Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

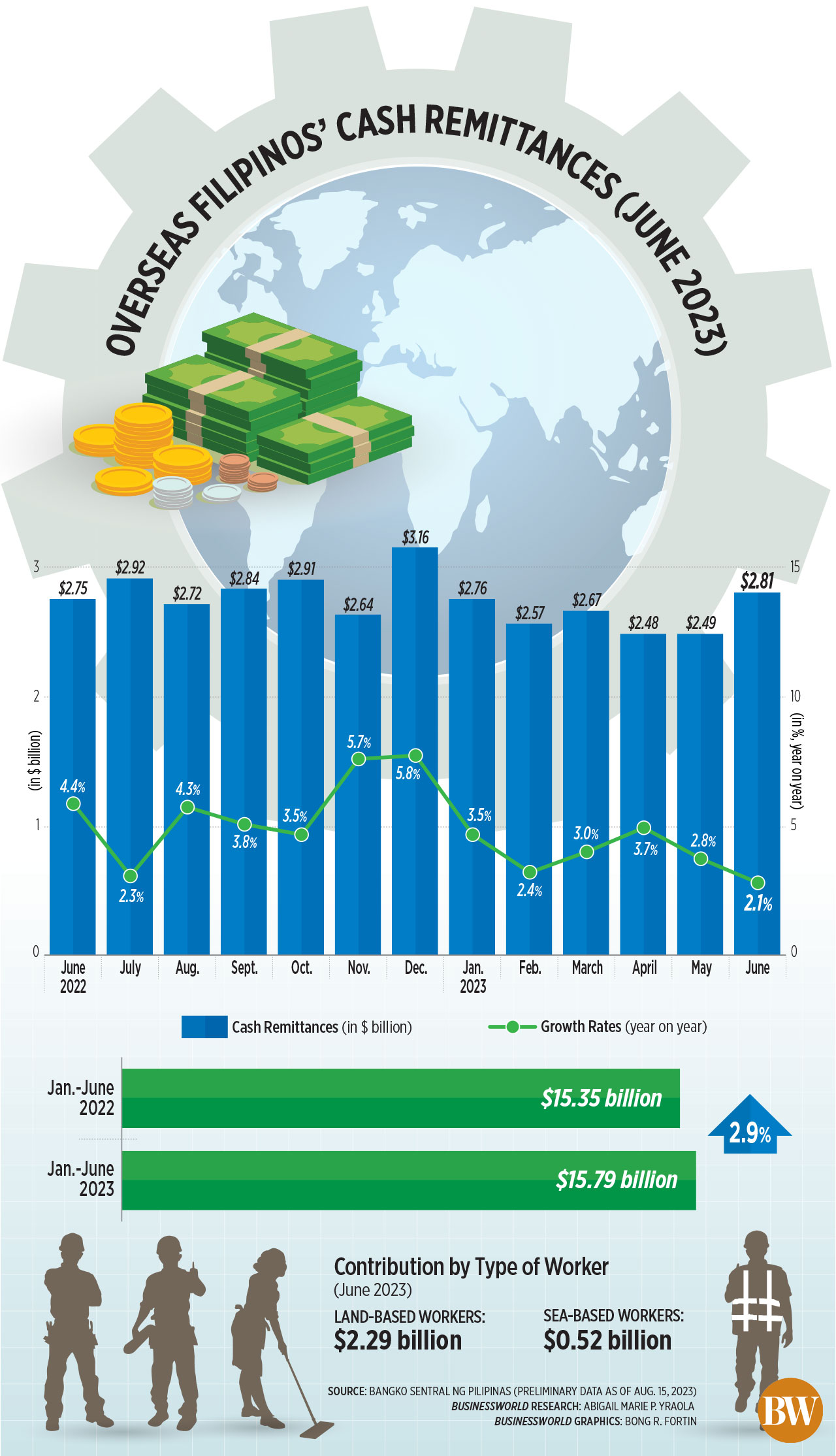

June remittances hit 6-month high

Money sent by overseas Filipino workers (OFWs) rose to a six-month high in June, data from the Bangko Sentral ng Pilipinas (BSP) showed.

Cash remittances coursed through banks rose by 2.1% to USD 2.81 billion in June, from USD 2.75 billion in the same month in 2022.

The June cash remittance inflows are at the highest level since the USD 3.16 billion in December 2022.

However, the 2.1% annual growth in cash remittances was the slowest in 13 months or since the 1.8% rise seen in May 2022.

However, the 2.1% annual growth in cash remittances was the slowest in 13 months or since the 1.8% rise seen in May 2022.

“The expansion in cash remittances in June 2023 was due to the growth in receipts from land- and sea-based workers,” the BSP said.

Remittances from land-based workers jumped by 2.1% year on year to USD 2.29 billion in June, while money sent by sea-based workers increased by 1.9% to USD 524 million.

For the first six months of 2023, cash remittances rose by 2.9% to USD 15.79 billion, from $15.35 billion in the comparable period last year.

Security Bank Corp. Chief Economist Robert Dan J. Roces said improved economic conditions in host countries led to more job opportunities and better wages for OFWs.

“Increased demand for labor in host countries boosted OFW employment and remittances… Positive fluctuations in exchange rates increased remittance values in Philippine peso terms,” he said.

The peso closed at PHP 55.20 against the dollar on June 30, appreciating by 95 centavos or 1.7% from its PHP 56.15 close on May 31.

However, the slower growth rate in June may be attributed to base effects, with a high-remittance month in the previous year made growth seem slower, Mr. Roces said.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said OFWs may have sent more money back home to support their families amid rising prices.

Headline inflation eased to 5.4% in June from 6.1% both in May 2023 and June 2022, the slowest in 14 months. Still, it marked the 15th straight month of inflation exceeding the BSP’s 2-4% target band.

BSP data showed cash remittances in the January-to-June period were driven mainly by higher inflows from the United States, Singapore, and United Arab Emirates (UAE).

By country, the US accounted for the biggest share (41.1%) of total remittances during the six-month period.

The US, along with Singapore, Saudi Arabia, Japan, the United Kingdom, the UAE, Canada, Korea, Qatar, and Taiwan, accounted for 79.7% of total cash remittances in the first semester.

Meanwhile, BSP data showed personal remittances, which included inflows in kind, rose by 2.2% to USD 3.13 billion in June from the $3.06 billion posted in the same month last year.

This brought personal remittances 3% higher to USD 17.59 billion in the first half of the year from USD 17.09 billion a year ago.

“The outlook remains uncertain due to evolving global conditions and offshore market movements which affect the peso,” Mr. Roces said. “However, economic recovery and stability in host countries will influence remittance trends.”

Mr. Ricafort said he expects OFWs to continue sending more cash to their families, especially as school reopens.

“Risk of an economic slowdown in the US partly due to aggressive Fed rate hikes… would still be a drag for OFW remittances especially if there would be job losses,” Mr. Ricafort said, but added this may be offset by the economic reopening in China.

The central bank expects remittances to grow by 3% this year. — Keisha B. Ta-asan

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld