February Economic Update: Cut to the chase

DOWNLOAD

DOWNLOAD

Inflation Update: Nowhere but up

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

Inflation accelerates in August for 1st time in 7 months

Headline inflation accelerated for the first time in seven months in August, amid a spike in the prices of rice, vegetables and fuel, the Philippine Statistics Authority (PSA) said on Tuesday.

Preliminary data from the PSA showed the consumer price index (CPI) quickened to 5.3% in August from 4.7% in July, but slower than the 6.3% clip a year ago.

This was above the 4.9% median estimate in a BusinessWorld poll conducted last week. However, it settled within the Bangko Sentral ng Pilipinas’ (BSP) 4.8-5.6% forecast range for the month.

August also marked the 17th consecutive month that inflation surpassed the BSP’s 2-4% target range.

At 5.3%, last month’s inflation print was the fastest in two months, or since the 5.4% in June. Stripping out seasonality factors, month-on-month inflation inched up 1.1% in August.

For the first eight months of 2023, inflation averaged 6.6%, still above the BSP’s 5.6% full-year projection.

Core inflation, which excludes volatile prices of food and fuel, further eased to 6.1% year on year in August. This was lower than the 6.7% seen in July, but above the 4.6% in August last year.

“Higher prices for oil and key agricultural commodities drove inflation during the month,” the BSP said in a statement.

National Statistician Claire Dennis S. Mapa said inflation was mainly driven by the faster annual increase in the heavily weighted index for food and nonalcoholic beverages to 8.1% in August from 6.3% in the previous month.

Food inflation alone quickened to 8.2% in August from 6.3% in July.

Rice inflation surged to 8.7% in August from 4.2% in July due to tight supply. This was the fastest pace since the 9% print in November 2018 when the country experienced another rice shortage. August also marked the sixth straight month of increase or since 2.2% in February.

Mr. Mapa noted that an increase in rice prices typically signals rising inflation since rice accounts for 8.9% of the total CPI basket for all income households and 17.9% for the bottom 30%.

Meanwhile, inflation for vegetables, tubers, plantains, cooking bananas and pulses climbed to 31.9% in August from 21.8% a month prior. This was the fastest since 33% in February.

Mr. Mapa said recent typhoons have caused agricultural damage, which drove up prices of vegetables and rice, especially in Central Luzon.

Bank of the Philippine Islands (BPI) Lead Economist Emilio S. Neri, Jr. said the inflation trend in the next few months will largely depend on food supply.

“The upcoming harvest season for rice may help in stabilizing the price of the commodity. However, local production can only cover around 85% of rice consumption and the country needs to import the rest from abroad,” he said in a note.

Mr. Neri said retail prices may stay elevated in the near term, as global rice prices are at a 12-year high. There may be uncertainties as well on the ability of other countries to supply rice amid the El Niño weather event.

ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa in a note said the uptick in August inflation was a reversal from the steady downtrend in inflation in the last six months.

“With supply shocks to important food items and imported energy, we could see a resumption of price pressures building up,” he said.

The government on Tuesday began implementing a nationwide price ceiling on regular and well-milled rice as part of efforts to address rising prices of the national staple.

Fuel prices

“Another threat we are looking at is the consistent increases in fuel prices (in recent months). If pump prices continue to rise, other commodity items may be affected,” PSA’s Mr. Mapa said.

PSA data showed transport inflation quickened to 0.2% in August from -4.7% in July, ending three months of decline.

In August alone, oil firms hiked fuel prices by PHP 5.90 per liter for gasoline, PHP 9.90 per liter for diesel and PHP 10 per liter for kerosene.

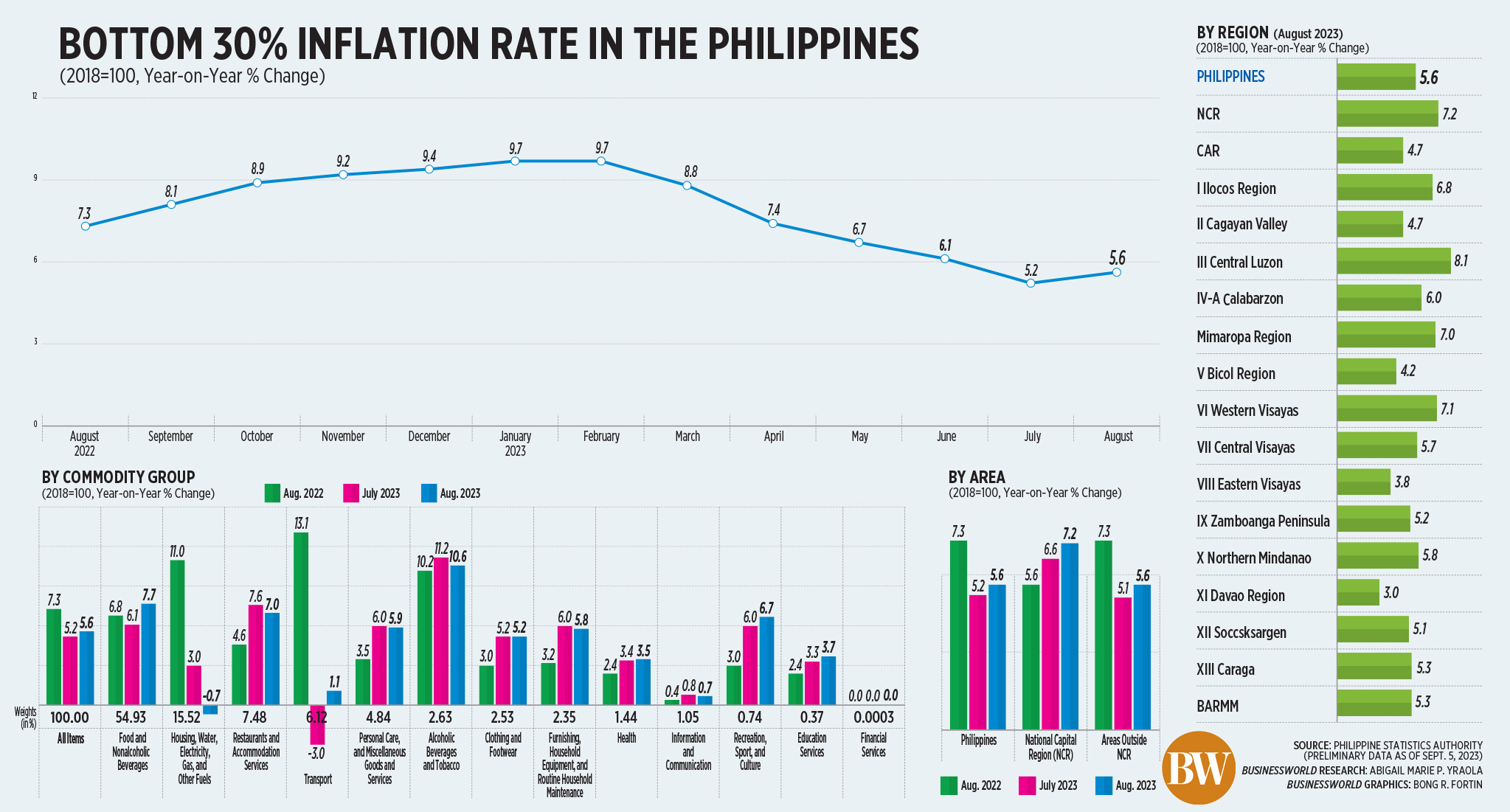

Meanwhile, the inflation rate for the bottom 30% of income households rose to 5.6% in August from 5.2% in July. However, it was slower than the 7.3% print in August 2022.

From January to August, inflation averaged 7.4% for the bottom 30%.

In the National Capital Region (NCR), inflation inched up to 5.9% from 5.6% in July. Inflation in areas outside NCR accelerated to 5.2% in August from 4.4% in July.

Policy outlook

The BSP said inflation may remain elevated in the coming months due to the impact of supply shocks on food prices as well as the increase in global oil prices.

Despite the uptick in August, the central bank said it still projects inflation to decelerate to within the 2-4% target by the fourth quarter.

“The BSP stands ready to adjust the monetary policy stance as necessary to prevent the further broadening of price pressures as well as the emergence of additional second order effects in view of the persistent upside risks to the inflation outlook,” the BSP said.

The BSP has kept the key rate steady at 6.25% at its last three meetings. It has raised borrowing costs by 425 basis points (bps) from May 2022 to March 2023 to curb inflation.

According to the BSP, the balance of risks to the inflation outlook remains on the upside due to the potential impact of additional transport fare increases, higher-than-expected minimum wage hikes in other regions, and supply constraints for key food items.

It also cited the El Niño weather phenomenon and the likely knock-on effects of higher toll rates on prices of agricultural products as upside risks to the inflation outlook.

The impact of a weaker-than-expected economic recovery globally remains as the primary downside risk.

“The August upside surprise now has BSP on notice although we doubt one data point will be enough for Governor Eli M. Remolona, Jr. to flip back into tightening mode,” ING’s Mr. Mapa said.

Should inflation for rice, electricity and transportation accelerate further, he said that Mr. Remolona will not hesitate to raise rates to get a hold of inflation expectations.

Finance Secretary Benjamin E. Diokno said that the government is “resolute” in mitigating the impact of inflation on the public.

“While we are seeing a slight uptick, our inflation rate assumption of 5% to 6% for full-year 2023 remains doable,” he said in a separate statement.

With the higher-than-expected August print, Pantheon Chief Emerging Asia Economist Miguel Chanco said they have raised their average inflation forecasts to 5.6% for this year and 2.8% for 2024 from 5.4% and 2.6% previously.

“A return to the BSP’s target range in the fourth quarter still is very much in the cards, from our perspective, given the favorable food base effects from the fourth quarter last year,” Mr. Chanco said in an e-mail.

“We continue to believe that the BSP will cut its benchmark rate by 50 bps in the fourth quarter in order to take pressure off the economy, though the risks to this forecast are now more skewed to the upside,” he added.

For BPI’s Mr. Neri, rate cuts are still premature due to the likelihood of inflation remaining above target in the next six months.

“It should be noted that inflation has been above the target of the BSP for almost two years already. A longer period of above-target inflation may affect the BSP’s credibility as an inflation targeting central bank, which in turn may limit their ability to control inflation,” he said.

“Inflation can easily bounce back given these conditions. With the trade and current account deficit of the Philippines at substantial level, the BSP may find it difficult to decouple its monetary policy from that of the US,” he added.

The next meeting of the Federal Open Market Committee is scheduled for Sept. 19-20, while the BSP’s next policy meeting is on Sept. 21. — By Keisha B. Ta-asan, Reporter

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld