Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Inflation uptick seen in Feb. — poll

Headline inflation likely quickened in February amid higher prices of key commodities like food, electricity, and fuel, analysts said.

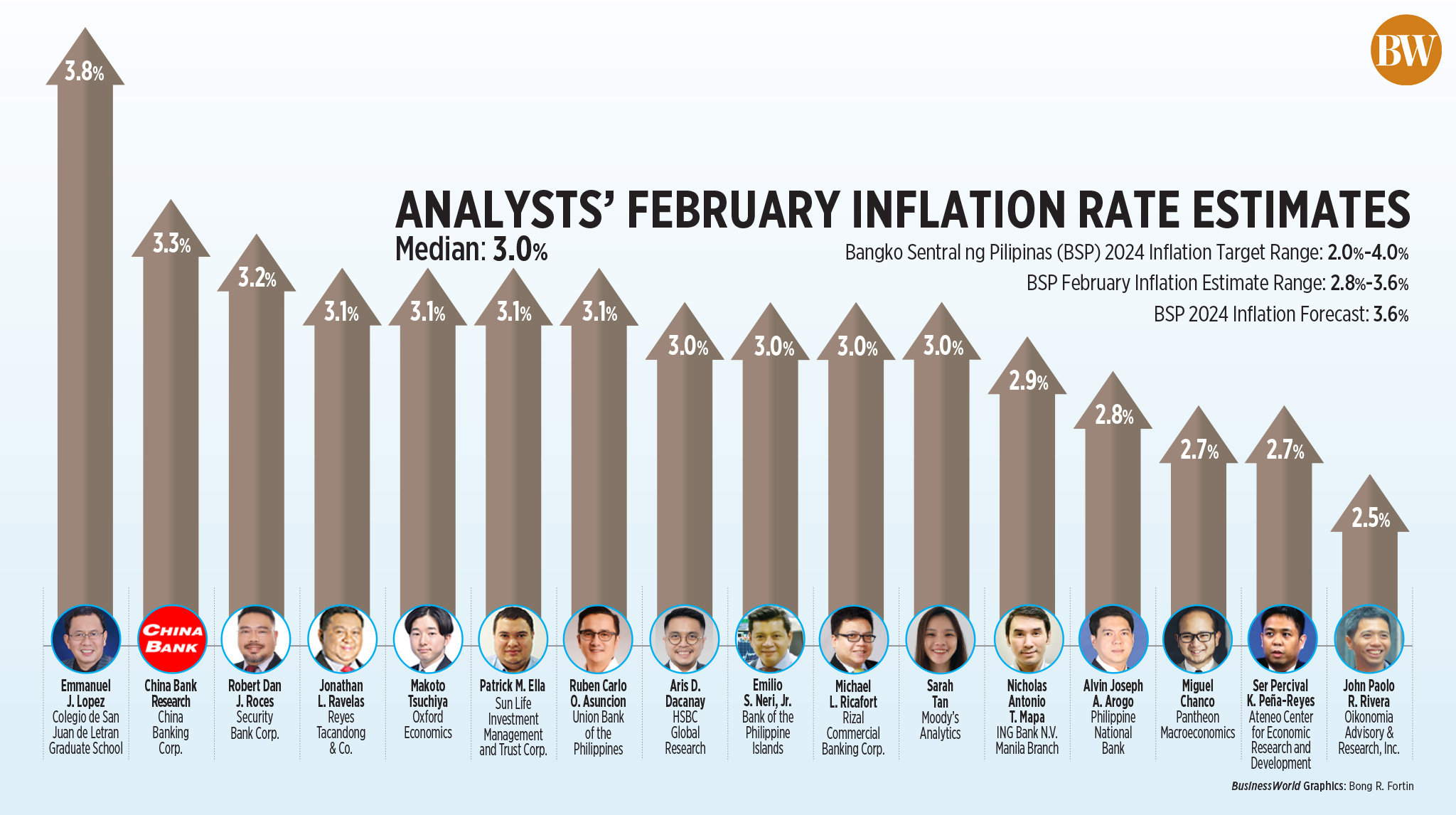

A BusinessWorld poll of 16 analysts yielded a median estimate of 3% for the consumer price index (CPI) in February. This is within the 2.8-3.6% forecast of the Bangko Sentral ng Pilipinas (BSP) for the month.

If realized, February inflation would be slightly faster than the 2.8% print in January but much slower than 8.6% in the same month a year ago.

It would also mark the first time that inflation picked up on a month-on-month basis since September 2023.

February would also mark the third straight month that inflation was within the BSP’s 2-4% target range.

The Philippine Statistics Authority (PSA) is set to release February inflation data on Tuesday (March 5).

“We look for headline inflation to accelerate a touch to 3% year on year in February from 2.8% in January,” Sarah Tan, an economist from Moody’s Analytics, said in an e-mail.

“Key factors driving upward price pressures include higher prices of key agricultural goods such as rice and meat produce, an increase in electricity rates as well as higher petroleum prices,” she added.

Data from the Agriculture department showed that as of Feb. 29, the price of a kilogram of local well-milled rice ranged from PHP 48 to PHP 55 from PHP 37 to PHP 45 in the same period a year ago. Regular-milled rice rose to PHP 50 per kilogram from PHP 32 to PHP 40.

ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said that rice continued to be a main driver of inflation.

“High domestic rice prices and a hike in electricity rates also fanned inflationary pressures during the month. Global rice prices slightly eased by the end of February but its impact on domestic prices will likely take some time before taking effect,” HSBC economist for ASEAN Aris Dacanay said in an e-mail.

China Bank Research also noted electricity rates rose in areas serviced by Manila Electric Co. (Meralco), as well as parts of Visayas and Mindanao, during the month.

The overall rate for a typical household rose by PHP 0.5738 to PHP 11.9168 per kilowatt-hour (kWh) in February from PHP 11.3430 in the previous month, Meralco said. This was due to an increase in the generation charge, which accounts for almost 80% of a consumer’s monthly electricity bill.

“Also, the Department of Energy reported an increase in crude oil prices due to supply-side constraints coming from the Organization of the Petroleum Exporting Countries output caps and lingering conflicts along the Red Sea,” Ms. Tan added.

In February alone, pump price adjustments stood at a net increase of PHP 1.05 a liter for gasoline, PHP 1.55 a liter for diesel and PHP 0.35 a liter for kerosene.

Meanwhile, analysts said that fading base effects have also contributed to the potential uptick in inflation.

“Inflation for February could pick up to 3% year on year mathematically due to some easing of the high base effects,” Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in an e-mail.

Mr. Dacanay also noted the “unfavorable” base effects due to the peak in inflation in January 2023, which stood at a 14-year high of 8.7%.

“Without any sudden change in policy or external conditions, these unfavorable base effects will likely remain in place until July of this year and can potentially push inflation to breach the central bank’s 2-4% target band sometime in the second quarter,” he added.

RISKS TO OUTLOOK

In the coming months, analysts said inflation may spike in the middle of the year.

“Looking ahead, we anticipate inflation will breach the BSP’s 2-4% target again from April to July due to base effects. However, average headline inflation will likely settle within target this year,” China Bank Research said.

Philippine National Bank economist Alvin Joseph A. Arogo flagged risks to the inflation outlook, such as the El Niño weather event.

“Our baseline estimates assume that amid the wearing-off of base effects, there will be a transitory spike in prices because of the threats from El Niño, possible Middle East conflict escalation, and lagged impact of minimum wage hikes,” he said in an e-mail.

The latest bulletin from the state weather bureau showed that the El Niño will likely persist until May.

Earlier estimates by the central bank showed that the dry weather pattern could impact inflation by 0.02 percentage point.

“We expect some volatility in the inflation readings over the next few months given the El Niño weather pattern could strengthen and keep food prices elevated,” Moody’s Analytics Ms. Tan said.

“We understand that we are now experiencing El Niño, however, we note that other crops appear to have prices either falling or more behaved. If authorities can find a way to lower the cost of rice, we could see inflation well under control,” Mr. Mapa added.

Fading base effects and the El Niño could cause inflation to peak at 5% in the June-July period before easing to 3.5% in September, Union Bank of the Philippines, Inc. Chief Economist Ruben Carlo O. Asuncion said.

POLICY CUT

Despite the potential uptick in inflation, analysts expect the BSP to keep rates steady until it begins policy easing in the middle of the year.

Sun Life Investment Management and Trust Corp. economist Patrick M. Ella said he expects the BSP to cut rates starting June.

“Should February’s inflation print settle within the BSP’s target range of 2% to 4%, this will give the BSP confidence to keep its policy rate steady when they next meet on April 4,” Ms. Tan said.

The BSP kept its benchmark rate steady at 6.5% at its February meeting. The central bank raised borrowing costs by 450 basis points (bps) from May 2022 to October 2023.

“Our base case at the moment is that the Monetary Board will start normalizing (cutting) rates in May, by 25 bps, with 2024 likely to see a total of 100 bps in reductions,” Pantheon Chief Emerging Asia Economist Miguel Chanco said.

ING’s Mr. Mapa also said the BSP will remain on hold as long as the US Federal Reserve keeps rates unchanged. – Luisa Maria Jacinta C. Jocson, Reporter

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld