January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

Inflation soars to 6.1% in Sept.

Inflation quickened for a second straight month in September due to a double-digit increase in rice prices, putting pressure on the Bangko Sentral ng Pilipinas (BSP) to resume monetary tightening.

“I think a hike in November is possible but we’re still analyzing the (inflation) data,” BSP Governor Eli M. Remolona, Jr. said in a Viber message.

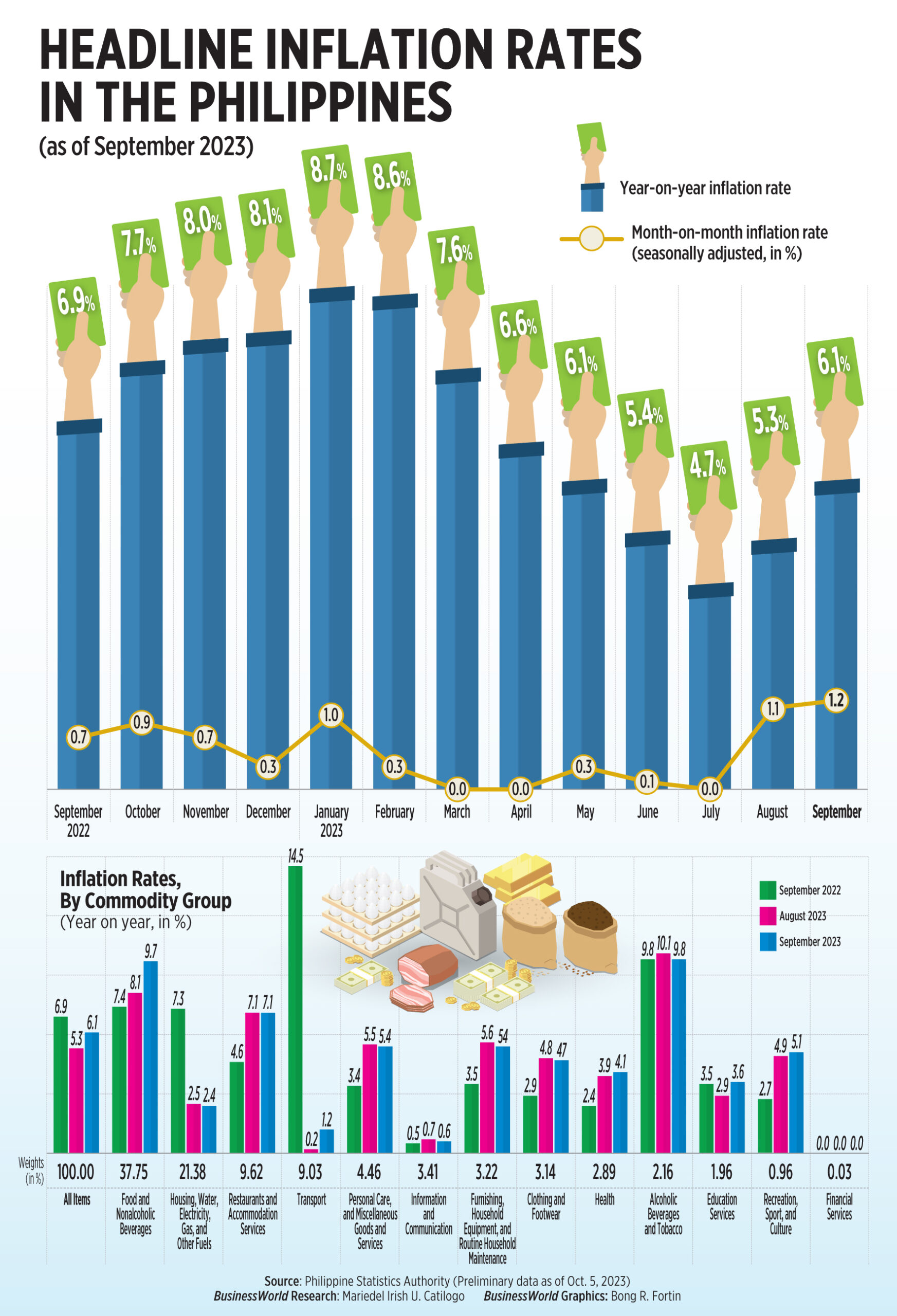

Preliminary data from the Philippine Statistics Authority (PSA) showed headline inflation accelerated to 6.1% in September from 5.3% in August but slowed from 6.9% in September 2022.

The September print was above the 5.4% median in a BusinessWorld poll conducted last week, and also at the upper end of the BSP’s 5.3-6.1% forecast.

The latest consumer price index (CPI) was also the fastest in five months or since the 6.6% in April 2023, and matched the 6.1% logged in May.

September marked the 18th straight month that inflation breached the BSP’s 2-4% target this year.

On a monthly basis, headline inflation inched up by 1.2% in September from 1.1% in August.

This brought nine-month average inflation to 6.6%, higher than 5.1% a year ago and still above the BSP’s recently revised 5.8% forecast for 2023.

The government’s imposition of a price cap on rice starting Sept. 5 appeared to have failed to tame overall inflation in September.

The heavily weighted food and non-alcoholic beverages index rose to a seven-month high of 9.7% in September from 8.1% in August. Food inflation alone soared to 10% from 8.2% a month ago.

Rice inflation surged to 17.9% in September from 8.7% in August. This is the highest print since March 2009, when rice inflation rose to 22.9%. Rice has the biggest weight in the overall CPI basket at 8.87%.

National Statistician Claire Dennis S. Mapa said at a briefing that rice prices may have increased as many retailers appeared unable to comply with the price ceiling of PHP 41 for regular milled and PHP 45 for well-milled rice.

“The PSA was able to collect (data on) 2,601 regular milled rice varieties in September and we saw that only 640 of these varieties were priced at PHP 41 or below. For well-milled rice, the total number of varieties that we got was 3,498, and 687 or about 20% followed the PHP 45 cap or less,” he said in mixed English and Filipino.

In September, he said the average price of regular milled rice rose to PHP 47.50 per kilogram from PHP 43.30 in August. The average price of well-milled rice also went up to PHP 52.70 per kilogram from an average of PHP 47.63 a month earlier.

ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said in an e-mail that he expected rice inflation to be “modest” due to the price cap.

“However, it appears that price caps were largely ineffective in keeping a cap on the all-important rice price,” he said,

President Ferdinand R. Marcos, Jr. on Wednesday announced the lifting of the ceiling on domestic rice prices.

Bank of the Philippine Islands (BPI) Lead Economist Emilio S. Neri, Jr. said the contribution of rice to headline inflation doubled to 1.6% in September, accounting for the majority of the jump in inflation.

“The upcoming harvest season for rice may help in stabilizing the price of the commodity. However, local production can only cover around 85% of rice consumption and the country needs to import the rest from abroad,” he said.

Mr. Neri noted that global rice prices have not shown any signs of slowing down so far.

“With the rice export ban of India still in place, the global supply of rice might remain tight in the near term,” he said.

“There is also a spillover impact on other food items whenever the price of rice goes up significantly. It seems other food items tend to follow the price behavior of rice especially those that are considered as substitute for the said staple.”

Meanwhile, core inflation, which discounts volatile prices of food and fuel, eased to 5.9% year on year in September from 6.1% a month ago but still faster than the 5% a year earlier.

Year to date, core inflation averaged 7.2%.

PSA’s Mr. Mapa said headline inflation was also driven by faster increases in transport (1.2% in September from 0.2% in August), health (4.1% from 3.9%), recreation, sport and culture (5.1% from 4.9%), and education services (3.6% from 2.9%).

Inflation in the National Capital Region (NCR) jumped to 6.1% in September, from 5.9% in August, while inflation in the areas outside Metro Manila surged to 6% from 5.2% in the prior month.

Similarly, inflation as experienced by the bottom 30% income households climbed to 6.9% in September from 5.6% in August. It averaged 7.3% in the nine months to September.

The National Economic and Development Authority (NEDA) said the government will continue to support the most vulnerable sectors while implementing measures to mitigate rising prices.

“The government is committed to providing targeted assistance to affected vulnerable segments of the population while food prices remain elevated,” NEDA Secretary Arsenio M. Balisacan was quoted in the statement as saying.

Finance Secretary Benjamin E. Diokno in a statement said the government is “redoubling its efforts” to stabilize inflation.

“The Philippine government is all-hands on deck in ensuring that we have the right policy measures, programs, and monitoring mechanisms in place to arrest rising commodity prices,” he said.

Still within target by end-2023

According to the BSP, inflation is expected to “remain elevated in the coming months” amid supply shocks on food and oil.

“Nonetheless, inflation is still projected to decelerate back to within the inflation target by end-2023 in the absence of further supply shocks,” the central bank said.

However, risks to inflation remain for 2023 to 2025.

“The potential impact of new petitions for transport fare adjustments, higher domestic prices of key food items facing persistent supply constraints, higher-than-expected minimum wage adjustment in areas outside NCR, impact of El Niño weather conditions on food prices and utility rates, and higher electricity rates are the major upside risks to the inflation outlook,” it said.

PSA’s Mr. Mapa said October inflation may be affected by the PHP 1 provisional jeepney fare hike that will be implemented starting Sunday (Oct. 8).

He noted fare hikes directly impact transport inflation as jeepney fare has a weight of 3.5% to the overall CPI basket.

Pantheon Macroeconomics Chief Emerging Asia Economist Miguel Chanco said he raised his 2023 average inflation forecast to 6% from 5.6% previously, in light of September’s “hot print.”

“Our revised near-term outlook now implies that inflation is unlikely to return to the BSP’s 2-4% target range until December, at the earliest, so our call for the start of an easing in policy in the fourth quarter no longer applies,” he said.

“Crucially, the (Monetary) Board won’t be digesting target inflation until its first meeting in Q1 next year. To be clear, we doubt that fresh hikes will be on the table next month either, especially if we’re right about the Q3 gross domestic product (GDP) report revealing a technical recession.”

The PSA will release its third-quarter GDP data on Nov. 9.

The BSP said it is ready to resume monetary policy tightening as necessary “to prevent the renewed broadening of price pressures as well as the emergence of additional second order effects in view of the persistent upside risks to the inflation outlook.”

The BSP has kept its key interest rate at a near 16-year high of 6.25% since March this year. Mr. Remolona earlier said the BSP is considering hiking policy rates if inflationary pressures continue, even hinting at an off-cycle rate hike.

For ING’s Mr. Mapa, the BSP may likely be forced to hike borrowing costs anew.

“We expect the BSP to be monitoring the actions of the Fed closely with a potential off-cycle rate hike carried out but only if the Fed hikes in early November,” he said.

“If the Fed stands pat, the BSP could consider further tightening should their own inflation forecast point to inflation in 2024 threatening the upper end target of 4%,” he said.

The US Federal Reserve kept the target Fed funds rate unchanged at 5.25-5.5% at its meeting last month, but earlier said it would keep rates higher for longer.

The Fed’s next meeting is from Oct. 31 to Nov. 1, while the BSP is scheduled to discuss policy on Nov. 16. — Keisha B. Ta-asan, Reporter

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld