January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

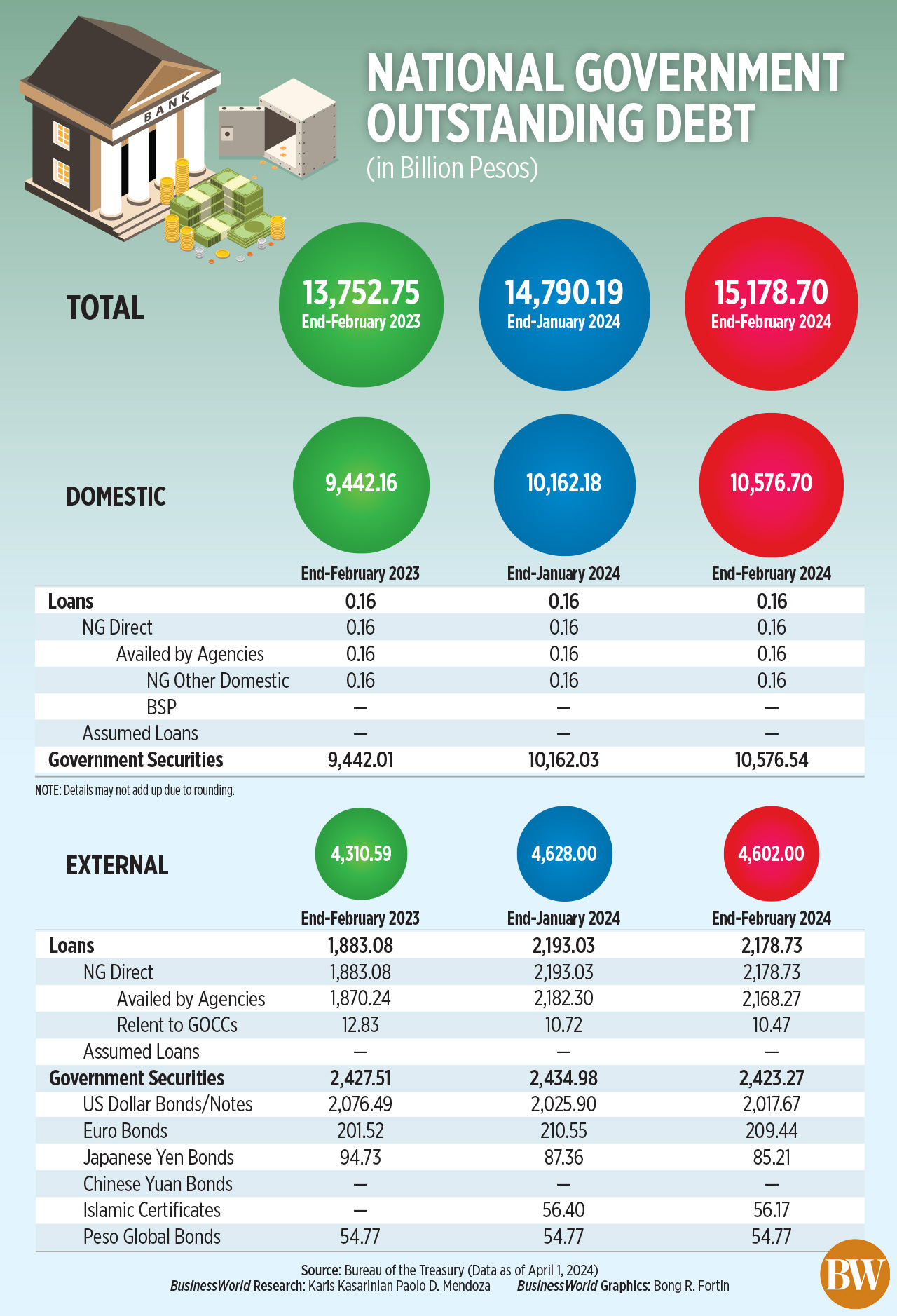

NG debt hits record PHP 15.18 trillion

The National Government’s (NG) outstanding debt hit a fresh high of PHP 15.18 trillion as of end-February, the Bureau of the Treasury (BTr) reported.

Data from the BTr on Wednesday showed that the NG’s debt portfolio rose by 2.63% from the PHP 14.79 trillion recorded as of end-January.

“The NG’s debt stock increased by PHP 388.51 billion or 2.63% month over month which was primarily attributed to domestic debt issuances, though partially tempered by the effect of the stronger peso on foreign debt valuation,” the BTr said in a statement.

Year on year, outstanding debt increased by 10.37% from PHP 13.75 trillion in February 2023.

Year on year, outstanding debt increased by 10.37% from PHP 13.75 trillion in February 2023.

More than two-thirds or 69.68% of the NG’s debt came from domestic sources.

As of end-February, domestic debt went up by 4.08% to PHP 10.58 trillion from PHP 10.16 trillion in the previous month due to the net issuance of government securities.

It also jumped by 12.02% from PHP 9.44 trillion in the same period a year ago.

“Meanwhile, peso appreciation trimmed P0.66 billion from domestic debt through downward revaluation of foreign currency denominated domestic debt,” the Treasury said.

Data from the BTr showed the peso finished at PHP 56.174 versus the greenback at end-February, stronger than its PHP 56.403 close at end-January.

Government securities made up almost the entire domestic debt in the first two months of 2024.

On the other hand, external debt dipped by 0.56% to PHP 4.6 trillion from PHP 4.63 trillion as of end-January.

“The decrease was attributed to favorable foreign exchange movements by both local and third currencies against the US dollar amounting to PHP 18.79 billion and PHP 9.96 billion, respectively. These more than offset the PHP 2.75-billion net availment of foreign loans,” it said.

Year on year, foreign debt climbed by 6.76% from PHP 4.31 trillion in the same two-month period in 2023.

Broken down, external debt was composed of PHP 2.18 trillion in loans and PHP 2.42 trillion in global bonds.

The NG’s guaranteed obligations edged lower by 1.07% to PHP 344.93 billion as of end-February from PHP 348.66 billion in the previous month.

Year on year, guaranteed obligations declined by 10.91% from PHP 387.19 billion.

“The lower level of NG guarantees was due to the net repayment of external guarantees amounting to PHP 3.23 billion as well as favorable foreign exchange movements by both local currencies and third currencies against the US dollar amounting to PHP 0.69 billion and PHP 1.1 billion, respectively,” the BTr said.

“Moreover, the net adjustment in domestic guarantees further offset PHP 1.29 billion from the outstanding balance as of end-February 2024,” it added.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said that the rise in outstanding debt was expected given the retail Treasury bond (RTB) issuance in February.

The Philippine government raised a record PHP 584.86 billion from its offering of five-year RTBs in February, surpassing the PHP 400-billion target set by the Treasury.

“The large maturities of government securities in March 2024, especially the PHP 700-billion maturing RTBs, could potentially lead to some decrease in the outstanding NG debt by March,” Mr. Ricafort said.

“However, new global bond issuance for the coming weeks or as early as the second quarter of 2024 could add to the foreign debts and overall NG debt stock by then,” he added.

Finance Secretary Ralph G. Recto has said that the BTr is finalizing its first global bond issuance of the year but has yet to announce specific details of the offering.

The government’s borrowing program for this year is set at PHP 2.46 trillion, with PHP 1.85 trillion to be raised from the domestic market and PHP 606.85 billion from foreign sources.

Latest data from the Budget department showed that the NG’s outstanding debt is projected to reach PHP 15.84 trillion as of end-2024. – Luisa Maria Jacinta C. Jocson, Reporter

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld