January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

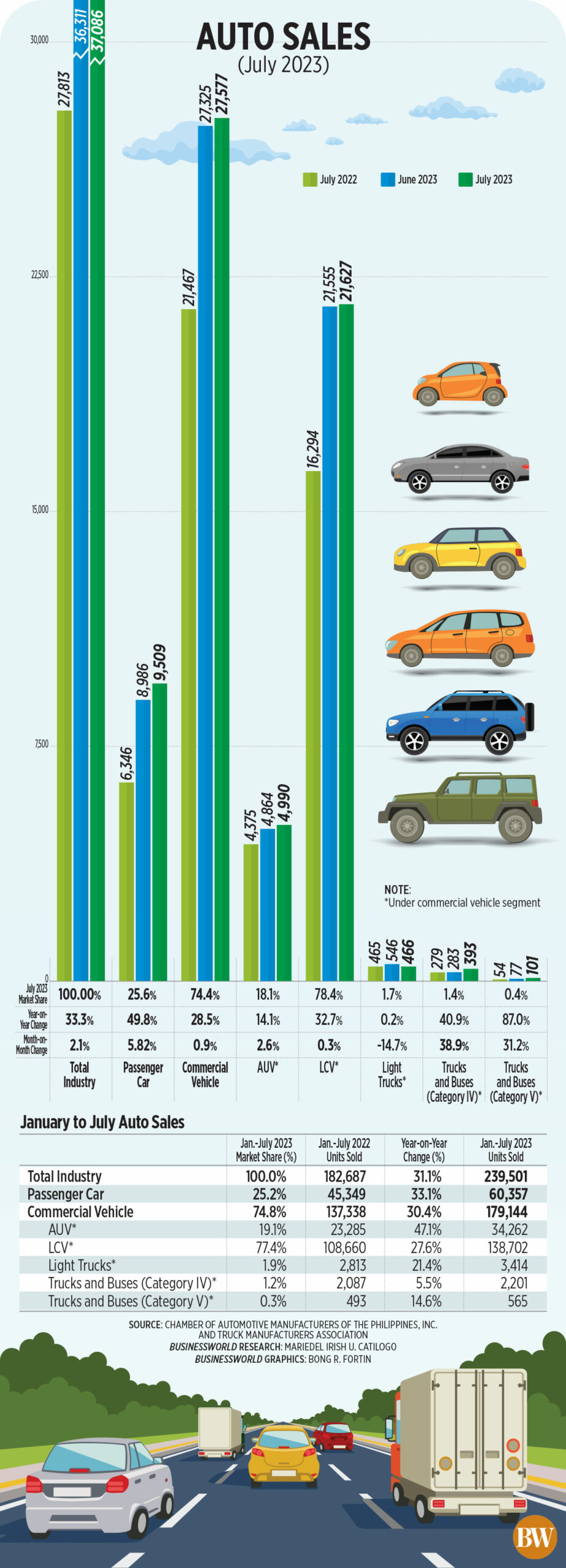

High inflation fails to dampen vehicle sales in July

The Philippine auto industry recorded a 33% increase in vehicle sales in July, even as elevated inflation dampens overall consumer spending.

A joint report by the Chamber of Automotive Manufacturers of the Philippines, Inc. (CAMPI) and the Truck Manufacturers Association (TMA) showed new vehicle sales rose to 37,086 units in July from 27,813 units in the same month a year ago.

“The auto industry is sustaining its positive growth trend as sales of new motor vehicles recorded a continued year-on-year growth for the past 17 consecutive months — since March 2022. The industry hopes to maintain this trend for the year,” CAMPI President Rommel R. Gutierrez said in a statement.

Month on month, auto sales went up by 2.1% from 36,311 units in June.

Month on month, auto sales went up by 2.1% from 36,311 units in June.

In July, passenger car sales accelerated by an annual 49.8% to 9,509 units from 6,346 units a year ago. Month on month, sales of passenger cars rose by 5.82% from 8,986 units in June.

Meanwhile, sales of commercial vehicles jumped by 28.5% to 27,577 units in July from 21,467 in the same month last year. Month on month, commercial vehicle sales inched up by 0.9%.

Asian utility vehicle sales in July grew by an annual 14.1% to 4,990, while sales of light commercial vehicles climbed by 32.7% to 21,627. Sales of light trucks inched up by 0.2% to 466.

For the first seven months of the year, CAMPI-TMA members sold 239,501 units, up by 31.1% from 182,687 a year ago.

The bulk of sales came from commercial vehicles, which rose by 30.4% to 179,144 units. Passenger car sales jumped by 33% to 60,357 in the January-July period.

“The auto industry is notably going strong despite the consumer spending slowdown attributed to the risks of inflation,” Mr. Gutierrez said.

The Philippine economy grew by a slower-than-expected 4.3% in the second quarter, as consumer demand was dented by rising prices. Household spending growth slowed to 5.5% in the April-June period, from 8.5% a year earlier.

Headline inflation cooled to a 16-month low of 4.7% in July from 5.4% in June, and 6.4% in the same month in 2022. For the seven-month period, inflation averaged 6.8%, still higher than the 5.4% forecast by the central bank.

Toyota Motor Philippines Corp. (TMP) remained the market leader with a 45.99% market share as seven-month sales jumped by 17.2% to 110,158.

Mitsubishi Motors Philippines Corp. is in second spot with a 70% surge in sales to 43,831 in the January-to-July period.

In third place is Ford Motor Company Phils. Inc., whose sales rose by 54.5% to 16,611 units in the period ending July.

Nissan Philippines, Inc.’s sales increased by 21.6% to 15,674 units, while Suzuki Phils., Inc. posted a 10.9% drop in sales to 10,174 units.

“The auto industry is truly inspired to expand its product and service offerings to the consumers and businesses alike as seeing this continued growing demand for new motor vehicles is indeed a welcome and significant part of growth development,” Mr. Gutierrez said.

Previously, Mr. Gutierrez said the auto industry set a sales target of 395,000 units for 2023.

In 2022, CAMPI-TMA members sold a total of 352,596 units. — Justine Irish D. Tabile

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld