January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

Inflation likely eased in April — poll

INFLATION likely further eased in April amid lower food prices, electricity rate cuts, and favorable base effects, analysts said.

However, still-elevated inflation may prompt the Bangko Sentral ng Pilipinas (BSP) to continue hiking interest rates at its policy meeting later this month, despite earlier signals of a pause.

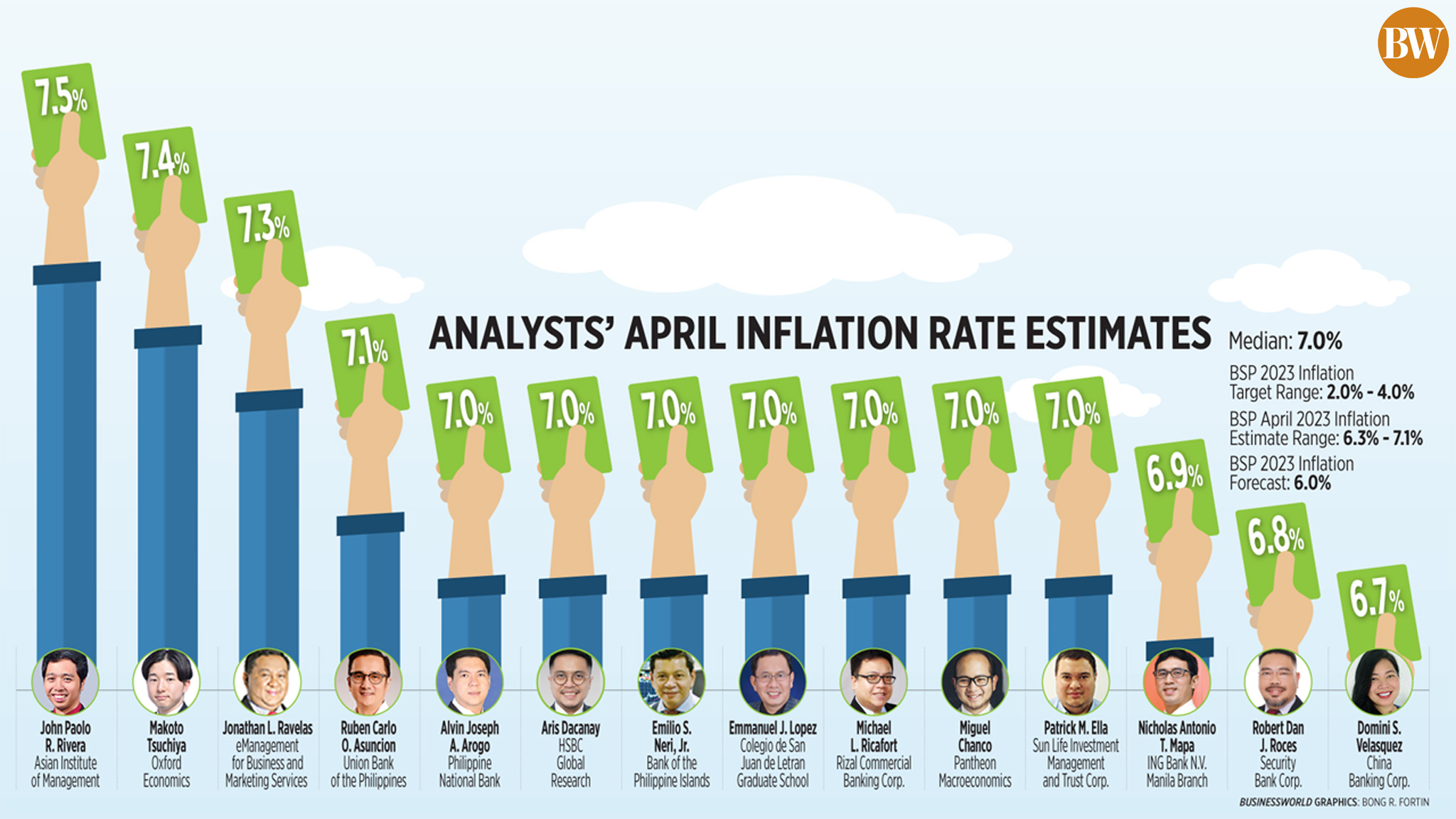

A BusinessWorld poll of 14 analysts yielded a median estimate of 7% for April inflation, settling near the upper end of the 6.3-7.1% forecast range by the BSP for the month.

If realized, this would be slower than the 7.6% in March, but faster than the 4.9% in April 2022. It will also be the slowest rise in prices in seven months, or since the 6.9% inflation rate in September last year.

However, April inflation would surpass the BSP’s 2-4% target range for the 13th consecutive month.

Consumer price index (CPI) data for April will be released on May 5.

“Although oil prices have increased and the longer-lasting effects from last year’s supply shocks are still prevalent, the headline inflation print will likely be lower than March’s 7.6% due to favorable base effects,” Philippine National Bank economist Alvin Joseph A. Arogo said.

In April alone, pump price adjustments stood at a net increase of PHP 2.90 per liter for gasoline, PHP 1.10 per liter for diesel, and PHP 2 per liter for kerosene.

“The prices of numerous food items also moderated but a few continue to be very elevated. In particular, sugar and onion prices continue to soften with supply augmented from the government’s emergency importation of these goods whereas egg and oil prices are still high,” Hongkong and Shanghai Banking Corp. economist for the Association of Southeast Asian Nations (ASEAN) Aris Dacanay said.

The average price of local red onions went as high as PHP 180 per kilogram by end-April, while the price of refined sugar ranged from PHP 86 to PHP 110 per kilo during the month, data from the Department of Agriculture showed.

Oxford Economics assistant economist Makoto Tsuchiya said despite a year-on-year slowdown in inflation, momentum likely picked up month on month largely due to food prices, particularly meat.

“But a high base a year ago likely exerted downward pressures on both fuel and headline CPI,” Mr. Tsuchiya said in an e-mail.

Prices of pork kasim ranged from PHP 310 to PHP 365 per kilo at end-April, higher than the PHP 290 to PHP 350 range at end-March. Prices of whole chicken also rose to PHP 150-PHP 220 per kilo from PHP 150-PHP 200 a month ago, while prices of beef rump were unchanged at PHP 395-PHP 550.

“Possibly higher prices of fish, meat, rice, hotel accommodations and restaurant services, housing rentals were drivers for a return to month-on-month CPI increases,” Bank of the Philippine Islands (BPI) Lead Economist Emilio S. Neri, Jr. said.

China Banking Corp. Chief Economist Domini S. Velasquez noted liquefied petroleum gas prices and electricity rates in Manila Electric Co.’s (Meralco) service areas were also lower in April.

Fuel retailers cut prices of cooking gas by around PHP 9.18 to PHP 9.20 per kilogram in April, while Meralco also slashed the overall rate for a typical household by PHP 0.1180 to PHP 11.3168 per kilowatt-hour (kWh) in April.

“Nonetheless, there are upside risks to the forecast with the peso depreciating against the dollar in the second half of April,” Mr. Dacanay said.

The peso returned to the PHP 55-a-dollar mark in April. The local unit closed at PHP 55.38 on Friday, down by PHP 1.02 or 1.84% from its PHP 54.36 finish on March 31.

Meanwhile, Ms. Velasquez also said core inflation may have eased to 7.7% in April, from 8% in March, “which is sufficient to show that inflation is on a sustained downward trajectory.”

March was the fastest core inflation since December 2000.

One more rate hike?

According to analysts, the BSP may still hike rates by 25 basis points (bps) this month, bringing the benchmark interest rate to 6.5%, before pausing its tightening cycle.

The Monetary Board has raised borrowing costs by 425 bps since May last year, bringing the key policy rate to 6.25%, its highest in nearly 16 years. The BSP will again meet on May 18 to discuss policy.

Mr. Neri said strong gross domestic product (GDP) growth in the first quarter, another rate hike by the US central bank, and still-elevated core inflation may affect the BSP’s decision on May 18.

The Philippine Statistics Authority is set to release first-quarter GDP data on May 11.

“While BSP may decide to pause, this could erode some of the confidence it has regained in recent months,” Mr. Neri said.

“A follow-through hike seems more prudent at this point since these tightening actions can be dialed back later on. After back-to-back misses in 2022 and 2023, it’s best to pause when it’s clearer that we will meet the inflation target in 2024,” he added.

BSP Governor Felipe M. Medalla earlier said the Monetary Board may consider keeping policy rates at 6.25% at its meeting this month if inflation further slowed down in April.

“Although year-on-year figure will likely slow down, the sequential pickup should keep the BSP on the cautious side, opting for a 25-bp hike. That said, given the generally downward trend of prices, the 25-bp hike in May will likely be the last hike in the current hiking cycle,” Mr. Tsuchiya said.

The BSP sees full-year inflation at 6%, before easing to 2.9% in 2024. Mr. Medalla also said inflation will go back within the 2-4% target by the fourth quarter this year.

Miguel Chanco, chief economist for emerging Asia at Pantheon Macroeconomics, said if inflation in April falls within the BSP’s forecast range, the Monetary Board will be in a more comfortable position to pause.

“A further drop to 7% should give them more confidence that the Philippine economy has passed the January peak in inflation,” Mr. Chanco said. — By Keisha B. Ta-asan, Reporter

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld