February Economic Update: Cut to the chase

DOWNLOAD

DOWNLOAD

Inflation Update: Nowhere but up

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

Inflation likely quickened in April

Headline inflation may have quickened for a third straight month in April and possibly breached the Philippine central bank’s 2-4% target range, analysts said.

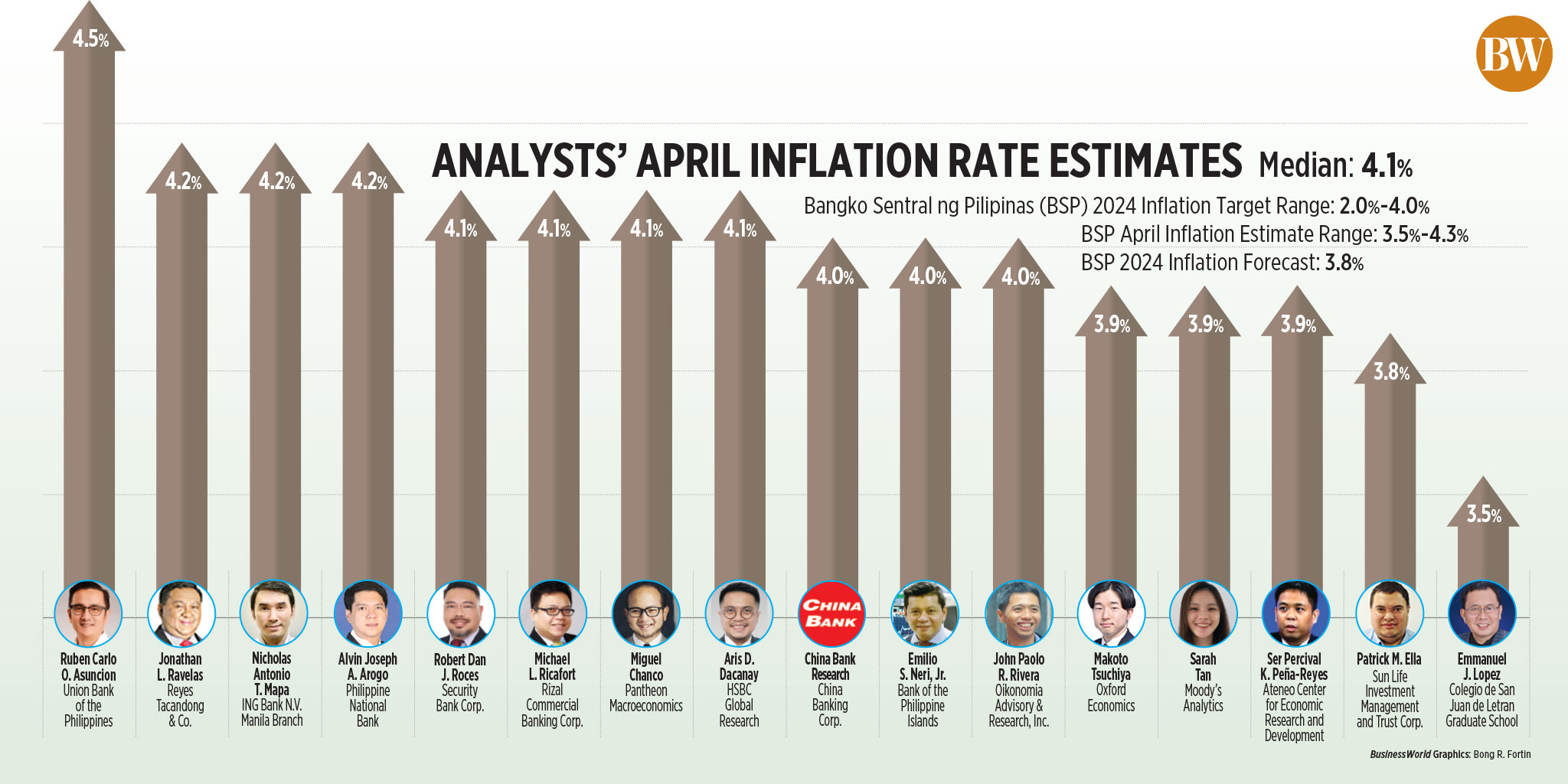

A BusinessWorld poll of 16 analysts yielded a median estimate of 4.1% for the consumer price index (CPI) in April, within the 3.5-4.3% forecast of the Bangko Sentral ng Pilipinas (BSP).

If realized, April inflation would be faster than 3.7% in March but slower than the 6.6% print a year ago.

This would also surpass the 2-4% target band for the first time since the 4.1% print in November 2023.

April would also mark the third straight month that inflation picked up on a month-on-month basis.

The Philippine Statistics Authority (PSA) will release April CPI data on May 7.

“I’m expecting a further rise in inflation in April to 4.1%, breaching the 4% upper bound of the BSP’s target range for the first time in five months,” Pantheon Chief Emerging Asia Economist Miguel Chanco said.

“The silver lining, though, is that this further upshift should be down mainly to adverse food price base effects — a technicality — rather than a real intensification of food price pressures,” he added.

Bank of the Philippine Islands Lead Economist Emilio S. Neri, Jr. said the monthly change in food prices appear to have “stabilized” in April.

“But a noticeable uptick of the year-on-year headline print in April from March is likely to emanate more from unfavorable base effects, something we expect to persist in May and June,” Mr. Neri said.

Analysts noted that food inflation continued to be the main driver of inflation.

ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said rice inflation is expected to be north of 24% year on year due to “tight supply conditions” in April.

In March, rice inflation accelerated to 24.4%, its fastest print since the 24.6% in February 2009.

As of end-April, the price of local well-milled rice averaged P48-P55 a kilo from P39-P46 a year ago, data from the Agriculture department showed. A kilo of regular milled rice averaged P50 from P34-P42 a year ago.

Analysts also noted April inflation will reflect the impact from the El Niño weather pattern.

“The main upward pressure comes from rising food prices as the dry spell from El Niño continues to put a toll on crop yields. Notably, rice and pork are the two food items that have suffered heavy supply-side disruptions,” Moody’s Analytics economist Sarah Tan said in an e-mail.

As of April 23, agricultural damage due to the El Niño has reached P4.39 billion. Rice was the most affected crop, accounting for 62% of total agricultural damage, equivalent to P2.71 billion.

“Private transport will also contribute to inflation in April after several weeks of price increase with only the last week of April seeing prices ease somewhat,” Mr. Mapa said.

For the month of April, pump price adjustments stood at a net increase of P2.25 a liter for gasoline, and P0.50 a liter for diesel. Kerosene prices had a net decrease of P0.80 a liter.

“Sequentially, fuel prices likely edged higher, particularly towards the end of the month reflecting a temporary jump in the global oil prices,” Makoto Tsuchiya, an economist from Oxford Economics, said in an e-mail.

OUTLOOK

Inflation may continue to accelerate for the rest of the second quarter before easing in the latter part of the year.

“We expect headline inflation to peak in the range of at least 5% year on year in April-May, consistent with broad food inflation peaking at 6.2% year on year in April before easing to 5.5% in July,” Ruben Carlo O. Asuncion, chief economist at Union Bank of the Philippines, Inc., said

HSBC economist for ASEAN (Association of Southeast Asian Nations) Aris D. Dacanay said he expects inflation to return to within the BSP’s 2-4% target band once the unfavorable base effects wear off in the third quarter.

With inflation likely to remain elevated, the BSP is seen to extend its policy pause at its next meeting.

“We think the BSP will stay put at the upcoming meeting given lingering inflationary risks as well as recent currency movement,” Mr. Tsuchiya said.

The peso returned to the P57 level this month. The BSP has said that this is due to the strong US dollar and not a weak peso amid the Middle East conflict.

“A faster print, especially above the BSP’s target, will strengthen the case for a sustained policy rate pause in May,” Philippine National Bank (PNB) economist Alvin Joseph A. Arogo said.

The Monetary Board stood pat for a fourth straight meeting in April, keeping its benchmark rate at a near 17-year high 6.5%.

From May 2022 to October 2023, the BSP has raised borrowing costs by 450 basis points (bps).

The Monetary Board is set to review policy on May 16.

Weaker-than-expected gross domestic product (GDP) growth may also prompt the BSP to keep its key rate unchanged.

“We suspect that the case for a continued pause will be bolstered by the first-quarter GDP data, which we expect to fall short of expectations,” Mr. Chanco added.

The government is targeting 6-7% growth this year. First-quarter GDP data will be released on May 9.

Mr. Tsuchiya said he expects the BSP to deliver its first rate cut in the fourth quarter.

“For as long as the El Niño impact on food CPI has not receded, BSP will not hesitate to keep its hawkish pause (thus, delay any BSP rate cuts) or highlight the risks to the outlook is still tilted to the upside,” Mr. Asuncion said.

There is also less chance for a rate hike, Ms. Tan said.

“The odds are low for the tightening cycle to resume. BSP is also cognizant that inflation can creep above the upper bound of their target range in the second quarter this year. Meanwhile, it is not yet time for BSP to begin monetary easing, especially as the US Federal Reserve appears to be delaying its first policy rate cut,” she added.

The Federal Reserve kept its Fed funds rates steady at its meeting on April 30-May 1. — By Luisa Maria Jacinta C. Jocson, Reporter

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld