Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

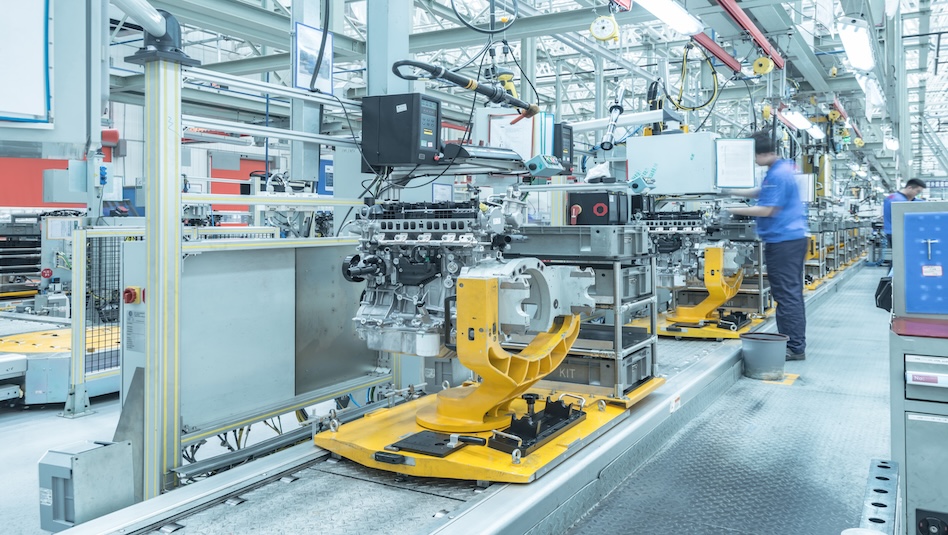

Manufacturing growth slows in Jan.

Philippine manufacturing activity continued to expand in January, albeit at the slowest pace in five months, S&P Global said on Monday.

The S&P Global Philippines Manufacturing Purchasing Managers’ Index (PMI) stood at 52.3 in January, easing from the 54.3 logged in December 2024. This was the lowest PMI reading in five months or since the 51.2 reading in August 2024.

In its report, S&P Global said the PMI reading signaled a “solid improvement” in manufacturing conditions in the Philippines.

A PMI reading above 50 denotes better operating conditions than in the preceding month, while a reading below 50 shows a deterioration.

A PMI reading above 50 denotes better operating conditions than in the preceding month, while a reading below 50 shows a deterioration.

“The Filipino manufacturing sector started the year with a further and strong improvement in demand. Output grew again, albeit at a pace which notably weakened from December,” Maryam Baluch, economist at S&P Global Market Intelligence, said in a statement on Monday.

In January, the Philippines had the fastest PMI reading among six Association of Southeast Asian Nations (ASEAN) member countries ahead of Indonesia at 52.3.

A contraction in manufacturing activity was seen in Thailand (49.6), Vietnam (48.9), Malaysia (48.7), and Myanmar (47.4).

Demand for Philippine-made goods improved in January, although the pace of growth slightly decelerated from the recent high observed in December, S&P Global said.

“Nevertheless, the rate of expansion in intakes of new orders remained historically robust, as firms reported that strong client demand and the acquisition of new customers drove increased sales,” it said.

S&P noted that solid demand trends drove manufacturing output higher, but January marked the second weakest in the current 10 consecutive months of growth.

This was attributed to competition and elevated raw material prices that constrained production.

However, an increase in production requirements prompted manufacturers to hike purchasing activity in January.

“Companies also focused on stock building, with both pre- and post-production inventories rising at historically strong rates during the latest survey period,” S&P said.

“Notably, stocks of finished goods recorded a fresh increase following a sharp decline in December.”

In January, supply chains remained under pressure. The lack of delivery trucks and port congestion prolonged the average lead times for inputs, S&P said.

The decline in vendor performance in January was the least pronounced in five months.

S&P Global said employment remained flat for the second consecutive month.

The increased sales enticed manufacturing companies to hire more workforce but was offset by reports of resignations, it said.

“Regarding prices, both cost burdens and output charges increased at similar, but historically subdued, rates,” S&P said, adding that high material and transportation costs drove up expenses which firms pass on to their clients.

For the coming year, manufacturers maintained a positive outlook, driven by expectations of stronger market demand and the upcoming election period. However, overall sentiment remained below the trend level.

“If demand trends continue to improve as they have done, then employment growth could be on the cards in the months ahead,” Ms. Baluch said.

Ms. Baluch said the election year will likely help drive growth in the manufacturing sector, citing the survey respondents.

“We could see 2025 shaping up to be another strong year of growth for the Philippines manufacturing sector with industrial production growth forecasted at 3.9% in 2025, up from 2.4% in 2024,” she said.

“In fact, the anticipation of greater demand has already prompted goods producers to increase their inventory levels.”

The Philippines will hold its midterm elections on May 12.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said the slower pace in factory activity was partly due to “the seasonal decrease in demand and production activities upon crossing the new year after the Christmas holiday season.”

“Still relatively higher prices, interest rates, and weaker peso exchange rate vs. the US dollar since 2022 also partly weighed on demand and manufacturing activities,” Mr. Ricafort added.

He also said that increased government spending on infrastructure and some election-related spending could benefit some manufacturers that are part of the supply chains for various infrastructure projects.

In an e-mail, Pantheon Macroeconomics Chief Emerging Asia Economist Miguel Chanco said the Philippines remains as the region’s main outperformer but “hit a big speed bump.”

“Overall, the regionwide index for January was the softest print in 11 months; at best, its general slowdown is still stabilizing.”

ASEAN PMI stood at 50.4 in January, easing from 50.7 in December.

Mr. Chanco said headline reading will likely fall rather than improve, “as short-term leading indicators continue to weaken.” — Aubrey Rose A. Inosante

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld