Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

NCR economic output rose 7.2% in 2022—PSA

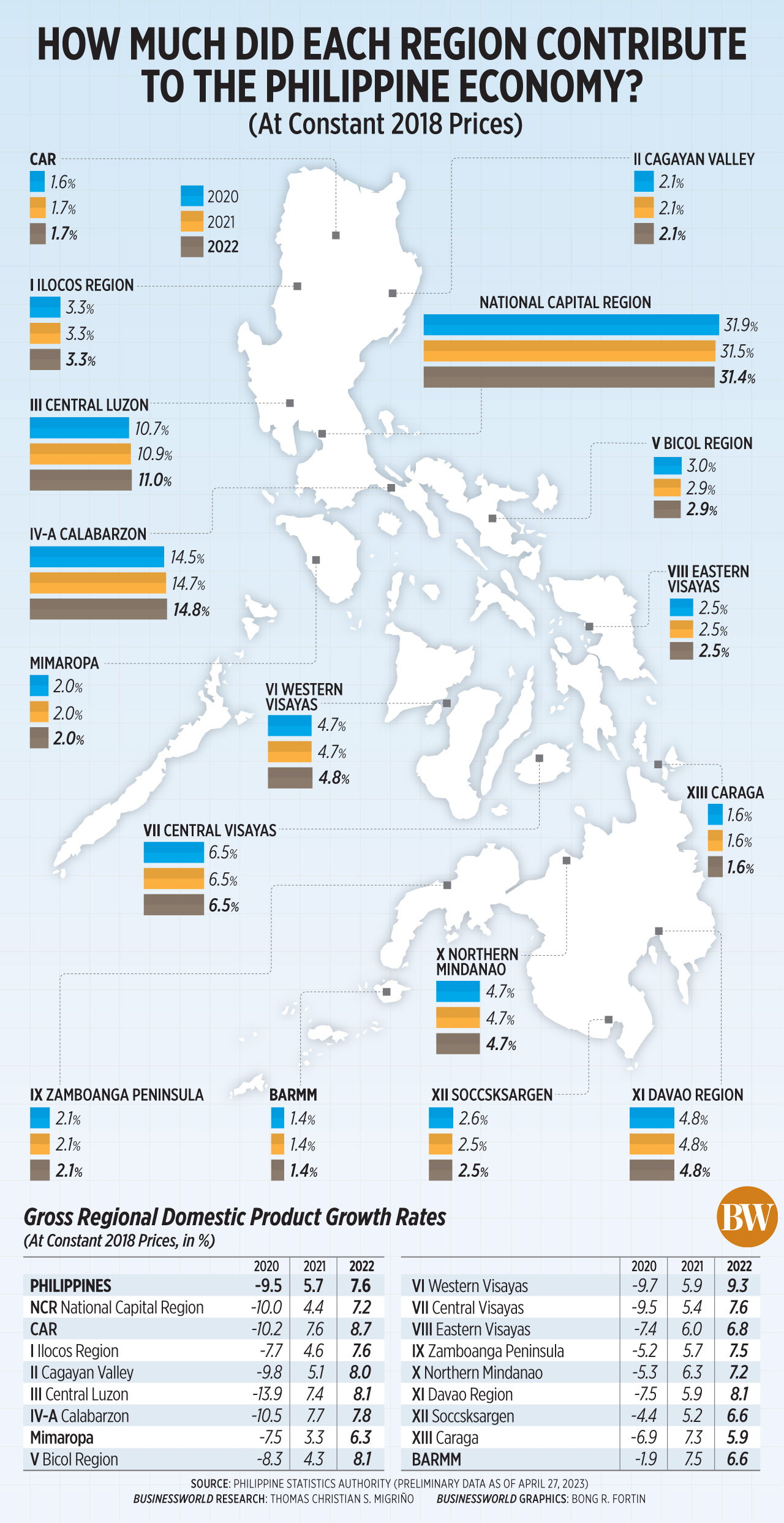

THE NATIONAL Capital Region’s (NCR) economy grew by 7.2% in 2022, buoyed by the full reopening of the country, the Philippine Statistics Authority (PSA) reported on Thursday.

Preliminary results from the latest regional accounts released by the PSA showed Metro Manila’s economic output growth last year was faster than the 4.4% expansion in 2021.

However, NCR’s economic expansion was a tad slower than the Philippines’ 7.6% growth for 2022.

Despite this, Metro Manila was still the country’s growth center as it accounted for nearly a third of the country’s economic output last year.

Despite this, Metro Manila was still the country’s growth center as it accounted for nearly a third of the country’s economic output last year.

The size of NCR’s economy at constant 2018 prices amounted to PHP 6.27 trillion last year, higher than PHP 5.85 trillion in 2021. It even surpassed its pre-pandemic size of PHP 6.22 trillion in 2019.

All of the regions posted growth last year. However, Bangsamoro Autonomous Region in Muslim Mindanao (BARMM) and Caraga saw growth ease to 6.6% (from 7.5%) and 5.9% (from 7.3%), respectively.

NCR’s growth was the eleventh fastest among the 17 regions, ahead of Northern Mindanao (7.2% from 6.3%), Eastern Visayas (6.8% from 6%), Soccsksargen (6.6% from 5.2%), and Mimaropa Region (6.3% from 3.3%).

Western Visayas recorded the fastest growth rate among the 17 regions with 9.3%, better than the 5.9% in 2021. This was followed by Cordillera Administrative Region (8.7% from 7.6%), and Davao Region (8.1% from 5.9%).

Meanwhile, Metro Manila remained the biggest contributor in the national economic output with 31.4%, a bit lower than 31.5% in 2021. This was followed by Calabarzon (14.8% from 14.7%), and Central Luzon (11% from 10.9%).

PSA-NCR Regional Director Paciano B. Dizon said at a media briefing that NCR’s total value of goods and services was mainly driven by wholesale and retail trade, repair of motor vehicles and motorcycles and the financial and insurance activities. These accounted for more than half of the total gross value added.

In 2022, 82% of the Philippine capital’s output came from the services sector. The bulk of this came from wholesale and retail trade, which accounted for 28% of the services sector and 23% of Metro Manila’s output. It was followed by financial and insurance activities (23.5% of services and 19.2% of the total), and professional and business services (15.7% of the sector and 12.8% of the total).

The total value of Metro Manila’s service industry amounted to PHP 5.14 trillion in 2022, up by 8.1% from PHP 4.76 trillion in 2021.

ING Bank N.V. Manila Branch Senior Economist Nicholas Antonio T. Mapa attributed Metro Manila’s growth due to the looser mobility curbs that helped spur economic activity.

Starting February 2022, the NCR was placed under Alert Level 1, the most lenient restriction level.

“Despite a slowdown in private consumption due to inflation and higher interest rates, public sector consumption has been heavy with most agencies’ cash utilization at almost 100%,” Asian Institute of Management Economist John Paolo R. Rivera said in a text message.

In a separate e-mail, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said regions that grew above the 7.57% national average may have benefited from the “economic reopening narrative.”

In terms of sectoral output, Western Visayas showed the highest growth in services at 13% from 6% in 2021. This was followed by Mimaropa Region (11.7% from 3.4%) and Cagayan Valley (11% from 5.1%).

By industry, Cagayan Valley recorded the fastest growth in 2022 with 11.5% from 9.5% in 2021, followed by Western Visayas (9.2% from 7.4%). Slower growth was seen in Central Luzon (8.9% from 13.9%).

BARMM posted the fastest growth in agriculture (3.53% from 8.3%), followed by NCR (3.48% from 5.5%), and Davao Region (3% from 0.8%).

On the expenditure side, Western Visayas recorded the quickest growth rate in household spending (12.2% from 7.4%), followed by NCR (10.2% from 0.4%), Zamboanga Peninsula (9.6% from 5.9%), and Northern Mindanao (8.4% from 7.2%).

Government spending in 17 regions increased in 2022, led by NCR with 7.4% although this was slower than the 7.8% in 2021.

Cordillera Administrative Region recorded the quickest growth in gross capital formation, the investment component of the economy, with 71.2%. This was a turnaround from the 10% decline in 2021.

Meanwhile, Cagayan Valley posted the biggest expansion in export of goods and services to the rest of the world at 90.3% from 5.6% in 2021.

Of the 17 regions, Metro Manila led the highest gross regional domestic product (GRDP) on a per-capita basis with PHP 443,782 at constant 2018 prices, up by 6% from 3.2% in 2021.

For this year, both analysts expect slower economic expansion due to elevated inflation, higher interest rates and moderate government spending.

“We could see NCR GRDP remain in expansion this year, however, we may need to expect a moderation in year-on-year growth rates as base effects normalize and overall spending and investment momentum slows this year,” Mr. Mapa said in an e-mail.

The PSA will announce April’s consumer price index on May 5. — By Mariedel Irish U. Catilogo, Researcher

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld