January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

Quarterly Economic Growth Release: Growth takes on a slower pace

DOWNLOAD

DOWNLOAD

Gov’t debt yields rally following Fed, RRR cuts

Yields on government debt rallied across the board last week after the US Federal Reserve kicked off its long-awaited easing cycle with a jumbo cut.

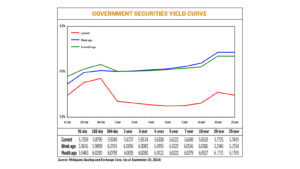

Debt yields, which move opposite to prices, went down by an average of 32.61 basis points (bps) week on week at the secondary market, data from the PHP Bloomberg Valuation Service Reference Rates as of Sept. 20 published on the Philippine Dealing System’s website showed.

Rates went down across all tenors last week. At the short end, yields on the 91-, 182-, and 364-day Treasury bills (T-bills) dropped by 12.57 bps (to 5.7359%), 11.04 bps (5.8795%), and 8.69 bps (5.9249%), respectively.

At the belly, the rates of the two-, three-, four-, five-, and seven-year Treasury bonds (T-bond) fell by 32.79 bps (to 5.6737%), 35.49 bps (5.6354%), 38.55 bps (5.6338%), 40.99 bps (5.6222%), and 43.07 bps (5.6249%), respectively.

Lastly, at the long end, the 10-, 20-, and 25-year T-bonds declined 44.06 bps, 44.15 bps, and 47.29 bps to fetch 5.652%, 5.7725%, and 5.7405%, respectively.

The volume of government securities (GS) traded jumped to P113.58 billion on Friday from P50.29 billion on Sept. 13.

The week-on-week decline in GS yields was driven by the Fed’s policy decision, as well as the cut in domestic banks’ reserve requirement ratios (RRR) announced by the Bangko Sentral ng Pilipinas (BSP) on Friday, Jonathan L. Ravelas, senior adviser at Reyes Tacandong & Co., said in a Viber message.

“Prior to the week, domestic market participants were expecting the US Federal Reserve to deliver a 25-bp rate cut in its policy meeting. However, as subtle market indications that the US central bank is actually considering to reduce policy rates more aggressively, domestic yields followed suit, with yields falling by at least 25 bps over the week,” a bond trader said in an e-mail.

“Local market participants were firmly awaiting on the US Federal Reserve decision over the week. While most market players already expect the BSP to continue reducing domestic policy rates for the rest of the year, this massive cut from the Fed would provide more leeway for the BSP to consider loosening monetary settings more aggressively. as evidenced by the recent announcement of the 250-bp cut in reserve requirement ratio for universal banks,” the trader added.

The US central bank on Wednesday kicked off an anticipated series of interest rate cuts with a larger-than-usual half-percentage-point reduction that Federal Reserve Chair Jerome H. Powell said was meant to show policymakers’ commitment to sustaining a low unemployment rate now that inflation has eased, Reuters reported.

“We made a good strong start and I am very pleased that we did,” Mr. Powell said at a press conference after the Fed, noting its increased confidence that the country’s bout with high inflation was over, reduced its benchmark policy rate by 50 bps to the 4.75%-5% range. “The logic of this both from an economic standpoint and from a risk management standpoint was clear.”

In addition to approving the half-percentage-point cut on Wednesday, Fed policymakers projected the benchmark interest rate would fall by another half of a percentage point by the end of this year, a full percentage point next year, and half of a percentage point in 2026, though they cautioned that the outlook that far into the future is necessarily uncertain.

The move marks a significant pivot in US monetary policy and a recognition of the Fed’s growing comfort with inflation continuing to ease to its target. It is currently about half a percentage point above it.

The Fed had kept its policy rate in the 5.25%-5.5% range since last July, when it ended an 18-month rate-hike campaign that was meant to control a surge in inflation, which soared in 2022 to a 40-year high.

Mr. Powell declined to declare victory on that front, but he did say inflation is now near the Fed’s 2% goal, and labor conditions are consistent with the central bank’s other goal of maximum employment.

Rate futures traders moved to price in even more easing than projected by the Fed, with the policy rate now expected to be in the 4%-4.25% range by end of this year.

Analysts have said that the start of the Fed’s easing cycle gives the BSP more room to cut benchmark interest rates further.

The Monetary Board on Aug. 15 reduced its policy rate by 25 bps to 6.25% from the over 17-year high of 6.5%, which marked its first cut in nearly four years.

BSP Governor Eli M. Remolona, Jr. has said that the central bank can deliver another 25-bp cut in the fourth quarter. The Monetary Board’s remaining meetings this year are scheduled for Oct. 17 and Dec. 19.

Meanwhile, the BSP on Friday said it will reduce the RRR for universal and commercial banks and nonbank financial institutions with quasi-banking functions by 250 bps to 7% effective on Oct. 25.

It will also cut the RRR for digital banks by 200 bps to 4%, while the ratio for thrift lenders will be reduced by 100 bps to 1%. Rural and cooperative banks’ RRR will likewise go down by 100 bps to 0%.

“The magnitude of future BSP rate cuts will depend mainly on Philippine inflation readings in the coming months. However, the BSP has also previously acknowledged that they are willing to consider a measured approach in cutting more aggressively if Philippine economic performance showed significant downside risks,” the bond trader said.

For this week, the trader said GS yields may continue to go down.

“Yields could potentially decline further [this] week amid expectations of a further softening in the US personal consumption expenditure (PCE) inflation for August, which is the primary inflation gauge of the Federal Reserve,” the trader said. August US PCE price index data will be released on Sept. 27 (Friday).

Mr. Ravelas added that he expects GS rates to move sideways to down in the near term. — K.K.P.D. Mendoza with Reuters

This article originally appeared on bworldonline.com

By BusinessWorld

By BusinessWorld