February Economic Update: Cut to the chase

DOWNLOAD

DOWNLOAD

Inflation Update: Nowhere but up

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

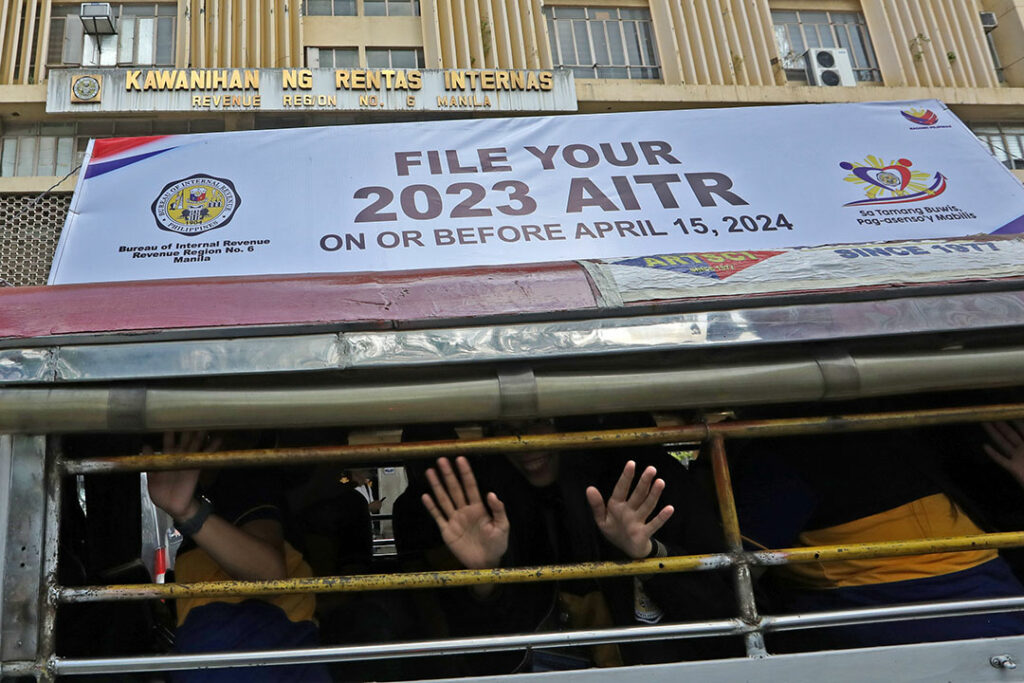

New taxes ‘last resort’ — Recto

The Finance department may not introduce any new tax proposals under the Marcos administration, but will instead focus on improving tax collection efficiency, its top official said.

“It is incumbent upon this administration that its last resort should always be to increase taxes,” Finance Secretary Ralph G. Recto told reporters in mixed English and Filipino at the sidelines of an Economic Journalists Association of the Philippines event last Thursday.

Asked if there is a chance that there will be no new tax measures until the end of the administration, Mr. Recto said: “There is a possibility. I think we should try first to collect what’s there. There are so many leakages.”

Latest Development Budget Coordination Committee (DBCC) data showed that the government is targeting to generate PHP 4.235 trillion in revenues this year, equivalent to 15.5% of gross domestic product (GDP).

Of this, the Bureau of Internal Revenue and the Bureau of Customs are expected to collect PHP 3.055 trillion and PHP 959 billion, respectively.

Mr. Recto earlier said he does not plan to push for new tax measures at least this year and the next, save for the pending tax reforms in Congress, such as the rationalization of the mining fiscal regime and the Passive Income and Financial Intermediary Taxation Act.

Current tax rates are already high as is, Mr. Recto said. “In my view, taxes are already high. What can you tax? 60% of our revenue already is indirect tax. And it’s the most efficient way to collect, indirect tax.”

“I cannot tax oil anymore. I cannot tax power anymore. I cannot increase the price of your vehicle anymore. I cannot increase the registration of your vehicle anymore,” he added.

Mr. Recto is also not keen on imposing luxury taxes.

Asked about taxing luxury cars, he said: “Cars already have excise and value-added tax (VAT). There’s registration fees, there’s motor vehicle user’s charge.”

Raising sin taxes such as a tobacco tax would also result in more smuggling, he added.

“Hopefully there will be no trigger (or need to impose new taxes). Collection efficiency first. But that will take time. You have to digitize, digitalization, so on and so forth. I think it is prudent for us to say, let’s first try to improve tax collection efficiency,” he said.

“The best way to grow your revenues is to grow the economy. If you grow the economy, you’ll collect more taxes.”

Instead of major tax proposals, Mr. Recto said he would be willing to study proposals on higher fees and charges. “We can probably look at fees and charges. I’m willing to take a look too. User fees, like that.”

The Finance department is also looking at ways to better tax the e-commerce sector, he said.

“People are shifting to e-commerce. It’s hard to collect there. We have to find a way, so let’s concentrate on that. But like we said, it’s easy to make a law but will you be able to enforce it? Maybe we should computerize that.”

“It’s unfair to brick-and-mortar (stores) that they pay taxes and those in e-commerce don’t,” he added.

A Senate bill seeking to impose a 12% VAT on digital transactions is now up for second reading, while the counterpart bill was approved by the House of Representatives in November 2022.

Latest data from the Bureau of the Treasury (BTr) showed that the National Government (NG) posted a budget surplus of HP P88 billion in January, driven by a 21.15% jump in revenues to PHP 421.8 billion.

The NG’s deficit ceiling is capped at PHP 1.39 trillion or 5.1% of GDP this year. As of end-2023, the deficit-to-GDP ratio stood at 6.2%. — Luisa Maria Jacinta C. Jocson

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld