Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

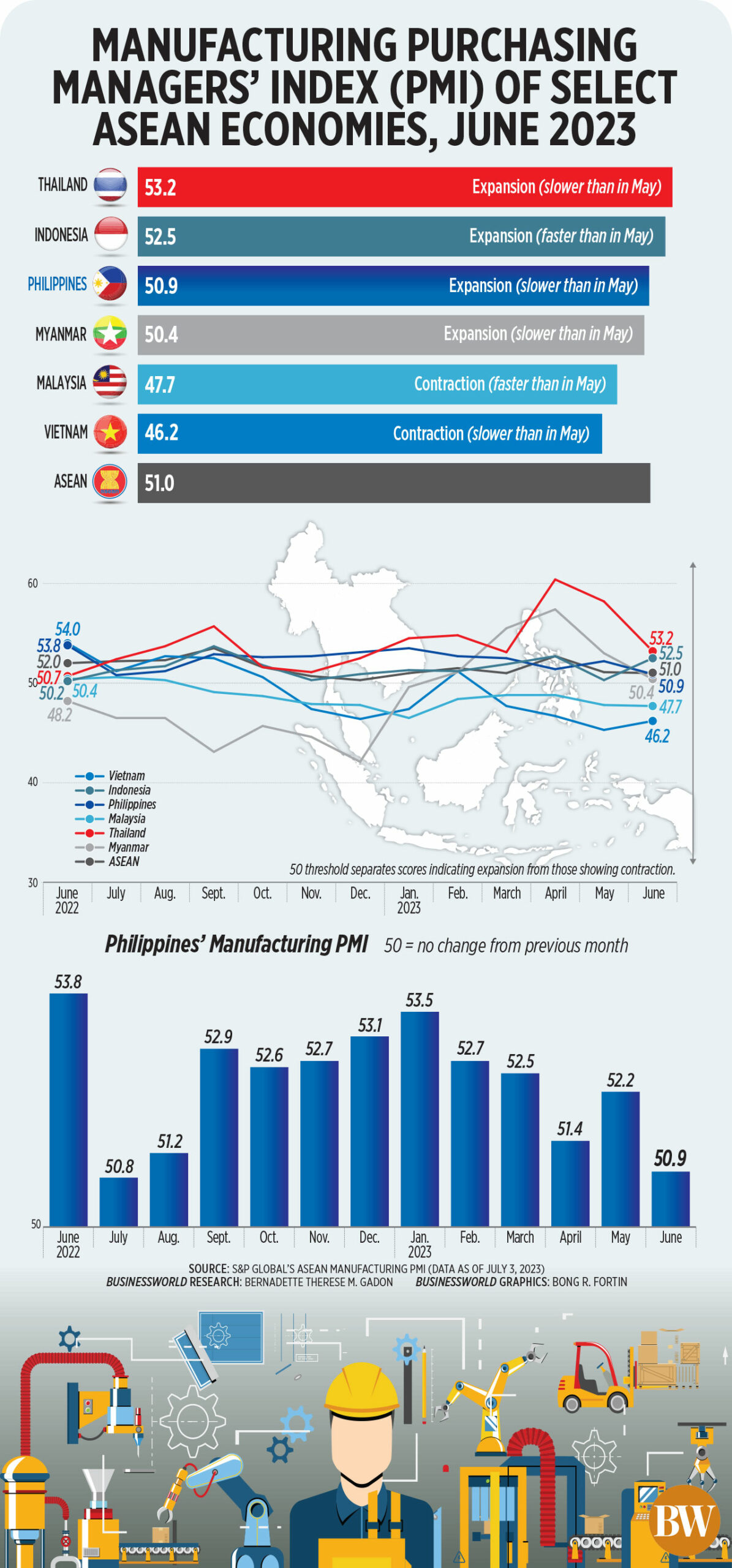

Manufacturing growth cools in June

Philippine factory activity lost momentum in June, with output expanding to its slowest pace in 11 months, S&P Global said on Monday.

The S&P Global Philippines Manufacturing Purchasing Managers’ Index (PMI) eased to 50.9 in June from 52.2 in May, remaining above the 50-point index mark that separates growth from contraction.

This was the weakest manufacturing growth seen in 11 months or since the 50.8 reading in July 2022.

June also marked the 17th straight month that the PMI reading was above 50.

June also marked the 17th straight month that the PMI reading was above 50.

“Growth across the Filipino manufacturing factor slowed as the June PMI index reading signaled the weakest improvement in the health of the sector since July 2022,” Maryam Baluch, economist at S&P Global Market Intelligence, said in a statement.

“The muted headline figure reflected softer rates of expansion across both output and new orders, while manufacturing employment registered a fresh reduction,” she added.

The headline PMI measures manufacturing conditions through the weighted average of five indices: new orders (30%), output (25%), employment (20%), suppliers’ delivery times (15%) and stocks of purchases (10%).

Based on the latest PMI reading, the Philippines had the third best PMI reading in June out of six Southeast Asian countries.

The Philippines was behind Thailand (53.2) and Indonesia (52.5), but ahead of Myanmar (50.4). Meanwhile, Malaysia (47.7) and Vietnam (46.2) both reported a contraction in factory activity.

Weak demand

“Filipino manufacturing firms signaled a moderate improvement in overall business conditions in the closing month of the second quarter. Overall growth was supported by continued expansion in production and factory orders. However, in both cases, the rates of increase eased from May, with some panelists reporting weaker underlying demand trends,” S&P Global said.

Firms’ output only showed a “fractional rise” in June, and the weakest since the current run of expansion started in September 2022, it added.

Philippine firms saw a slower rise in new orders, although they noted this was driven by additional demand and new client wins.

“Similarly, while helping to sustain growth in total factory orders, foreign demand for Filipino manufacturers’ goods also expanded in June,” S&P Global said.

However, manufacturing firms reported a decline in employment due to slowing output growth.

“According to surveyed businesses, the renewed reduction in manufacturing employment was in part due to the non-replacement of voluntary leavers as well as some firms actively reducing their payroll numbers,” S&P Global said.

On the other hand, firms increased their purchasing activity for a 10th straight month in June, and at the fastest clip in four months.

The survey also showed that price pressures eased in June.

“Rates of input price and output charge inflation slowed and were the softest recorded in over two-and-a-half years. With inflationary pressures fading and global economic uncertainties still a looming threat to growth, the central bank maintained their policy rate at 6.25% for the second successive policy meeting in June,” S&P Global said.

Philippine firms also kept an optimistic outlook for the next 12 months.

“Going forward, the sector remains optimistic of growth in the coming 12 months. However, global headwinds could dampen the outlook for manufacturers in the Philippines,” Ms. Baluch said.

ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said that manufacturing growth slowed in June as demand eased.

“Also, the lack of pickup on demand and activity has once again translated to a slower recovery in employment,” he said in a Viber message.

China Banking Corp. Chief Economist Domini S. Velasquez said that weaker manufacturing growth may be attributed to the moderation in economic activity.

“Although external headwinds will likely cause softer export demand, we think that this is likely to improve. Easing supply chains globally could prop up the manufacturing sector despite weak demand. Domestically, a slowdown in consumer and producer prices should benefit the manufacturing sector,” she said in a Viber message.

“Moving forward, we expect the manufacturing sector to continue to expand modestly until we see improvements in Chinese and advanced economies’ demand,” she added. — Luisa Maria Jacinta C. Jocson

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld