January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

Growth in big banks’ assets, loans slowed sharply in Q3

The Philippines’ largest banks saw the weakest asset growth in over three years in the third quarter as the flood control mess weighed on economic activity.

At the same time, loan growth also logged its slowest expansion in over a year.

According to the latest release of BusinessWorld’s quarterly banking report, the aggregate assets of 44 universal and commercial banks grew annually by 7.42% in the third quarter to PHP 27.91 trillion from PHP 25.98 trillion in the same period a year earlier.

Asset growth slowed from the 9.05% seen in the previous quarter and the 11.17% in the same period last year.

This was the weakest growth in assets in 14 quarters or since the 7.37% expansion in the first quarter of 2022.

Total loans grew by 10.91% to PHP 14.6 trillion at end-September, slowing from the 12.38% in the second quarter and from 15.07% a year ago.

This was the weakest loan expansion in seven quarters or since the 10.22% growth logged in the last three months of 2023.

The third-quarter slowdown in asset and loan growth came amid the investigation into anomalous flood control projects, which has dampened consumer and investor confidence.

Some government officials, lawmakers and contractors were accused of getting kickbacks from substandard or nonexistent infrastructure projects.

The economy grew by 4.5% in the third quarter — the slowest in four years, mainly due to sluggish government spending and household expenditure.

At the same time, big banks’ nonperforming loans saw a higher share of the total loan portfolio in the July-to-September period.

Data showed that the ratio of bad loans, or those with unpaid principal and/or interest beyond 90 days, to total loans reached 3.49%, the highest share in six quarters or since 3.6% in the first quarter of 2024.

Meanwhile, the median return on equity, which measures how much shareholders earn for every peso invested, fell to 7.09% in the third quarter.

This was lower than the 8.05% median return in the same period last year and the 7.67% in the second quarter. It also marked an 11-quarter low in profitability since 6.36% in the fourth quarter of 2022.

The median capital adequacy ratio (CAR), on the other hand, rose to the highest in two quarters at 20.32%. However, it was still lower than 20.52% logged in the third quarter last year.

The CAR shows how much a bank’s capital weighs against its risk-weighted assets, indicating its capacity to absorb losses.

As of end-September, Philippine big banks’ CAR remained clearly above standard, surpassing the 10% regulatory minimum of the BSP and the international 8% lower bar under the Basel III framework.

Meanwhile, the leverage ratio, which gauges the institution’s ability to absorb shocks by measuring the bank’s capital relative to total exposure, dropped to a median of 11.05% from 11.39% in the previous quarter and 11.53% a year ago.

This continued to surpass the minimum 5% guideline of the central bank and the 3% international standard.

The net interest margin (NIM) went up to 3.82% in the third quarter from 3.54% in the second quarter but was lower than 3.91% as of end-September last year.

The NIM measures a bank’s investment profitability by dividing its net income by average earning assets.

Return on assets in the July-September period slipped to 1.59% from 1.62% in the second quarter and 1.69% a year ago.

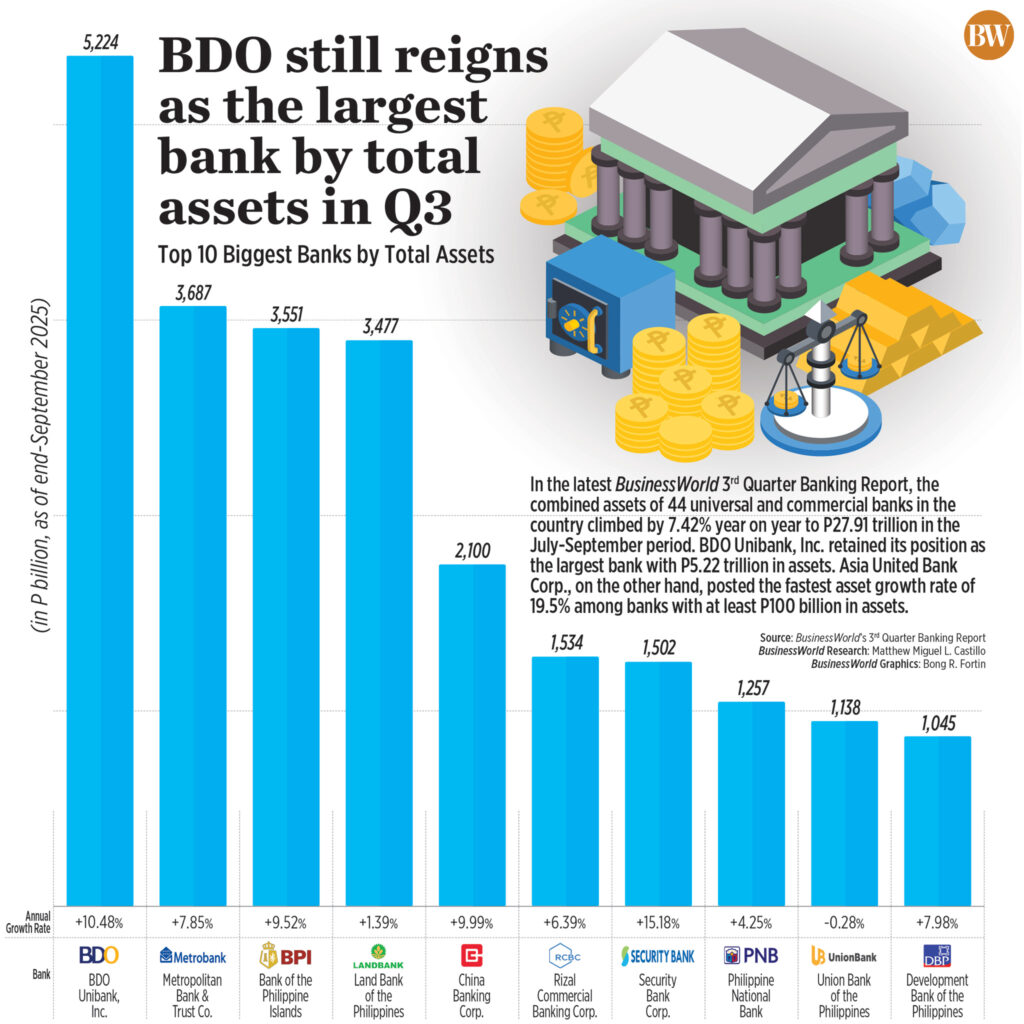

BDO Unibank, Inc. (BDO) retained its top spot among all banks in terms of assets in the third quarter with PHP 5.22 trillion.

It was followed by Metropolitan Bank & Trust Co. (Metrobank) with P3.69 trillion, and Bank of the Philippine Islands (BPI) with PHP 3.55 trillion.

The same three banks topped the list in terms of total loans in the quarter.

BDO led all banks as it lent a total of PHP 3.47 trillion, followed by BPI with PHP 2.4 trillion, and Metrobank with PHP 1.86 trillion.

In terms of total deposits, BDO remained the leader with PHP 4.1 trillion in deposits, followed by Land Bank of the Philippines with P3.08 trillion, and BPI with PHP 2.68 trillion.

Among banks in the PHP 100 billion-and-above-tier, Asia United Bank Corp. (AUB) had the fastest asset growth in the third quarter with 19.53%, followed by Bank of Commerce with 17.35% and Security Bank with 15.18%.

AUB also led the industry in annual loan growth at 36.19% in the third quarter, followed by Bank of Commerce and Philippine Trust Co. with 18.49% and 14.54%, respectively.

BusinessWorld Research has been tracking the financial performance of the country’s large banks quarterly since the late 1980s using banks’ published statements. — Matthew Miguel L. Castillo, Researcher

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld