January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

Inflation eases for 1st time in 6 months

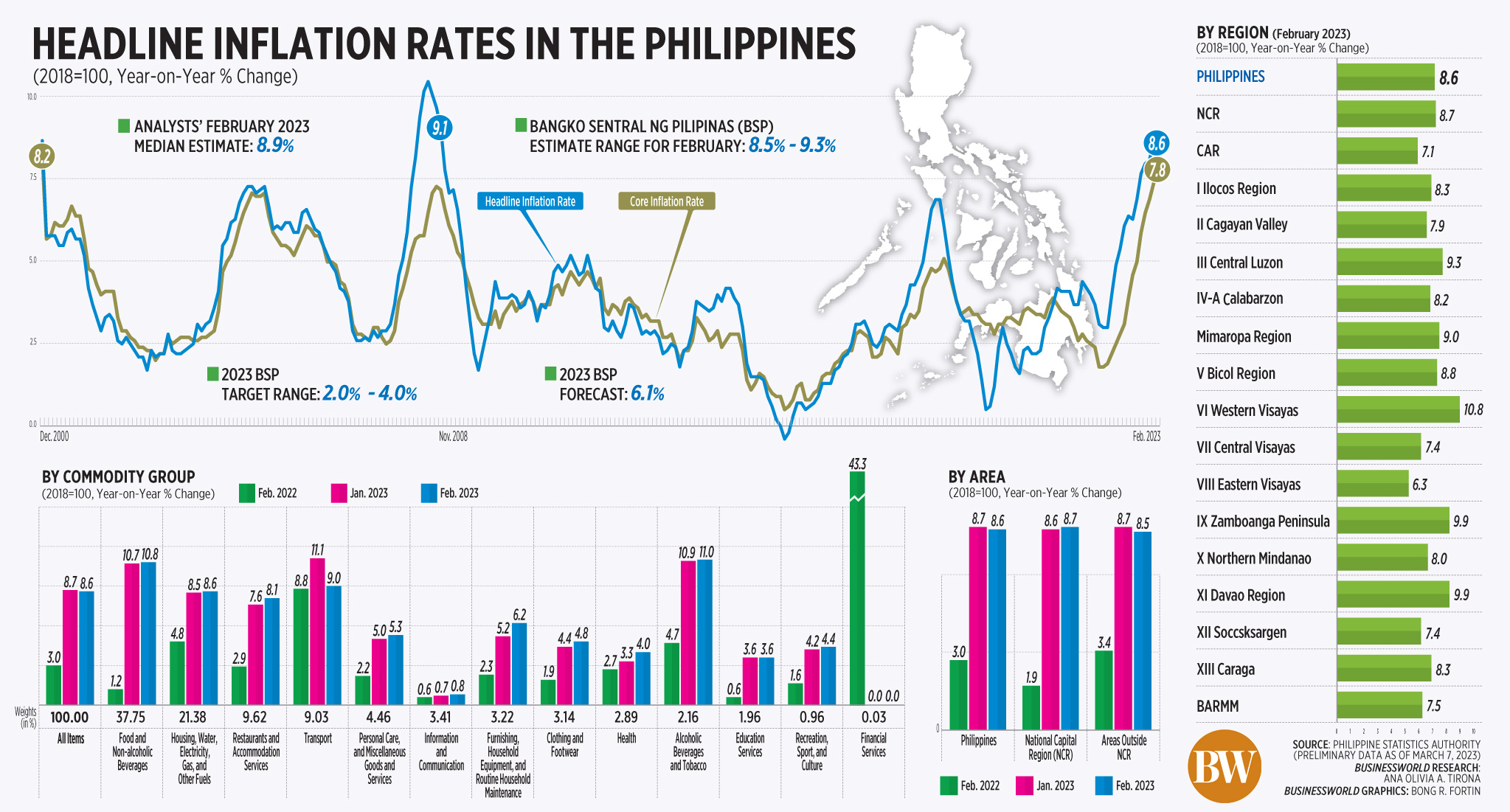

PHILIPPINE INFLATION eased for the first time in six months in February as transport and food prices rose at a slower pace, the statistics agency said.

Core inflation, however, accelerated to the fastest pace in over 22 years, which will likely ensure the Bangko Sentral ng Pilipinas (BSP) continues its tightening path.

Preliminary data from the Philippine Statistics Authority (PSA) showed the consumer price index (CPI) slowed to 8.6% in February, from the 14-year high 8.7% in January. Still, this was faster than the 3% in February 2022.

February inflation was below the 8.9% median in a BusinessWorld poll conducted last week, but within the Bangko Sentral ng Pilipinas’ (BSP) 8.5-9.3% projection.

Stripping out seasonality factors, consumer prices dipped by 0.3% in February from 1% a month earlier.

Core inflation, which discounted volatile prices of food and fuel, quickened to 7.8% in February from 7.4% in January and 1.9% in the same month in 2022.

This is the quickest rise in core inflation in over 22 years or since 8.2% in December 2000.

Core inflation has been rising since March 2022.

For the first two months of the year, inflation averaged 8.6%. The BSP expects inflation to average 6.1% this year.

At a press briefing, PSA Undersecretary and National Statistician Claire Dennis S. Mapa said transport was the main source of the deceleration in February inflation as prices of gasoline and diesel declined.

Transport inflation slowed to 9% in February, from 11.1% in January, as price increases in gasoline and diesel eased.

Pump price adjustments stood at a net decrease of PHP 0.50 a liter for gasoline, PHP 5.45 a liter for diesel and PHP 6.85 a liter for kerosene in February.

On the other hand, nine out of 13 commodity groups posted faster inflation rates, led by food and non-alcoholic beverages (10.8% in February from 10.7% in January).

Other commodities that posted higher annual increases were alcoholic beverages and tobacco (11% from 10.9% in January), furnishings and household equipment (6.2% from 5.2%), clothing and footwear (4.8% from 4.4%), and health (4% from 3.3%).

Meanwhile, food inflation slightly eased to 11.1% in February from 11.2% in January and 1.1% in the same month in 2022.

Mr. Mapa said the downtrend in food inflation was due to slower annual growth of vegetables, tubers, plantains and cooking bananas (33.1% in February from 37.8% in January), and rice (2.2% from 2.7%). Price increases in corn; meat; oils and fats; and sugar, confectionary and desserts, also slowed during the month.

However, higher annual increases were seen in flour, bread and other bakery products; fish and other seafood; milk and other dairy products; fruits and nuts; and ready-made food products.

National Economic and Development Authority (NEDA) Secretary Arsenio M. Balisacan said the government should rethink its strategies to combat elevated food prices.

“The country’s current high inflation is largely driven by domestic, supply-side constraints. Agricultural imports were ill-timed and food supplies have been inadequate. The solution is to get to the root of the problem, including fixing the bottlenecks along all segments of the agricultural value chain,” he said in a statement.

Hongkong and Shanghai Banking Corp. (HSBC) economist for the Association of Southeast Asian Nations (ASEAN) Aris Dacanay said the slower February inflation was due to favorable base effects.

“Across all sub-commodity baskets, only transport CPI eased on a year on year basis given some favorable base effects in fuel prices. It has been a year since global oil prices first spiked. As a result, gasoline and diesel CPI eased substantially to 3.8% (from 9.6%) and 14.2% year on year (30.5%), respectively,” Mr. Dacanay said.

Fuel prices surged amid Russia’s invasion of Ukraine that started in late February last year.

‘Sticky’ core inflation

Inflation for the bottom 30% income households quickened to 9.7% in February, steady from a month ago but faster than the 3.5% print last year.

Food inflation for the bottom 30% households rose slightly to 10.5% in February from 10.4% in January, PSA’s Mr. Mapa said.

In the National Capital Region (NCR), headline inflation climbed to 8.7% in February from 8.6% in January and 1.9% a year ago. Mr. Mapa said this is the fastest print since 9.5% in December 2000.

Outside of NCR, consumer prices went down 8.5% from 8.7% in January and 3.4% a year prior.

PSA’s Mr. Mapa said an increase in gasoline and diesel prices as well as “sticky” core inflation may still drive inflation higher in March.

Local oil companies on Tuesday increased gasoline prices by PHP 0.40 per liter, diesel by PHP 1.50 per liter and kerosene by PHP 1.25 per liter.

Mr. Mapa noted that a deceleration in meat and vegetable prices may help slow inflation this month as the weight of food in the CPI basket is around 35% for all income households, and around 51% for the bottom 30%.

“While we are seeing a slight drop in prices, particularly with food, prices are still elevated… We’re still facing challenges particularly with our core inflation. Core inflation is continuously increasing,” Mr. Mapa said in mixed English and Filipino.

According to HSBC’s Mr. Dacanay, it’s hard to determine whether inflation has peaked as consumer demand is still strong.

“Indeed, the momentum of inflation eased significantly in February, but it’s difficult to determine the peak with confidence given the extent to which inflation was spreading to other goods and services,” he said.

Bank of the Philippine Islands (BPI) Lead Economist Emilio S. Neri, Jr. said inflation may have peaked already, and will slow in the coming months.

“But the decline will likely be gradual due to upside risks outside of oil. The agriculture sector continues to struggle amid structural problems, preventing it from keeping up with the country’s rising population,” Mr. Neri said. “With core inflation still rising, the BSP may need to hike further in the coming months.”

An all-of-government approach is needed to address inflation and the pressure is now on the fiscal side, Finance Secretary Benjamin E. Diokno said on Tuesday.

Trade Secretary Alfredo E. Pascual said the government must also intensify campaigns to lower prices of basic necessities, especially agriculture products.

Rate hike outlook

The BSP said it projects inflation to remain above target until the fourth quarter this year before easing to the low end of the 2-4% target range by January 2024. This is due to negative base effects and a likely decline in global oil and non-oil prices.

However, uncertainties in the global food market, supply constraints, additional transport fare hikes, and higher-than-expected wage adjustments this year were cited as upside risks to the inflation outlook.

“The BSP remains prepared to adjust its monetary policy settings as necessary to prevent inflation expectations from becoming disanchored and safeguard the inflation target over the policy horizon,” the central bank said in a statement.

The BSP has raised rates by a total of 400 basis points (bps) since May 2022, bringing the policy rate to 6% — the highest since 2007.

It expects inflation to average 6.1% this year, before easing to 3.1% in 2024.

ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa expects the BSP to further tighten policy, but likely at a slower pace as inflation eased in February.

“BSP Governor Medalla recently shared that he would only consider a 50-bp rate hike should headline inflation top 9%. (This) inflation report solidifies our expectation that Governor Medalla can opt for a 25-bp rate increase, taking the overnight reverse repurchase rate to 6.25%, which should likely be the peak for this tightening cycle,” Mr. Mapa said.

He added the peso may face pressures in the near term as easing inflation “opens the door for a less aggressive policy response from the central bank.”

Following the PSA’s announcement, the local currency closed at PHP 55 versus the greenback on Tuesday, depreciating by 12 centavos from Monday’s PHP 54.88 finish.

The behavior of the peso this year will largely depend on what the US Federal Reserve will do, said BPI’s Mr. Neri.

“If US activity prints weaken significantly, the US central bank may pause more quickly or even cut interest rates earlier than expected. This will diminish the strength of the US dollar and provide support to other emerging market currencies like the peso,” he said.

The US Federal Reserve raised the fed funds rate by 25 bps to 4.5-4.75%. It has hiked rates by a total of 450 bps since March 2022. The Fed’s next policy review will be on March 21 and 22. — By Keisha B. Ta-asan, Reporter

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld