January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

Income-price gap keeps Filipino families from owning homes — ULI

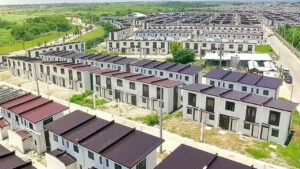

Home ownership in the Philippines remains out of reach for many households due to the wide gap between residential property prices and income, particularly in urban areas like Metro Manila and Davao, according to the Urban Land Institute (ULI).

In the 2025 ULI Asia-Pacific Home Attainability Index, the Philippine capital was identified as one of the most expensive livable cities in the Asia-Pacific region.

Condominium prices in Metro Manila are now 19.8 times the median annual household income, far exceeding affordable levels, the Washington, DC nonprofit research and education group said. Townhouses are even more unattainable at 33.4 times the average income.

“Home attainability is still a problem in Metro Manila, to the extent that many families, even those working in one of the capital’s business districts, choose to buy a landed home on the outskirts of the city and commute,” ULI said in the report.

To be considered attainable, median home prices should not exceed five times a household’s annual income, while median monthly rents should take up no more than 30% of their monthly income. Metro Manila and Davao, however, both far exceed these thresholds.

ULI said the average rent for a Metro Manila apartment consumes about 141% of a household’s monthly income. In Davao, rents take up 94% of earnings, still significantly above the affordability benchmark.

While Davao fares better than Metro Manila, home prices are still about 14 times the median income, which ULI described as “scarcely more attainable.”

Data from the Bangko Sentral ng Pilipinas showed that in the first quarter, condominium prices rose 10.6% year on year, while house prices climbed 4.5%.

Amid rising property prices, ULI noted that the development of major railway infrastructure projects has made living outside the capital more attractive to working families, even as commuting remains a challenge.

Ironically, despite high prices, Metro Manila is also grappling with a supply glut of condominiums due to a wave of new projects launched from 2019 to 2023.

Many of these unsold units are in areas outside business districts that were affected by the government’s crackdown on Philippine offshore gaming operators.

“The oversupply is mainly noticeable in the lower-mid segment, where units typically cost between PHP 3 million and PHP 7 million,” ULI said, citing data from real estate consultancy KMC Savills, Inc.

For a studio or one-bedroom condo in this price range, monthly mortgage payments may run from PHP 20,000 to PHP 40,000 (USD 354 to USD 708) — a significant burden for Filipino families earning PHP 50,000 to PHP 60,000 monthly.

At the same price, a three- to four-bedroom house outside Metro Manila could be bought, according to the report. “The problem is that many of these condominiums were targeted at middle-class families who prefer a more distant home to a city condo,” it pointed out.

While developers have introduced more flexible payment terms to drive sales, high land acquisition and construction costs have limited their ability to offer significant price cuts.

“Some observers believe this will lead more to explore alternatives such as co-living or multifamily rental use for unsold projects,” ULI said.

To improve affordability, the group urged property developers to cut construction costs and use less expensive land.

“Developers could look at using modular construction to reduce development costs and focus on simple, repeatable designs to ensure faster delivery and therefore lower costs,” Mark Cooper, senior director for thought leadership at ULI Asia-Pacific, said in an e-mailed reply to questions.

“They should consider partnering with local governments to access land more cheaply in return for developing public or affordable housing,” he added.

Across the Asia-Pacific region, ULI said home attainability remains a widespread issue. Only seven of 51 market segments studied offered homes priced within five times the median income. In contrast, rental homes were generally more affordable, with 41 of 51 markets offering rents below 30% of monthly income.

ULI noted that key factors influencing home demand include population growth, aging demographics, household formation, urbanization, immigration, income growth, financing availability and transaction costs. — Beatriz Marie D. Cruz, Reporter

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld