February Economic Update: Cut to the chase

DOWNLOAD

DOWNLOAD

Inflation Update: Nowhere but up

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

March manufacturing growth slows

MANUFACTURING ACTIVITY in the Philippines expanded at its slowest pace in seven months in March despite strong demand, S&P Global said.

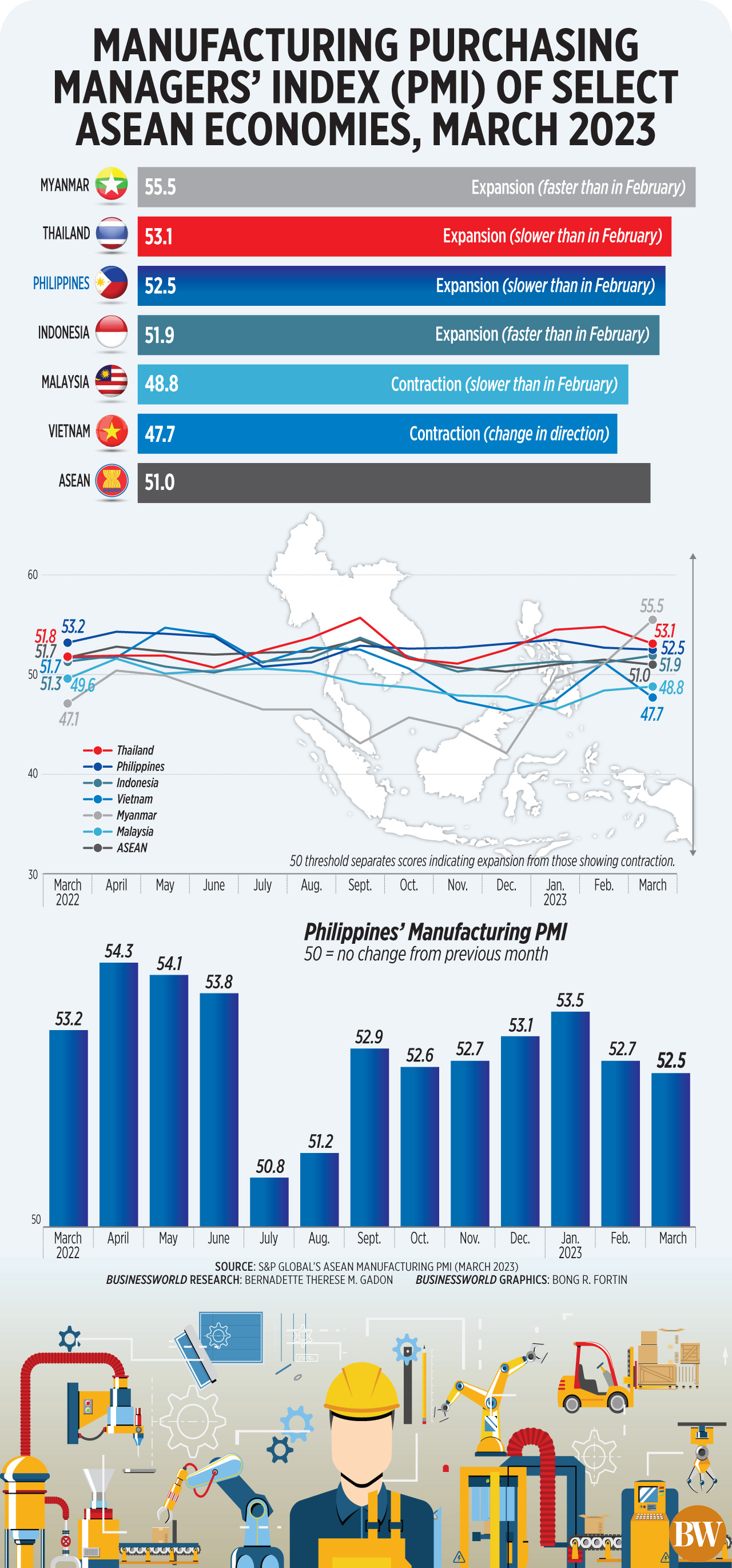

The S&P Global Philippines Manufacturing Purchasing Managers’ Index (PMI) reading slipped to 52.5 in March from 52.7 in February. This was the lowest PMI reading since the 51.2 posted in August last year.

In its report, S&P Global said despite the softer pace of expansion, the headline figure still showed a “historically strong improvement in operating conditions.”

March also marked the 14th straight month that the PMI reading was above the 50 mark, which indicates an improvement in conditions for the manufacturing sector. A reading below 50 means a deterioration.

March also marked the 14th straight month that the PMI reading was above the 50 mark, which indicates an improvement in conditions for the manufacturing sector. A reading below 50 means a deterioration.

“The first quarter of 2023 concluded on a solid note, with a further expansion reported across the Filipino manufacturing sector, according to the latest PMI data. Both output and new orders rose at historically strong rates,” Maryam Baluch, economist at S&P Global Market Intelligence, said in a statement.

However, the slower expansion in March was partly due to the weaker rise in production and purchasing.

3d in ASEAN

The Philippines’ PMI reading was the third fastest among six Association of Southeast Asian Nations (ASEAN) member countries, behind Myanmar (55.5) and Thailand (53.1). The Philippines was ahead of Indonesia (51.9) and also above the ASEAN average of 51.

Malaysia (48.8) and Vietnam (47.7) saw a contraction in manufacturing activity.

The headline PMI measures manufacturing conditions through the weighted average of five indices: new orders (30%), output (25%), employment (20%), suppliers’ delivery times (15%) and stocks of purchases (10%).

For the Philippines, S&P Global said production rose for the seventh month in a row in March, largely due to the “strong upturn” in new orders.

“Firms noted that a stronger demand environment, new projects and a broader clientele helped boost sales. That said, foreign demand increased at a slower pace, with March data indicating only a fractional uptick in new business from abroad and suggesting that domestic demand propelled total new sales growth in the manufacturing sector,” S&P Global said.

Purchasing activity rose at a slower pace in March as high input costs weighed on manufacturing firms.

“Despite a softer rise in input buying, companies were keen to maintain their holdings of raw materials and semi-finished items amid hopes of continued growth in sales, and to protect against long lead times,” S&P Global said.

Ms. Baluch said the latest data showed pressures on inflation and supply chains eased in March, adding that operating expenses rose at the slowest pace in 27 months.

“Greater demand for inputs, higher prices for energy and material scarcity continued to drive up operating expenses. That said, the rate of input price inflation was the slowest since December 2020, and softer than the historical average,” S&P Global said.

While the incidence of delays was also among the slowest, S&P Global said port congestion and material shortages resulted in longer lead times for manufacturers. Backlogs also rose due to delivery delays, it added.

March data also showed firms implemented job cuts for a second month in a row.

“The rate of job shedding remained only marginal overall, as strong growth in new orders meant some firms were able to make additional hires,” S&P Global said.

Ms. Baluch said business confidence remained positive, as “strong demand conditions buoyed optimism in the outlook for future output.”

“Filipino manufacturers remained strongly optimistic, with more than a half of the respondents predicting growth in output in the year ahead. That said, the degree of confidence was below the historical trend,” S&P said.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort attributed the easing manufacturing activity in March to the higher prices of goods and rising borrowing costs.

“The sustained expansion mode (above 50) in the local manufacturing PMI is still a good signal, as one of the major sources of economic growth,” Mr. Ricafort said.

The Bangko Sentral ng Pilipinas has raised key lending rates by a total of 425 basis points (bps) since May 2022, bringing the policy rate to 6.25% — the highest since 2007.

Moving forward, higher inflation and interest rates may weigh on manufacturing growth for the next months. A recession in the US could also hurt exports, investments, among others, Mr. Ricafort said. — Keisha B. Ta-asan

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld