February Economic Update: Cut to the chase

DOWNLOAD

DOWNLOAD

Inflation Update: Nowhere but up

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

Inflation likely cooled further in Jan.

Headline inflation likely eased further in January, as favorable base effects may have offset rising prices of some food items and higher utility rates.

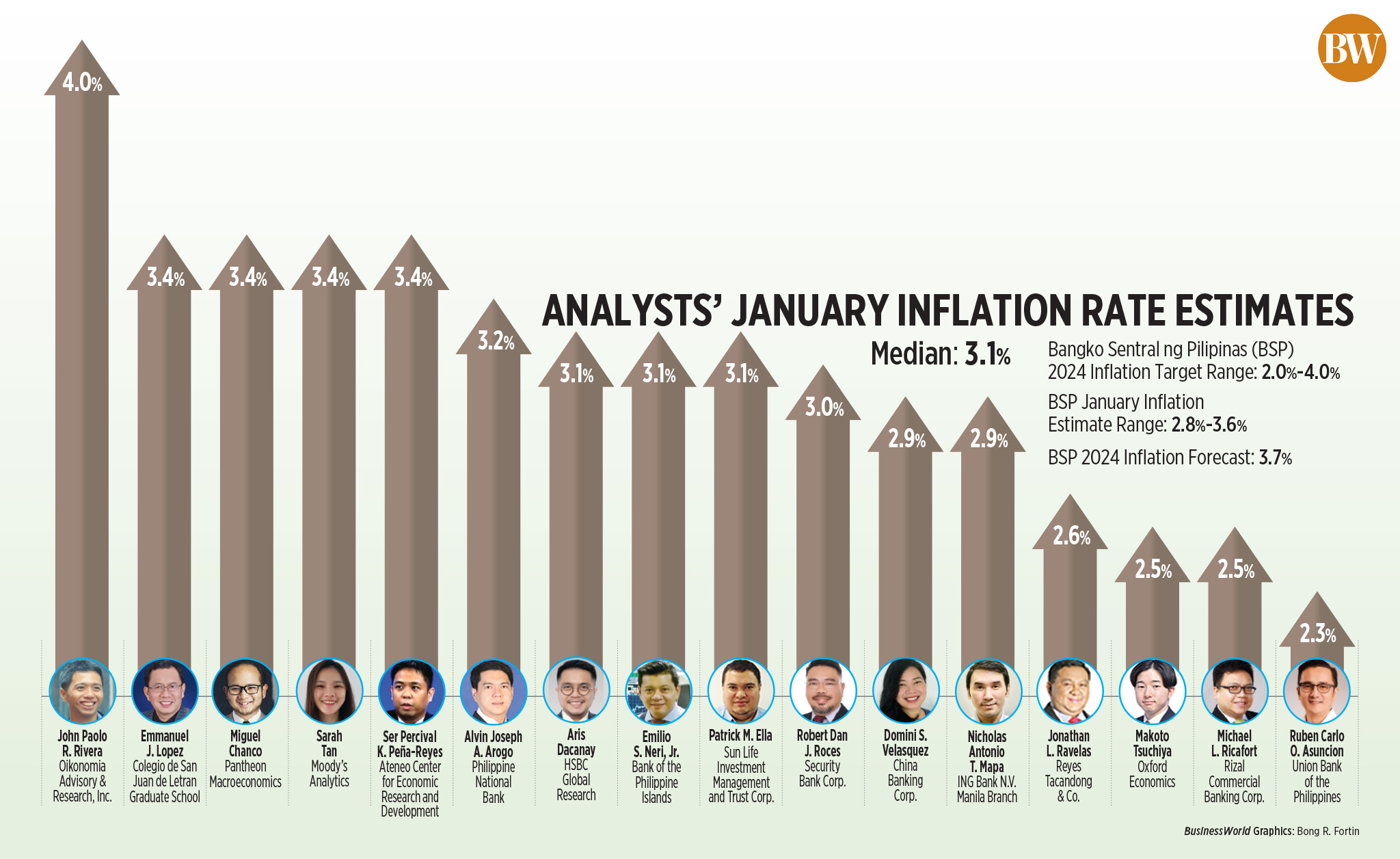

A BusinessWorld poll of 16 analysts last week yielded a median estimate of 3.1% for January inflation, settling within the 2.8-3.6% forecast of the Bangko Sentral ng Pilipinas (BSP).

If realized, this will be the second consecutive month that inflation will be within the BSP’s 2-4% target band. It will also be slower than the 3.9% print in December.

At 3.1%, January inflation would be the slowest since the 3% print in February 2022.

The Philippine Statistics Authority will release the January consumer price index (CPI) report on Feb. 6 (Tuesday).

Analysts said base effect was a major factor why inflation likely slowed in January.

“The January print will benefit from a high base effect — recall that inflation hit a 14-year high of 8.7% in January last year — which will temper inflation,” Sarah Tan, an economist from Moody’s Analytics, said in an e-mail.

Headline CPI soared to 8.7% in January 2023, which marked the fastest rise in prices since November 2008. After the peak in January, inflation gradually slowed throughout 2023, bringing full-year inflation to 6%.

Pantheon Chief Emerging Asia Economist Miguel Chanco in an e-mail said inflation may slow to 3.4% in January, mainly driven by a significant drop in inflation for housing and utilities “where base effects will do a lot of heavy lifting.”

He also said food inflation may continue to moderate to 5% in January from 5.5% in December 2023.

Meanwhile, China Banking Corp. Chief Economist Domini S. Velasquez said inflation may increase 0.7% month on month amid higher prices of rice, meat, fruits, and fish.

Data from the Department of Agriculture showed that as of Jan. 31, prices of regular milled rice rose to as much as PHP 53 per kilo from PHP 52 on Dec. 29. Prices of beef rump ranged at P390-P500 per kilo as of end-January, while prices of beef brisket were at the PHP 350-PHP 440 a kilo range.

“Higher prices of key agricultural goods such as rice and meat produce, and hikes in electricity rates likely added upward pressure,” Ms. Tan said.

Manila Electric Co. earlier raised the rate for a typical household by PHP 0.6232 to PHP 10.9001 per kilowatt-hour (kWh) in January.

“Additionally, an uptick in domestic pump prices, utilities, and another tranche of sin taxes contributed to the upward pressure on prices. However, lower prices of vegetables possibly tempered the rise in overall inflation,” Ms. Velasquez said.

Fuel retailers implemented price hikes in January. For the month, pump price adjustments stood at a net increase of PHP 4.40 a liter for gasoline, PHP 2.90 a liter for diesel, and PHP 0.85 a liter for kerosene.

“In January, fuel prices slightly increased, rice prices remained elevated, while electricity prices were hiked. Nonetheless, we expect headline CPI in January to have decelerated sharply to 3.1% on the back of very favorable base effects, and partly due to vegetable prices easing as of late,” Aris D. Dacanay, HSBC economist for ASEAN, said in an e-mail.

However, base effects may wear off in the coming months, Mr. Dacanay added.

Philippine National Bank economist Alvin Joseph A. Arogo said inflation would only settle sustainably within the 2-4% target by the fourth quarter this year.

“This is because we assume agricultural disruptions due to El Niño and rebound in oil prices as the Middle East conflict remains a significant threat,” he said.

Hotter weather in the first half of the year may also lead to an uptick in electricity rates, Mr. Arogo said. He noted that the minimum wage hikes implemented last year will be reflected in consumer prices this year.

Ms. Tan also said it would be difficult for inflation to stay firmly within the 2-4% target band this year.

“We expect some volatility in the opening months of the year given the risk that the El Niño weather pattern could strengthen and keep food prices elevated. That should see inflation bump around the 4% mark before returning firmly to BSP’s target range by mid-2024,” she said.

The El Niño phenomenon, which affects local agricultural production, is expected to last until the second quarter of the year.

Union Bank of the Philippines, Inc. Chief Economist Ruben Carlo O. Asuncion said full-year inflation may hit 3.7% by end-2024.

He noted higher food inflation may cause headline CPI to breach the 4% target again in April, before settling back to the target in the second half this year.

“We project core inflation to end 2024 at 3.5% for a full-year average of 3.2%. El Niño-spawned food price shocks will not spill over into the non-food segment of CPI (60% weight),” he said.

For his part, ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said the central bank’s baseline forecast shows inflation is within the 2-4% target this year.

“We believe that we could very well see inflation settle within target for the year barring any supply-side shocks and if fiscal authorities continue their push to combat price pressures,” he said in an e-mail.

The BSP’s average inflation baseline forecast is at 3.7% for 2024 and 3.2% for next year. Meanwhile, its risk-adjusted inflation forecast is at 4.2% this year and 3.4% for 2025.

BSP TO KEEP RATES STEADY

With inflation likely to slow further in January, it is highly likely that the BSP’s tightening cycle is over, Ms. Tan said.

“An easing inflation in January, especially since it will be tempered by a high base effect, will see the BSP hold its policy rate steady at 6.5% when they next meet in February,” she said.

Despite the widely expected decline in inflation, the BSP is expected to remain vigilant against risks and price pressures, according to Ms. Velasquez.

“Various factors, including the impact of El Niño on rice production, geopolitical risks affecting freight costs and oil prices, and domestic risks like transport fare increases due to public transport modernization, will keep inflation risks elevated throughout the year,” she said.

“As a result, the BSP will likely continue to closely monitor and manage these risks to ensure price stability and maintain an appropriate monetary policy stance,” she added.

The BSP hiked borrowing costs by 450 basis points (bps) from May 2022 to October 2023. This brought the key interest rate to 6.5%, the highest in 16 years.

The Monetary Board may also opt to keep rates steady due to the stronger-than-expected economic growth print in the fourth quarter, Mr. Chanco said.

“Accordingly, we now expect the BSP to remain on hold next month, and the earliest the Board is likely to cut is now May, from our point of view,” he said.

Philippine gross domestic product (GDP) grew by just 5.6% in 2023, slower than the 7.6% expansion in 2022 and below the 6-7% target of the government.

Patrick M. Ella, economist at Sun Life Investment Management and Trust Corp., said the inflation figures in the coming months and the timing of the US Federal Reserve’s rate cut is a more important variable in the BSP’s policy decision making.

“The real question is if the BSP will consider a 50-bp cut in the next few months and so far, I’m still not convinced they will, but we have to keep this topic open for consideration,” he said.

The BSP will have its first policy review of the year on Feb. 15. – Keisha B. Ta-asan, Reporter

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld