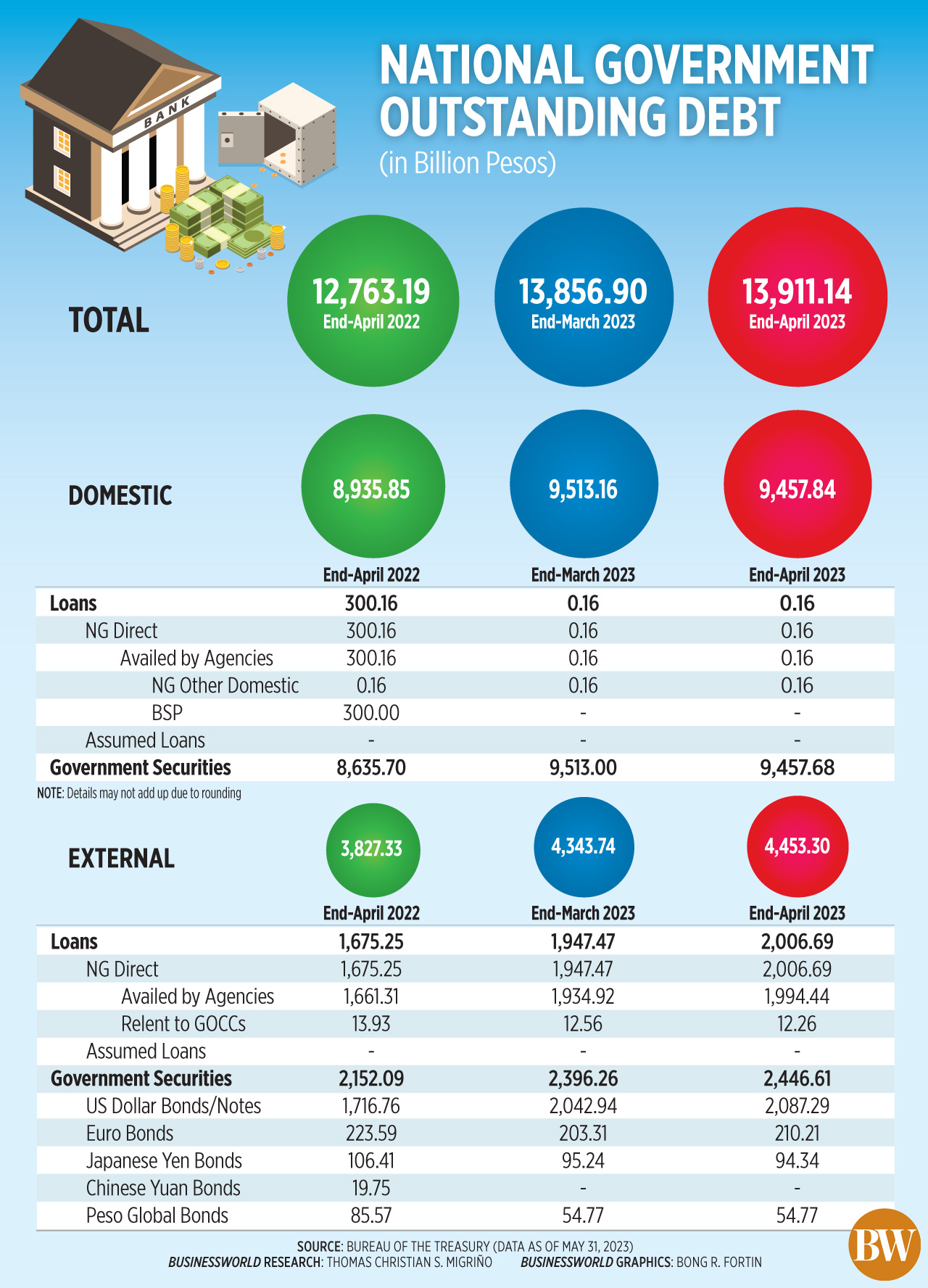

The National Government’s (NG) total outstanding debt hit a fresh high of PHP 13.91 trillion at the end of April, the Bureau of the Treasury (BTr) said.

Data from the BTr showed that the outstanding debt inched up by 0.4% from PHP 13.86 trillion at the end of March.

“NG outstanding debt increased by PHP 54.24 billion or 0.4% from the previous month due to the net issuance of external debt and local currency depreciation against the US dollar,” the BTr said in a press release on Wednesday.

Year on year, the debt stock rose by 9% from PHP 12.76 trillion. Outstanding debt went up by 3.7% from PHP 13.42 trillion as of end-December 2022.

More than two-thirds or 68% of total outstanding debt as of end-April was from domestic sources.

As of end-April, domestic debt increased by 5.8% to PHP 9.46 trillion from PHP 8.94 trillion a year ago.

Month on month, it slipped by 0.6% from PHP 9.51 trillion at end-March, due to the net redemption of domestic securities amounting to PHP 57.79 billion.

“This was slightly offset by the PHP 2.47-billion effect on onshore foreign currency-denominated securities caused by peso depreciation against the US dollar,” it added.

Based on figures from the BTr, the peso weakened by 2% to PHP 55.497 against the dollar at the end of April, from PHP 54.318 at the end of March.

The government mainly borrows from domestic sources to mitigate foreign currency risk.

Meanwhile, external debt climbed by 16.4% to PHP 4.45 trillion from P3.83 trillion a year ago. It also rose by 2.5% from PHP 4.34 trillion as of end-March.

Broken down, external debt consisted of PHP 2 trillion in loans and PHP 2.45 trillion in global bonds.

“For April, the increment to external debt was due to the PHP 27.98-billion net availment of external loans and PHP 94.28-billion impact of local-currency depreciation against the US dollar,” the BTr said.

“On the other hand, third-currency adjustments against the US dollar trimmed P12.3 billion from the peso value of foreign currency debt,” it added.

As of end-April, the NG’s overall guaranteed obligations declined by 7.9% to PHP 380.69 billion from PHP 413.43 trillion a year ago. Month on month, this was 0.9% lower than the PHP 384.12 billion as of end-March.

Analysts expect the NG debt to continue climbing this year.

“We will continue to see government debt rise this year but at a slower pace due to the limited fiscal space,” China Banking Corp. Chief Economist Domini S. Velasquez said in a Viber message.

However, Ms. Velasquez said the improvement in the fiscal balance may lead to less borrowings.

“Recent budget surpluses could also ease some pressure on government borrowing. If we look at the fiscal performance of the National Government, the deficit has continued to outperform the program mainly because spending is lower. This is challenging though because we still need government spending to support economic growth,” she said.

The NG’s budget surplus ballooned to PHP 66.8 billion in April from PHP 4.9 billion a year ago. In the January-to-April period, the fiscal deficit narrowed by 34.57% to PHP 204.1 billion.

This year, the government has set a budget deficit ceiling of PHP 1.499 trillion, equivalent to 6.1% of the gross domestic product.

“As long as revenues rise due to the reopening narrative and economic growth prospects get better due to further disinflation and less restrictive monetary policy down the line, we may see a more robust NG debt stock scenario,” Union Bank of the Philippines, Inc. Chief Economist Ruben Carlo O. Asuncion said in a Viber message.

The government’s outstanding debt as a share of the gross domestic product (GDP) stood at 61% at the end of March, slightly higher than the 60.9% seen as of end-December.

This was lower than the 61.8% annual target under the medium-term fiscal framework but still above the 60% threshold considered manageable by multilateral lenders for developing economies.

The government aims to cut the debt-to-GDP ratio to less than 60% by 2025, and further to 51.5% by 2028.

This year, the government’s borrowing plan is set at PHP 2.207 trillion, where 75% will be sourced domestically. — By Luisa Maria Jacinta C. Jocson, Reporter

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld